Harvest.Finance (harvest.finance) is a decentralized finance (DeFi) protocol that offers automated yield farming through liquidity vaults. With marketing claims of 12% to 20% monthly ROI, and a multi-tiered affiliate structure, this platform has generated both interest and skepticism within the crypto investment community. In this Harvest.Finance Review report, we dissect Harvest Finance from every angle: ownership, ROI sustainability, technicals, compensation model, and transparency, to help you determine if it’s a genuine passive income tool or a sophisticated Ponzi scheme wrapped in DeFi buzzwords.

Despite branding itself as a decentralized protocol, Harvest Finance exhibits signs of centralized control with zero verifiable ownership. Promotional materials refer to a figure named Richard Green, a likely pseudonym or actor with no professional or crypto history outside this project. His videos appear to be shot against a green screen with a British accent, possibly staged from Southeast Asia. This type of facade matches the profile of what experts call a “Boris CEO” scheme—a marketing actor hired to impersonate company leadership.

Furthermore, the company offers shell registration certificates in the UK and Thailand, yet no traceable business or corporate identity can be verified in government databases.

Red Flag: Anonymity paired with fictitious leadership and fake business registrations aligns with tactics used in fraudulent MLMs.

Harvest Finance offers four Harvest Finance Unit (HFU) investment packages:

Pharmaceutical 1 Plan

Medical Cannabis 1 Plan

Pharmaceutical 2 Plan

Medical Cannabis 2 Plan

Harvest uses a 17-level unilevel MLM structure where commissions are tied to your deposit amount. The more you invest, the more referral levels you unlock:

This aggressive model encourages users to invest more to unlock deeper commission tiers, fostering Ponzi-like recruitment incentives.

Red Flag: No products/services are sold. Income is based purely on recruitment and reinvestment.

Claimed Returns

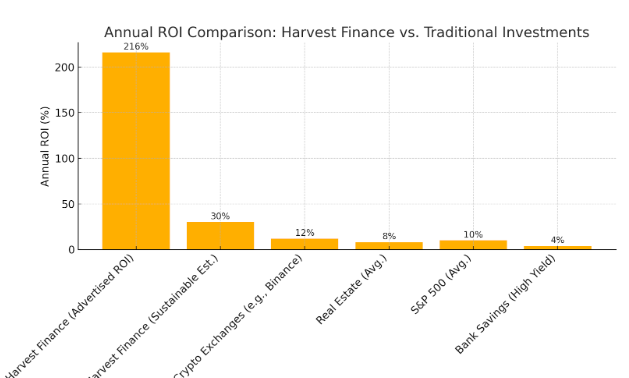

Harvest markets ROI rates of 18%-20% monthly. Compounded annually, this equals:

Annual ROI=(1+0.20)12−1≈792%\text{Annual ROI} = (1 + 0.20)^{12} – 1 \approx 792\%

Realistic DeFi APY Benchmarks:

Source | APY Estimate |

Harvest Finance (Claimed) | 216% – 792% |

Crypto Exchanges (Binance, Kraken) | 5% – 15% |

Real Estate | 6% – 12% |

Bank Savings | 0.5% – 4% |

This level of return is mathematically unsustainable unless new investors are consistently recruited or artificial price manipulation occurs.

Red Flag: Major historical breach with no investor guarantees.

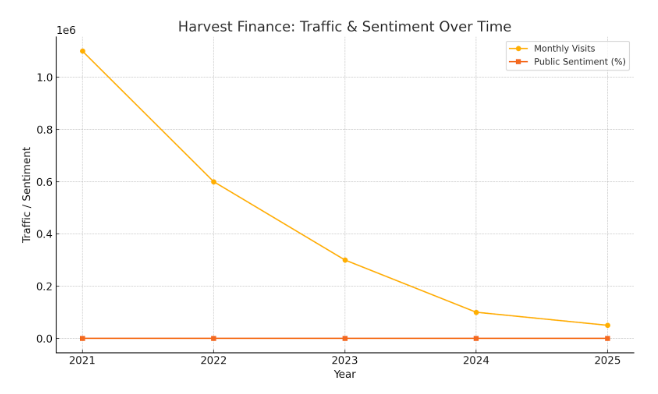

YouTube/Telegram: Numerous affiliate promo videos with no transparency

Criteria | Verdict |

Verifiable Leadership | (Absent) |

Sustainable ROI | (No) |

Transparent Tokenomics | (Limited) |

Regulated Entity | (No) |

Investor Protections | (None) |

Harvest.Finance blends typical MLM-Ponzi characteristics with flashy DeFi jargon. While technically operational, its ROI model is fundamentally unsustainable, its leadership is fictitious, and regulatory oversight is absent.

