In this Fast Start Profits review, we evaluate its reliability and investor hazards. With an emphasis on ownership, compensation plans, traffic trends, security, payment methods, customer service, technical performance, and ROI claims, this thorough analysis integrates important information from several sources. To ensure that everyone can understand this review, the Scams Radar researcher team always uses simple language, infographics, and bullet points. By pointing out warning signs and contrasting this platform with safe investments like real estate, bank savings, and cryptocurrency staking, we hope to assist you in making well-informed judgments regarding it.

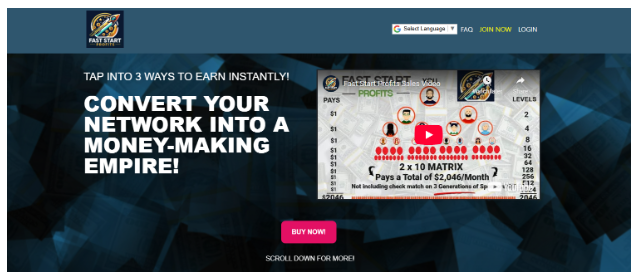

Through a matrix-based compensation model, the online portal Fast Start Profits promises to provide members with substantial monthly profits. Participants are encouraged by the corporation to pay a monthly subscription and earn money by bringing on new members. We will dissect every facet of Fast Start Profits in this study, from the legitimacy of the company’s executives to the operation of the payout plan.

Trust depends on ownership transparency. There is unclear information about the owners and leadership team of faststartprofits.com. The domain was registered on August 13, 2024, according to a WHOIS query, but the owner’s information is obscured, which is a regular problem with dubious platforms. Reputable investing firms, such as Binance or Vanguard, report their regulatory status and corporate entity frequently to the SEC or FCA. Without this, it’s difficult to tell if FastStartProfits.com is a legitimate company or a dangerous endeavor.

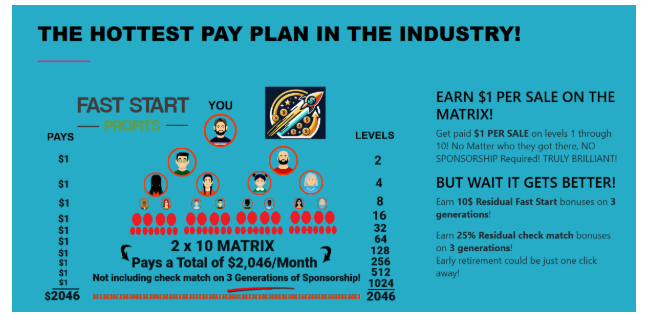

The platform operates a 2×10 forced matrix system, where participants pay $69.95 monthly to join. Earnings include:

This organization, which resembles a pyramid scheme, mostly depends on recruiting others. Instead of selling goods or services, revenue is derived by expanding one’s network. “We make no claims of income or guarantee that you will make money,” reads the website’s disclaimer, avoiding legal accountability but casting doubt on its dependability.

The platform’s claim of $2,046/month requires a full matrix of 2,046 participants, each paying $69.95:

This assumes 100% matrix occupancy, which is unrealistic. Sustaining payouts requires constant recruitment, a hallmark of Ponzi schemes. For example, to pay $500,000 in returns at 50% annually, the platform needs:

[

\text{New Funds} = \frac{500,000}{1 – 0.5} = 1,000,000

]

This means $1 million in new investments yearly, an unsustainable model as recruitment slows.

Investment Type | Annual ROI | Risk Level |

Real Estate | 8-12% | Medium |

Bank Savings (PK) | ~13% | Low |

Crypto Staking | 5-15% | High |

FastStartProfits | >240% (claimed) | Very High |

Visual Breakdown:

Matrix Level | Members at Level | Monthly Earnings |

Level 1 | 2 | $2 |

Level 2 | 4 | $4 |

Level 3 | 8 | $8 |

… | … | … |

Level 10 | 1,024 | $1,024 |

Total | 2,046 | $2,046 |

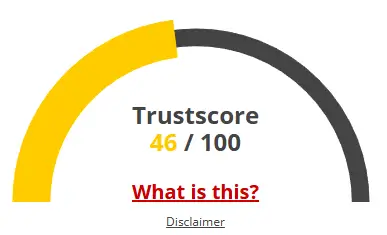

ScamAdviser and ScamDoc indicate low trust scores (1% on ScamDoc) because of the platform’s small traffic, hidden ownership, and recent registration. No user reviews are available on Trustpilot or Reddit, suggesting limited public interaction. It is uncommon for a reputable investment platform to be this obscure.

Although the website employs HTTPS for basic encryption, it is devoid of information on more sophisticated security measures like GDPR compliance or two-factor authentication. Without explicit regulatory control, it is dangerous to gather sensitive data (such as SSN for 1099 reporting). Although technical performance information (such as load speed) is not available, a poorly maintained website frequently indicates amateurish activity.

Payment methods are not clearly listed, and the site’s “no refunds” policy is concerning. Customer support is limited to a contact form, with cancellations processed in 48 hours. Legitimate platforms offer multiple support channels (e.g., phone, live chat) and transparent payment options like credit cards or bank transfers.

Promotions on Facebook and X highlight the compensation plan but lack transparency. No specific promoter accounts are identified, but such activity often involves new profiles pushing multiple schemes. Use Social Blade to check account authenticity.

In order to protect your money, always do your own research before investing, check claims using resources like ScamAdviser, speak with a financial advisor, and move cautiously. This Fast Start Profits Review is for informative purposes only and is not financial advice.

Answers to frequently asked questions about the validity of the FAST START PROFITS Networks study may be found here. To ease your concerns, we have included the following questions and answers:

FastStartProfits is an online platform offering a 2x10 forced matrix system for earning income through recruitment. It lacks transparency about ownership and regulatory status, raising concerns about its legitimacy. Investors should verify claims using tools like WHOIS or SEC databases before participating.

The platform’s compensation plan involves a $69.95 monthly fee to join a matrix, earning $1 per recruit (up to $2,046/month), $10 residual bonuses, and 25% matching bonuses. This recruitment-based model resembles a pyramid scheme, with no tangible products, making it risky and potentially unsustainable.

Yes, red flags include hidden ownership, a recent domain registration (August 2024), no clear products, and reliance on recruitment for income. Low trust scores from ScamAdviser and ScamDoc, plus vague security and payment details, suggest high risk for investors.

Unlike real estate (8-12% ROI) or crypto staking (5-15% APY), FastStartProfits.com claims high returns (potentially >240% annually) through recruitment, not assets or markets. Legitimate investments are transparent and regulated, while this platform’s model raises pyramid scheme concerns.

Conduct due diligence using ScamAdviser, VirusTotal, or FINRA’s BrokerCheck to assess domain trust, security, and regulatory status. Search X or Trustpilot for user reviews. Avoid sharing sensitive data until the platform’s legitimacy is confirmed with regulatory bodies like the SEC.

Title: FAST START PROFITS

There are no reviews yet. Be the first one to write one.