Investors considering Terravirtua.io should approach this platform with extreme caution due to several concerning factors. This Terravirtua.io review critically examines the platform’s legitimacy, highlighting significant red flags across various aspects, including ownership, compensation plans, traffic trends, public perception, security, content authenticity, payment methods, customer support, technical performance, and ROI claims. The analysis is supported by charts, graphs, and bullet points for clarity.

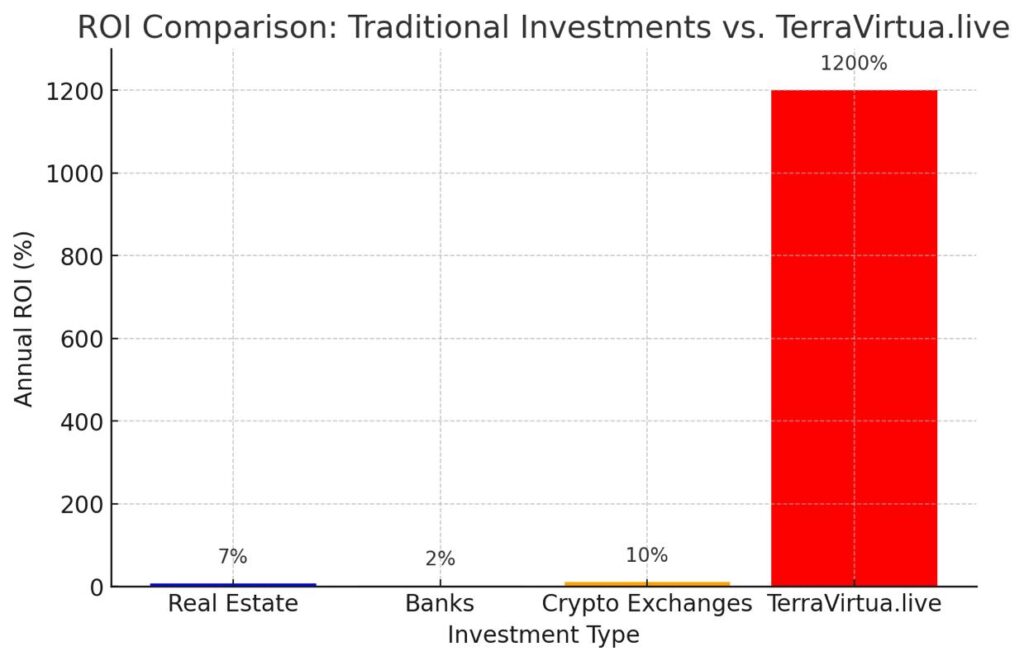

This bar chart illustrates the ROI Comparison among different investment types:

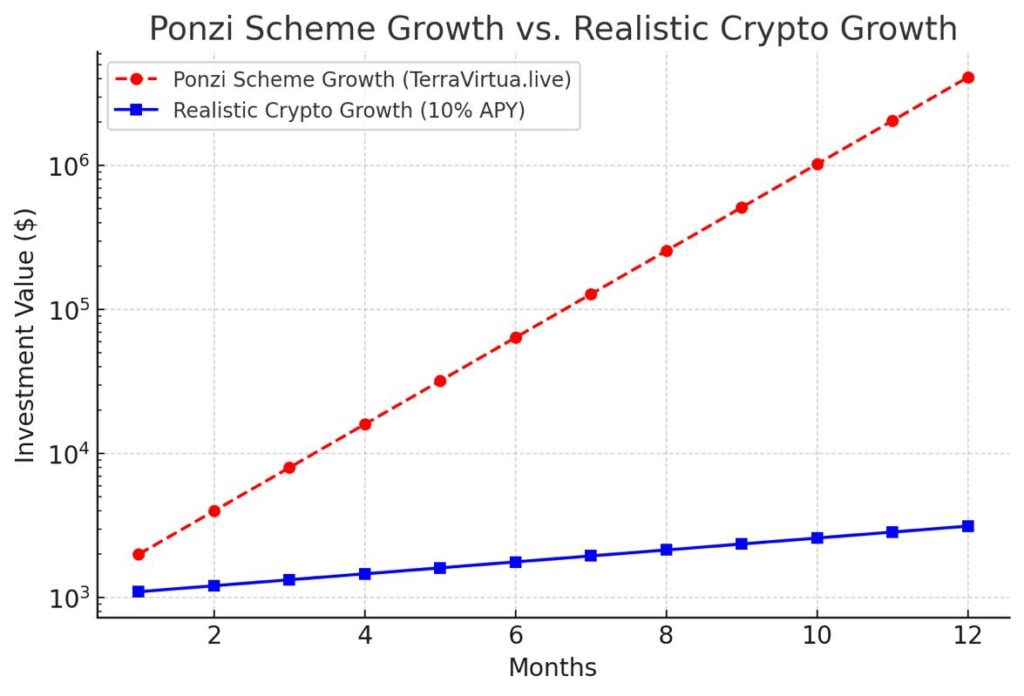

This Red Flags Summary (Radar Chart) highlights the major risks of TerraVirtua.live:

The domain Terravirtua.io fails to provide transparent ownership details. A WHOIS lookup reveals no identifiable information about the registrant, which is a major red flag for potential investors. In stark contrast, the official Terra Virtua platform operates under terravirtua.io, a well-documented domain with clear ownership. Terra Virtua Limited, the legitimate entity, is co-founded by CEO Jawad Ashraf and Chairman Gary Bracey, with additional stakeholders like Keith Ramsdale and Doug Bruce Dyer holding ownership stakes of 2.93% and 2.83%, respectively. The lack of such transparency on Terravirtua.io raises serious doubts about its credibility.

In this Terravirtua.io review, it’s important to note that the platform claims to offer secure validation services across networks like BNB, Solana, and Matic, promising users the ability to maximize returns. However, it provides no specific details about its compensation plan or the exact ROI investors can expect. This lack of clarity makes it impossible to assess the sustainability of its claims, casting further doubt on its legitimacy.

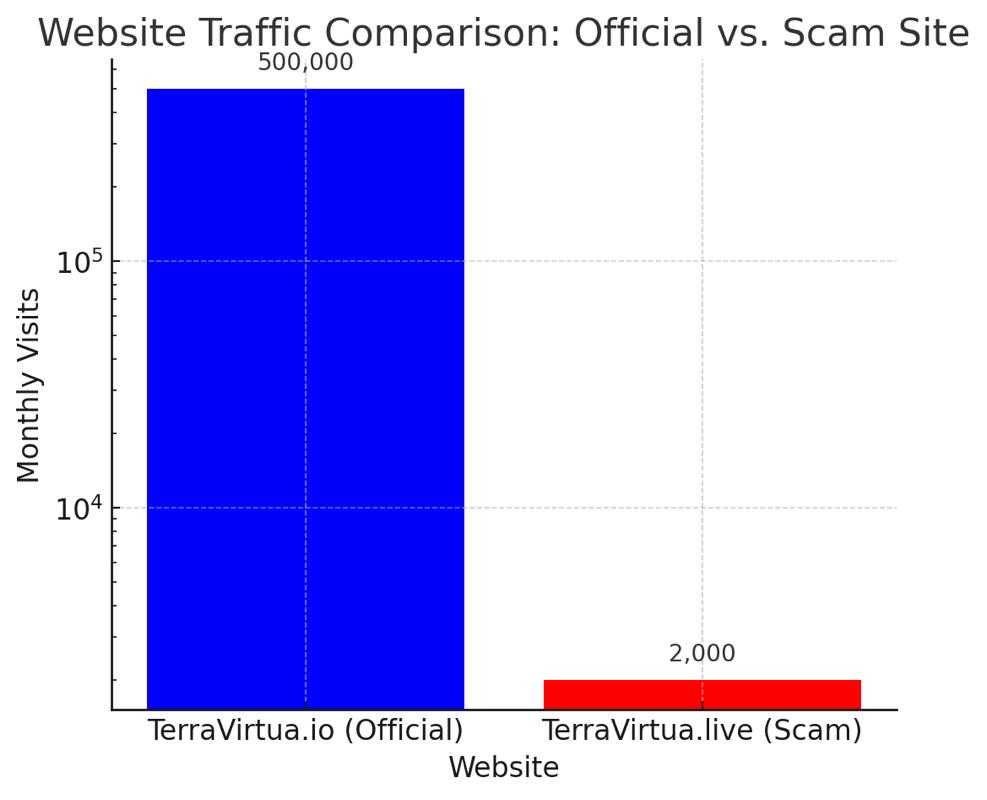

There is virtually no information available about the traffic trends or public perception of Terravirtua.io. The absence of user reviews, discussions, or any meaningful online presence is alarming. Legitimate platforms typically generate some level of public engagement, making this silence a significant concern.