DYOR Disclaimer

This blog is intended for educational and informational purposes only. It does not constitute financial advice. Investors should conduct their own due diligence using third-party tools and consult professional advisors before investing in high-risk financial products.

This Harvest.Finance Review is based on publicly available information and does not constitute financial advice. Always conduct your own research (DYOR) and consult a professional before investing.

Always research before investing. Use these tools to verify legitimacy:

WHOIS Lookup: https://whois.domaintools.com

SimilarWeb: https://www.similarweb.com

ScamAdviser: https://www.scamadviser.co

m

Trustpilot: https://www.trustpilot.com

Reddit Discussions: https://www.reddit.com

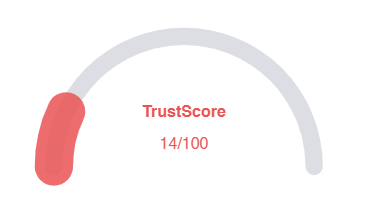

Given harvest.finance Very low trust score, there is a good chance that the website is a hoax. Use caution when accessing this website!

Our algorithm examined a wide range of variables when it automatically evaluated harvest.finance, including ownership information, location, popularity, and other elements linked to reviews, phony goods, threats, and phishing. All of the information gathered is used to generate a trust score.

Here are some frequently asked questions (FAQs) related to the Harvest.Finance Review article. These questions and answers are designed to address common concerns and provide additional clarity for readers:

Harvest Finance presents itself as a DeFi protocol but lacks transparency, has anonymous leadership, and unsustainable ROI claims, raising concerns about its legitimacy.

Harvest Finance uses a 17-level MLM-style structure, offering up to 20% monthly ROI and commissions based on deposit size, incentivizing recruitment over actual yield generation.

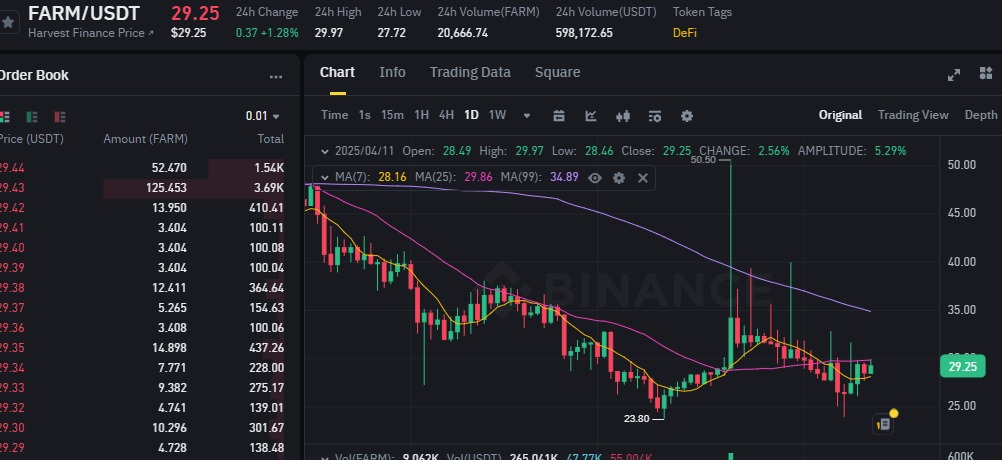

In October 2020, Harvest Finance lost over $24 million due to a flash loan exploit, exposing vulnerabilities in its smart contracts and shaking investor trust.

No. With monthly returns of up to 20%, the ROI is mathematically unsustainable compared to traditional investments like real estate or bank savings.

The Harvest.Finance Review highlights anonymous ownership, lack of financial reporting, MLM commission structure, prior hacks, and unrealistic returns as major red flags.

Title: harvest.finance

https://scamsradar.com/split-the-winnings-review-2025-shocking-scam-exposed/

https://scamsradar.com/earning-builder-review-2025-exposed-shocking-red-flags/

https://scamsradar.com/hunter-shoot-review-2025-scam-alert-you-must-read/

https://scamsradar.com/agi-ai-net-review-critical-facts-every-investor-needs/

https://scamsradar.com/talkfusion-review-2025-scam-or-real-deal-exposed/

There are no reviews yet. Be the first one to write one.