The increasing global money supply may have an impact on Bitcoin price movement in as little as three weeks, according to bulls.

In three weeks, Bitcoin is expected to “blow off” as global liquidity patterns shift in favor of riskier assets and cryptocurrencies.

The global money supply is expected to reach new all-time highs, according to a new X study by Andre Dragosch, European head of research at asset management company Bitwise.

With the strength of the US dollar falling to its lowest levels since the beginning of November of last year, a fresh Bitcoin BTC $89,347 price tailwind is developing.

According to data from Cointelegraph Markets Pro and TradingView, the US Dollar Index (DXY), which compares the strength of the dollar to a basket of trade partner currencies, is in danger of falling below 104.

The ramifications are already evident to Dragosch.

He stated, “The global money supply will soon regain new all-time highs if this trend continues like that.” He called the DXY the “most bullish chart you will see today.”

The new US government administration has not yet had a significant positive impact on the value of the dollar, and trade tariffs are still affecting risk-asset sentiment.

Colin Talks Crypto, an analyst, looked for signs of a fresh Bitcoin breakout in a recovery in the entire M2 money supply.

According to Cointelegraph, bull markets are strongly correlated with periods of growth, and Bitcoin is still very vulnerable to changes in global liquidity.

Colin Talks Crypto reiterated a similar forecast this week, telling X followers that “the rally for stocks, bitcoin, and crypto is going to be epic.”

It’s possible that Bitcoin and other cryptocurrencies may get a much-needed boost in advance.

Related: The 2020 bull run price measure for bitcoin indicates a fresh bottom of $69K.

The inaugural White House Crypto Summit, hosted by US President Donald Trump on March 7, is expected to approve a strategic Bitcoin reserve, according to Commerce Secretary Howard Lutnick.

Some seasoned players in the cryptocurrency market believe the reserve is unavoidable, while other sources claim the action will be postponed because of a lack of legislative backing.

Anthony Pompliano, the CEO and founder of Professional Capital Management, summed up the Strategic Bitcoin Reserve on X.

In a March 5 market note, Bitwise’s chief investment officer, Matt Hougan, of crypto index fund and ETF management, predicted that the reserve will eventually be “wholly” made up of Bitcoin.

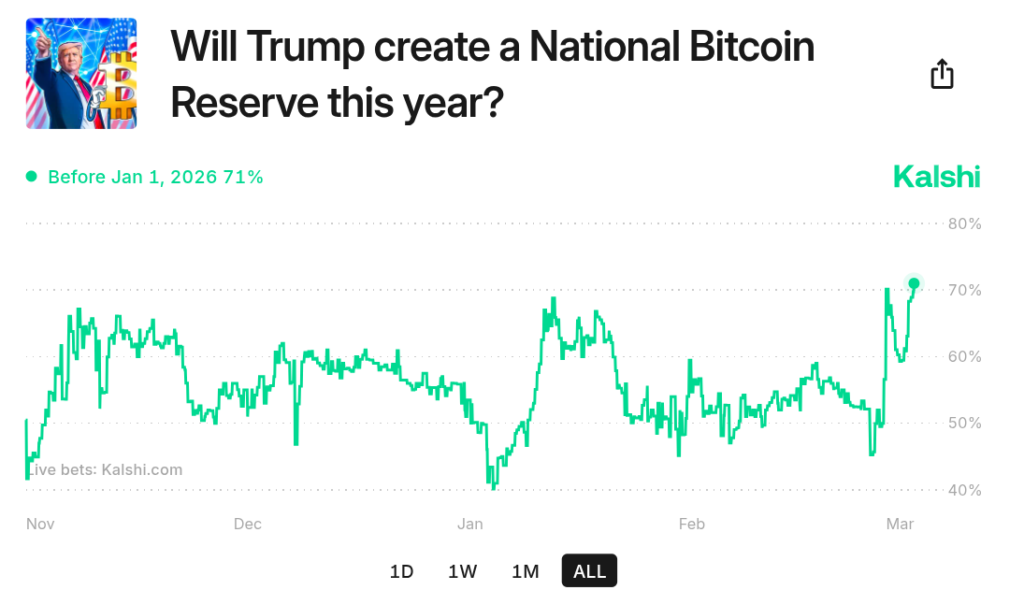

The possibilities of a Bitcoin reserve this year are at their highest ever, with a 71% possibility, according to the most recent statistics from prediction firm Kalshi.