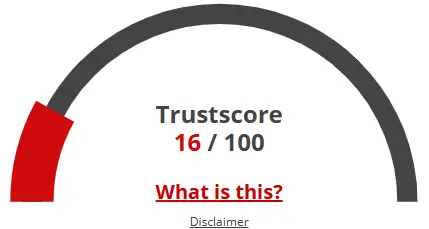

A website’s trust score serves as an essential indicator of its dependability. With its disturbingly low rating, Syntech raises considerable questions regarding its legitimacy. Extreme caution is strongly recommended for users.

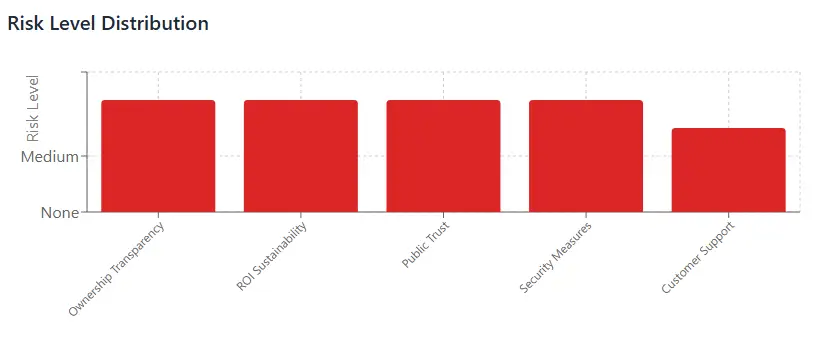

Major indicators of concern consist of low website traffic, inadequate user reviews, potential phishing threats, lack of ownership transparency, ambiguous hosting details, and insufficient SSL encryption.

A trust score this low greatly increases the risk of fraud, data breaches, and other dubious activities. Prior to using Syntech or another comparable online service, it is crucial to confirm these aspects thoroughly.