The rise of AI-driven investing platforms brings both opportunities and risks. BoosterApp.ai review claims to merge financial opportunities with AI-powered lifestyle apps. However, a thorough analysis raises doubts about BoosterApp.ai’s legitimacy and potential dangers for investors. This review explores BoosterApp.ai’s ownership, compensation structure, security, and warning signs to help users make informed decisions.

Regulatory Concerns: No proof of registration with SEC (U.S.), FCA (UK), or ASIC (Australia)—mandatory for legal investment platforms.

Although Scamadviser gives a 77% trust score, transparency issues persist. Additionally, negative reviews highlight withdrawal problems, poor customer service, and account closures (Source: Trustpilot). Furthermore, many positive testimonials appear generic or manipulated.

While BoosterApp.ai uses simple SSL encryption, it does not guarantee platform security. Additionally, cybersecurity risks are high, as rated by Norton Safe Web. Moreover, users report technical issues such as slow loading, broken links, and website outages.

One of the biggest red flags is hidden ownership, as there is no verified leadership information. Furthermore, the promised 10–20% monthly ROI is statistically impossible. Adding to the concerns, the platform relies on untraceable crypto payments without any refund options.

BoosterApp.ai review shows multiple red flags typical of fraudulent investment schemes. Lack of transparency, exaggerated returns, and a recruitment-based payout system indicate high risk.

✅ Avoid Investing: Platform appears unsustainable.

✅ Verify Financial Registrations: Invest only in regulated businesses.

✅ Report Suspicious Activity: Notify cybersecurity authorities & financial regulators.

✅ Educate Yourself: Stay informed about investment frauds to protect your finances.

By conducting thorough research, investors can avoid scams and financial losses. Remember—if it sounds too good to be true, it probably is.

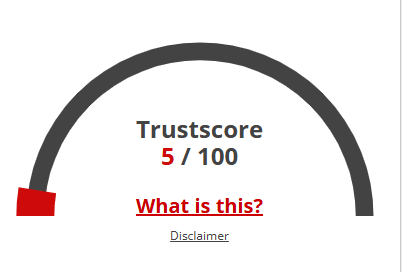

The trust score of CoinPlutus.com is extremely low, which strongly indicates that this website may be a scam.

We analyzed CoinPlutus.com using an advanced algorithm that scans multiple factors, including:

✅ Website source code

✅ Terms and conditions

✅ Company registry details

✅ Business location

✅ User reviews (positive & negative)

Based on this thorough analysis, CoinPlutus.com received a very low trust score. If a website gets such a low rating, we strongly advise verifying its legitimacy before using it.

BoosterApp.ai has multiple red flags, including hidden ownership, unrealistic returns, and an MLM structure. Investors should be cautious before investing.

The biggest risks include withdrawal issues, unregulated payment methods, and a Ponzi-like commission system. Many similar platforms have collapsed in the past.

No, BoosterApp.ai is not registered with SEC (U.S.), FCA (UK), or ASIC (Australia), raising concerns about its legitimacy.

If you believe BoosterApp.ai is fraudulent, report it to cybersecurity authorities, financial regulators, and scam-reporting platforms.

Title : Home | Booster Lifestyle Ap

https://scamsradar.com/helix-global-review-is-this-investment-platform-legit-or-a-scam/

https://scamsradar.com/cloud-bit-review-scam-or-legit-unbiased-analysis/

https://scamsradar.com/review-on-mintstakeshare-check-if-site-is-scam-or-legit/

https://scamsradar.com/review-on-sicamtech-check-if-site-is-scam-or-legit/

There are no reviews yet. Be the first one to write one.