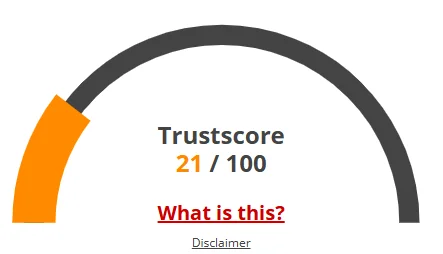

This Xanyos review highlights significant concerns about the platform’s legitimacy. Its unrealistic ROI claims, lack of transparency, and reliance on affiliate marketing align with Ponzi scheme traits. Compared to real estate (6–10%), bank savings (3–5%), or crypto staking (2–12%), its promised returns are unsustainable. Investors should prioritize regulated platforms and conduct thorough research. For safe investing, consult financial advisors and verify all claims independently.

DYOR Disclaimer: This review is for informational purposes only and not financial advice. Always conduct your research and consult licensed professionals before investing. The author is not liable for any financial losses.