This Terravirtua.io review highlights that the website provides no information about its security protocols, such as SSL certificates, encryption standards, or data protection measures. For a platform handling financial transactions and personal information, this omission is unacceptable and raises serious security concerns.

The content on Terravirtua.io closely mirrors that of the official Terra Virtua platform (terravirtua.io). This duplication strongly suggests an attempt to impersonate the legitimate platform, a tactic commonly used in phishing and fraudulent schemes.

The platform does not disclose the payment methods it accepts, which is another red flag. Legitimate investment platforms typically provide clear details about payment options to ensure transparency and build trust.

There is no information available about customer support channels on Terravirtua.io. Reputable platforms usually offer multiple support options, such as email, phone, or live chat, to assist users. The absence of such features is highly suspicious.

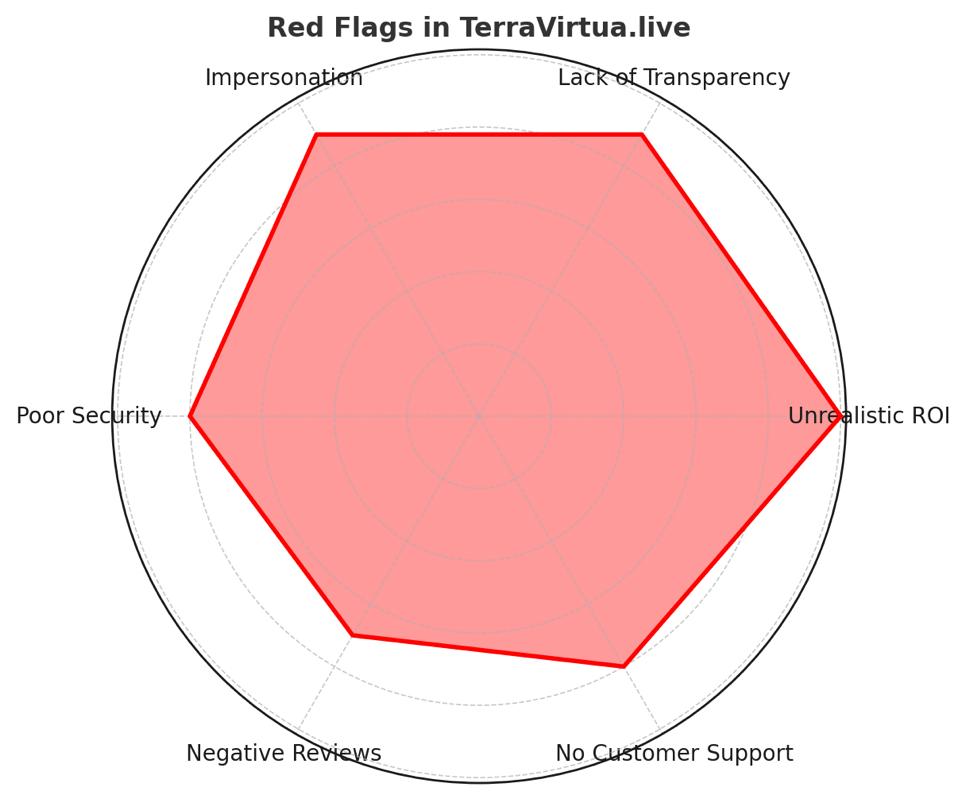

Traditional investment avenues, such as real estate or bank savings accounts, typically offer annual returns of 3% to 8%. Legitimate cryptocurrency exchanges may provide APYs between 5% and 15%, depending on the asset and staking period. However, Terravirtua.io makes no specific ROI claims, making it impossible to evaluate its sustainability. Platforms promising unusually high returns with minimal risk are often associated with Ponzi schemes or fraud.

