Platforms like LquidPay.com appear in the constantly changing cryptocurrency space, frequently with the promise of transforming financial transactions. Nevertheless, a thorough examination of LquidPay.com and its proprietor, Shavez Anwar, reveals alarming trends that cast doubt on the platform’s reliability and investor safety.

Unresponsive Support Channels: According to several user reviews, customer service is unresponsive, leaving emails and complaints unanswered. The platform’s already bad image is made worse by this lack of support.

According on trends seen in related frauds, LquidPay is probably going to go out of business in a year or two, which is the usual course of Ponzi schemes.

A high-risk website that demonstrates several signs of fraud is LquidPay.com. Investors are put at risk by its illusory promises, shady relationships, lack of transparency, and fraudulent claims.

Due diligence must be the top priority for investors in order to safeguard themselves against fraudulent schemes such as LquidPay.com. The evidence is unmistakable: liquidpay.com is a scam for gullible investors rather than a genuine financial solution. Remain alert and knowledgeable.

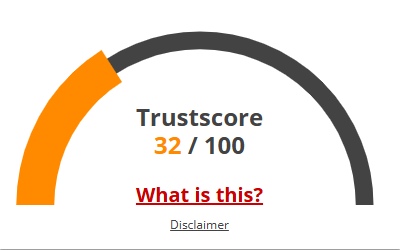

Given LquidPay Very low trust score, there is a good chance that the website is a hoax. Use caution when accessing this website!

Our algorithm examined a wide range of variables when it automatically evaluated LquidPay, including ownership information, location, popularity, and other elements linked to reviews, phony goods, threats, and phishing. All of the information gathered is used to generate a trust score.

There are no reviews yet. Be the first one to write one.