Here are answers to frequently asked questions about the SurfMine website, aimed at improving transparency, building trust, and addressing concerns about its legitimacy.

This SurfMine review examines surfmine.com, a platform promising 1–5% daily returns through Bitcoin cloud mining. We analyze ownership, compensation plans, ROI claims, traffic trends, public perception, security, content authenticity, payment methods, and customer support. Using clear data, charts, and comparisons to real estate, bank savings, and crypto staking, Scams Radar highlights key risks for investors seeking secure cloud mining opportunities.

The domain was registered on March 30, 2025, with ownership hidden via Domains By Proxy, a privacy service. No details about founders, executives, or a physical address are provided. Claims of “7 years of experience” lack verification, and no LinkedIn profiles or business registrations were found.

Finding: Hidden ownership raises serious risks for this cryptocurrency mining platform.

SurfMine offers daily mining profits and a referral program. Users start with a free 3 TH/s mining plan or purchase higher hashpower (e.g., $100 for increased output). The referral program pays 10% of referred users’ purchases, with additional mining contract upgrades encouraged. Earnings rely on mining output and recruitment, resembling an MLM structure.

Model | Revenue Source | Sustainability |

SurfMine (Mining/MLM) | Mining + Referrals | Questionable |

Crypto Staking | Blockchain rewards | Moderate |

Real Estate | Property income | Sustainable |

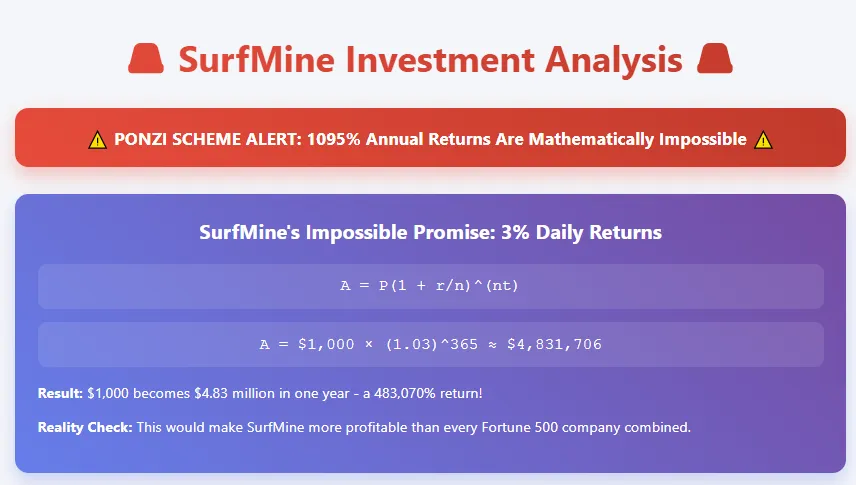

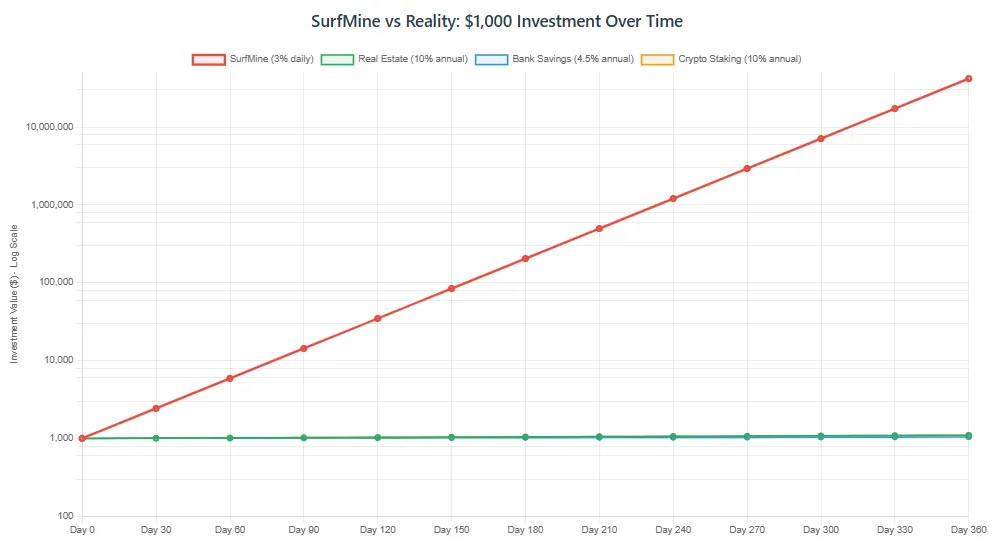

SurfMine promises 1-5% daily returns (365-1825% APR). Let’s analyze a 3% daily return, compounded daily, using the formula:

