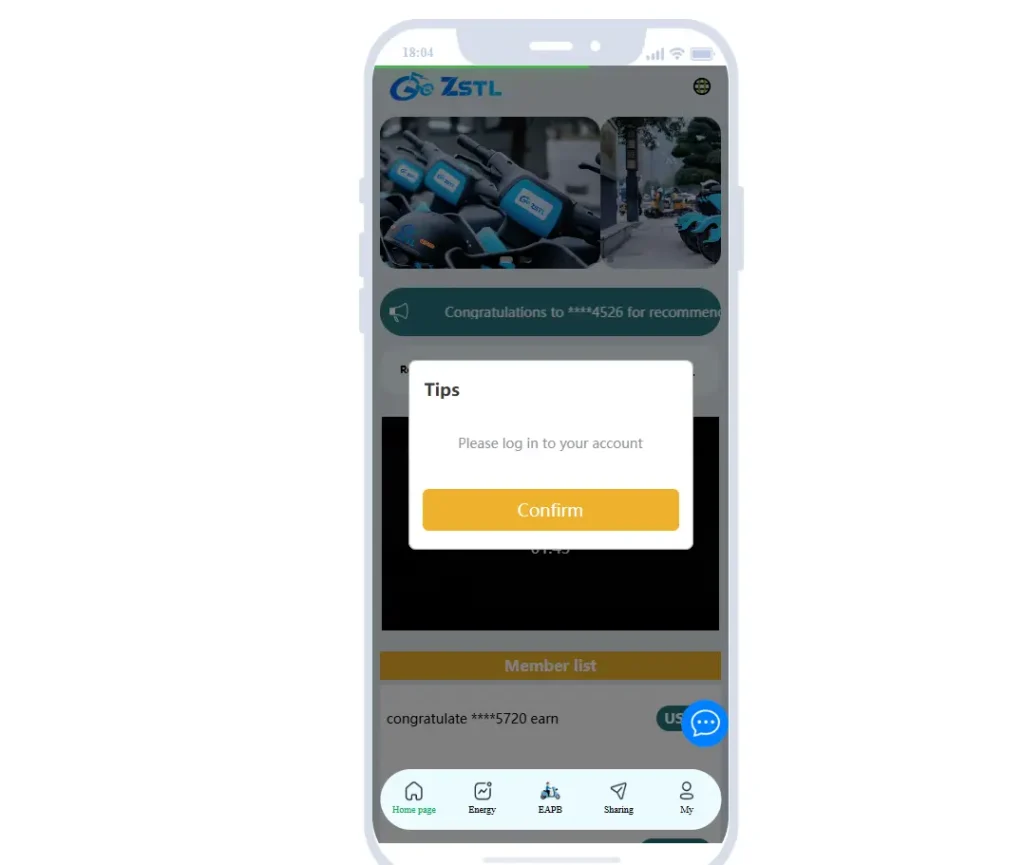

This ZSTL Bike review concludes that ZSTLBike.vip is a high-risk platform with no credible e-bike products, unsustainable ROI promises, and multiple scam indicators. Investors seeking a ZSTL Bike for commuting or affordable electric bikes in 2025 should avoid it. Opt for regulated platforms and conduct thorough research to protect your funds.

Disclaimer: This analysis is for educational purposes only. Always do your own research (DYOR) before investing. Verify business licenses, user reviews, and regulatory compliance. Investments carry risks, and past performance does not guarantee future results. If affected, report to the authorities and seek legal advice.