UpCapital Review: Evaluate the Risks of This Forex Investment Club

If you’re searching for an UpCapital review, you’re likely weighing whether this self-proclaimed exclusive investors’ club delivers on its promises of passive Forex income. Launched amid rising interest in hybrid fintech models, UpCapital.ai blends trading strategies with network marketing. But does it hold up?

This analysis draws on public records, expert breakdowns, and fresh calculations to assess its legitimacy. Scams Radar focuses on ownership details, the full compensation plan, and why its returns raise alarms, all in plain terms for everyday investors.

Table of Contents

Part 1: Who Runs UpCapital? A Closer Look at Leadership and Background

Transparency builds trust in finance, yet UpCapital keeps its operators in the shadows. The platform’s site mentions no verifiable executives or company address, only a support email. Marketing videos and posts name Oscar Buhler as CEO, claiming over 30 years in technology and strategy. But deeper checks reveal Buhler as a likely fabricated figure, a tactic experts call the “Boris CEO” pattern, where anonymous scammers invent personas to add credibility.

1.1 Company’s Background:

Public searches for Buhler’s background yield nothing substantial: no LinkedIn profile with financial ties, no conference appearances, and no regulatory filings. One unrelated Oscar Buhler-Appendini works in Swiss private credit at Obligate, but he has zero connection to UpCapital. The domains (upcapital.ai registered August 2024, upcapital.tech April 2025) use privacy services like Domains By Proxy, hiding owners further. No evidence of incorporation in Chile (its main market) or elsewhere shows up in CMF or SEC databases.

This opacity isn’t accidental. Legit firms like eToro list teams and licenses upfront. Here, it leaves investors without recourse if funds vanish, a core red flag in unregulated Forex plays.

Part 2: The Full Compensation Plan: How UpCapital Pays (or Doesn't)

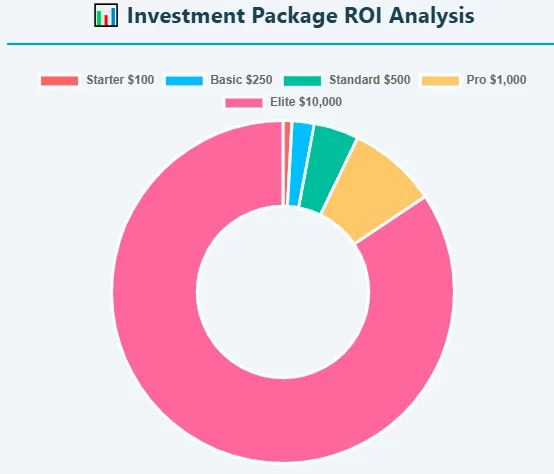

The UpCapital model mixes Forex “investments” with MLM referrals, urging users to deposit via USDT and recruit others. It offers nine participation packages, from $100 starter to $10,000 elite, with funds supposedly traded by pros or AI tools.

2.1 Core Earnings Structure

- Daily ROI: 0.5% to 1% Monday-Friday on your package balance, paid in USDT. No trading on weekends.

- Lifetime Cap: Total returns max at 300% per package—after that, reinvest to keep earning.

- Withdrawal Fee: 5% on all payouts, deducted automatically.

- Referral Commissions:

- Direct: 12% of a recruit’s deposit.

- Unilevel: ROI matching down seven levels (e.g., 5-10% of downline earnings, scaling with your rank).

- Binary: Ranks based on “weaker leg” volume, $5K for entry, up to $100K for top tiers, unlocking cash bonuses.

- Direct: 12% of a recruit’s deposit.

- Rank Bonuses: Hit volume thresholds (e.g., $50K group deposits) for one-time payouts, like 2-5% of team activity.

- Payments: Deposits only in USDT; withdrawals to crypto wallets, no fiat options.

This setup sounds layered, but it’s recruitment-heavy. Early joiners get paid from new deposits, not proven trades. No audits or broker statements verify Forex profits, claims of ATFX ties lack confirmation from the broker itself. Reviews note payouts start smooth but delay as recruitment slows, trapping funds via “reinvestment” rules.

2.2 UpCapital Investment Packages: ROI Math Behind the Promises

Package Tier | Minimum Deposit | Est. Daily ROI (0.5%) | Max Lifetime Return (300%) |

Starter | $100 | $0.50 | $300 |

Basic | $250 | $1.25 | $750 |

Standard | $500 | $2.50 | $1,500 |

Pro | $1,000 | $5.00 | $3,000 |

Elite | $10,000 | $50.00 | $30,000 |

Part 3: Why These Returns Are Unsustainable: Simple Math Breakdown

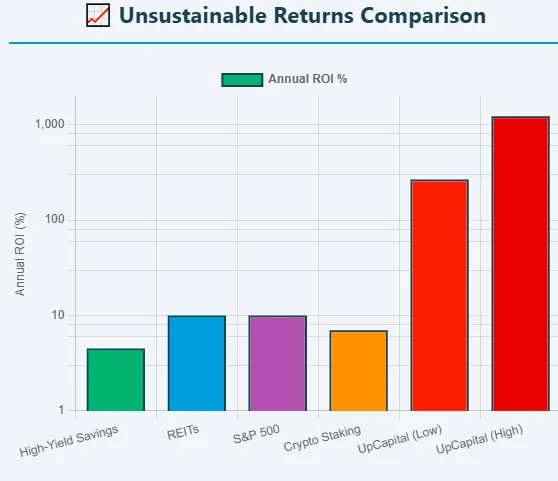

UpCapital touts “consistent passive income” without daily oversight. But let’s crunch the numbers for a $1,000 package at 260 trading days yearly.