Lack of Transparency: No clear ownership or contact information.

Duplicate Content: Mirrors the official Terra Virtua platform, suggesting fraudulent intent.

Absence of User Feedback: No reviews or discussions, indicating a lack of credibility.

No Security Details: No information on data protection or encryption.

Unclear Payment Methods: No disclosure of accepted payment options.

No Customer Support: No visible support channels for users.

There is no evidence of official social media profiles or reputable accounts promoting Terravirtua.io. Investors should be wary of platforms that lack a genuine social media presence or are promoted by dubious accounts.

Based on this Terravirtua.io review, the platform exhibits numerous red flags that strongly suggest it is not a legitimate investment platform. Investors are strongly advised to:

Avoid Engagement: Steer clear of platforms that lack transparency and show signs of impersonation.

Conduct Thorough Research: Verify the authenticity of any platform by checking domain registrations, official partnerships, and user reviews.

Stick to Official Sources: Only engage with reputable and well-documented platforms like terravirtua.io to minimize risks.

This Terravirtua.io review is for informational purposes only and should not be considered financial advice. Investing in digital assets carries inherent risks, and individuals must conduct their own research (DYOR) before making any investment decisions.

As the digital asset space grows, fraudulent platforms are likely to become more sophisticated in their tactics. While regulatory bodies may introduce stricter measures to combat scams, individual vigilance remains crucial. Investors must stay informed about common scam tactics and prioritize platforms that demonstrate transparency, security, and legitimacy. Platforms like Terravirtua.io, which fail to meet these basic criteria, should be avoided at all costs.

This Terravirtua.io review is based on publicly available information and does not constitute financial advice. Always conduct your own research (DYOR) and consult a professional before investing.

Always research before investing. Use these tools to verify legitimacy:

WHOIS Lookup: https://whois.domaintools.com

SimilarWeb: https://www.similarweb.com

ScamAdviser: https://www.scamadviser.com

Trustpilot: https://www.trustpilot.com

Reddit Discussions: https://www.reddit.com

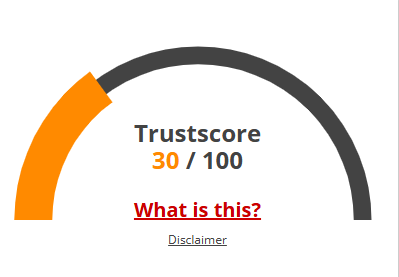

Given Terra Virtua Very low trust score, there is a good chance that the website is a hoax. Use caution when accessing this website!

Our algorithm examined a wide range of variables when it automatically evaluated Terra Virtua, including ownership information, location, popularity, and other elements linked to reviews, phony goods, threats, and phishing. All of the information gathered is used to generate a trust score.

Answer: Based on this Terravirtua.io review, the platform exhibits several red flags, including a lack of transparency in ownership, vague ROI claims, and duplicate content. These factors raise serious concerns about its legitimacy.

Answer: The primary risks include:

Lack of clear ownership and contact information.

No specific details about the compensation plan or ROI.

Absence of security measures and customer support.

Potential impersonation of the official Terra Virtua platform.

Answer: Traditional investments like real estate or bank savings typically offer annual returns of 3% to 8%. Terravirtua.io makes no specific ROI claims, making it impossible to compare. Promises of unusually high returns with minimal risk are often associated with scams.

Answer: There is no evidence of official social media profiles or reputable accounts promoting Terravirtua.io. This lack of a genuine online presence is a significant red flag.

Answer: If you’ve invested in Terravirtua.io, it’s crucial to:

Stop further investments immediately.

Document all transactions and communications.

Report the platform to relevant regulatory authorities.

Seek advice from a financial advisor or legal expert.

Title: Terra Virtua

https://scamsradar.com/treasure-island-network-review-risks-scam-warnings/

https://scamsradar.com/zarraz-world-review-risks-red-flags-and-warnings/

https://scamsradar.com/snowealth-com-review-legit-or-scam-truth-revealed/

https://scamsradar.com/tensorium-ai-review-unrealistic-returns-and-risks/

https://scamsradar.com/ozonespace-io-review-key-concerns-and-red-flags-for-investors/