Using the formula for compound growth: Final Value = Principal × (1 + Daily Rate)^Days

- At 0.5% daily: (1 + 0.005)^260 ≈ 3.66 × principal = 265.74% annual return (after fees, closer to 250%).

- At 1% daily: (1 + 0.01)^260 ≈ 13.29 × principal = 1,229.10% annual return.

To derive: Start with a daily multiplier (1 + rate). Raise to trading days power. Subtract 1 for percentage yield. These figures ignore slippage or losses, real Forex sees 70-80% win rates at best for pros.

It’s not sustainable. Top hedge funds average 15-20% yearly. UpCapital’s math demands endless new money to cover payouts, especially with referral cuts. Slow recruitment? Delays hit, as seen in similar collapses like Bitconnect.

Part 4: Red Flags in the Spotlight: Public Perception of UpCapital

Independent watchdogs paint a grim picture:

- No Regulation: Zero SEC, FCA, or CMF listings, offering returns without licenses breaks securities laws.

- Fake Cred: ATFX “partnership” unverified; site borrows legitimacy without proof.

- Poor Reviews: Trustpilot (upcapital.tech) holds one 1-star rating on unclaimed profile, citing withdrawal blocks. ScamAdviser scores 66/100, flagging hidden ownership and low traffic (mostly Chile referrals).

- Traffic Trends: Under 10K monthly visits, 80% from social spam, no organic growth like legit brokers.

4.1 What people say about it:

Promoters on YouTube (e.g., “Juan Smart” channel) and Facebook groups recycle MLM pitches, linking to past flops like Genesis Corp AI. X posts are sparse, mostly hype without substance, no verified user wins.

4.2 How UpCapital Stacks Against Real Options

Investment Type | Avg. Annual ROI | Risk Level | Regulation |

High-Yield Savings | 4-5% | Low | FDIC/Equivalent |

Real Estate (REITs) | 8-12% | Medium | SEC |

S&P 500 Index | 10% | Medium | N/A |

Crypto Staking (e.g., USDC) | 4-10% | High | Varies |

UpCapital Claim | 266-1,229% | Extreme | None |

Recommendations for Smart Investors

Steer clear of UpCapital Opt for regulated paths: Start with Vanguard ETFs for broad exposure or Ally Bank for safe yields. If Forex tempts, use licensed brokers like IG Group.

For those in: Withdraw small tests now, document everything, and report to FTC or local watchdogs. Build wealth slowly, true gains compound over years, not days.

Conclusion: Prioritize Proven Paths Over Promises

This UpCapital review uncovers a platform heavy on hype but light on substance. With untraceable leaders, recruitment-fueled payouts, and returns defying financial reality, it poses severe risks for investors. In crowded Forex space, stick to verifiable options for sustainable growth. Your financial future deserves better than unproven clubs, research thoroughly, diversify wisely, and invest only what you can lose. Also you can check out our latest article about Maopay and find out about its legit AI Profits or Ponzi Trap.

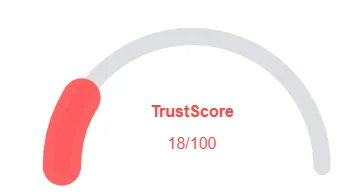

UpCapital Review Trust Score

A website’s trust score is a critical indicator of its reliability. UpCapital currently holds an alarmingly low rating raising serious concerns about its legitimacy. Users are strongly advised to proceed with caution.

The platform displays several warning signs, such as low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and inadequate SSL protection.

Given its low trust score, the risk of fraud, data breaches, or other security issues is much higher. It is essential to carefully consider these red flags before engaging with UpCapital similar platforms.

Positive Highlights

- Website content accessible

- No spelling/grammatical errors

- Domain age: Old

- Archive age: Old

Negative Highlights

- Low AI review rating

- Whois data hidden

- Domain not in top 1M on Tranco list

Frequently Asked Questions About UpCapital Review

This section answers key questions about , providing clarity, promoting trust, and addressing concerns regarding the platform’s legitimacy.

No public records show licensing. It disclaims managing funds, yet promises returns a gray area regulators flag.

It ties 70%+ earnings to recruitment, not trades. When sign-ups drop, payouts falter its classic pyramid math.

Reviews report 5% fees and caps force reinvestment. Early withdrawals work; later ones stall.

Staking yields 4-10% variably on platforms like Coinbase, with transparency. UpCapital's "guaranteed" dailies ignore market risks.

Channels like Juan Smart on YouTube push it, often tying to prior MLMs. Check their history before trusting.

Patterns suggest collapse by mid-2026 as recruitment peaks. Watch for payout delays as early warning.

Other Infromation:

Website: upcapital.ai

Reviews:

There are no reviews yet. Be the first one to write one.