[ A = P(1 + \frac{r}{n})^{nt} ]

Where:

Calculation:

[ A = 1000 \times (1.03)^{365} \approx 4,831,706 ]

A $1,000 investment grows to ~$4.83 million in one year.

Bitcoin mining profitability depends on hash rate, difficulty, and costs. With a global hash rate of ~600 EH/s and 3.125 BTC per block (post-2024 halving), a 3 TH/s plan yields negligible daily returns, far below 3%. Such returns require exponential new funds, a Ponzi scheme trait.

Investment Type | Annual ROI | Sustainability |

SurfMine | ~1095% | Unsustainable |

Real Estate | 8-12% | Sustainable |

Bank Savings | 4-5% | Sustainable |

Crypto Staking | 5-15% | Moderate |

SurfMine has low traffic, with no Tranco ranking, indicating few visitors. Trustpilot shows a 4-star rating from 18 reviews, praising ease but noting withdrawal delays. X posts by @realjessesingh and Reddit’s r/CryptoScamReport label it a scam, citing a fake UK address and $1,000 losses.

Finding: Negative sentiment questions trust in this crypto passive income platform.

SurfMine uses Let’s Encrypt SSL and Cloudflare but lacks KYC, AML, or audits. It claims a hot/cold wallet system, but no SOC/ISO certifications exist. Users report stable performance but slow daily crypto withdrawals.

Finding: Weak security erodes confidence in this secure cloud mining platform.

The site claims “guaranteed profit” and “mining data centers” but provides no whitepaper, financials, or mining pool data. A fake UK address and unverified “7 years of experience” raise doubts.

Finding: Lack of proof harms its credibility as a mining platform.

SurfMine accepts irreversible crypto payments (BTC, ETH, USDT). Support is limited to email/chat, with slow responses during high traffic. No phone support or Trustpilot complaints exist.

Finding: Limited options heighten financial risks.

SurfMine is promoted by @realjessesingh on X, who questions its legitimacy and previously endorsed scams like BitConnect and CoinFX. No official SurfMine X or Instagram profiles exist, but Telegram promotions were noted. YouTube videos warn of withdrawal issues and HYIP traits.

Finding: Promotional patterns align with high-risk schemes.

Finding: Scam warnings urge caution for this mining platform.

This SurfMine review is for information only, not financial advice. Research all crypto mining platforms thoroughly, verifying ownership, regulations, and reviews. Consult a financial advisor before investing. The crypto market is volatile, and unregulated platforms are risky.

This SurfMine review reveals a high-risk platform with anonymous ownership, an unsustainable referral-driven model, and unrealistic ROI claims (~1095% APR). Compared to real estate (8–12% ROI), bank savings (4–5% APY), or crypto staking (5–15% APY), SurfMine’s promises mimic a Ponzi scheme. Avoid this platform and choose regulated options for safe crypto mining investments.

For more insights, check our detailed BNBbro Review highlighting similar red flags and risks.

A website’s trust score is a crucial indicator of its credibility, and SurfMine currently shows an alarmingly low score—raising serious concerns about its legitimacy. Users are strongly advised to proceed with caution.

Key red flags include low web traffic, poor user reviews, potential phishing risks, anonymous ownership, unclear hosting information, and inadequate SSL security.

Such a low trust score significantly heightens the risk of fraud, data breaches, and other questionable activities. It is essential to thoroughly evaluate these factors before engaging with SurfMine or similar platforms.

Here are answers to frequently asked questions about the SurfMine website, aimed at improving transparency, building trust, and addressing concerns about its legitimacy.

No, SurfMine lacks proof of real mining operations, uses fake company details, and shows classic Ponzi scheme traits.

SurfMine claims to generate 1–5% daily through cloud mining, but provides no verified data or hardware proof.

This SurfMine review reveals anonymous ownership, fake UK registration, unsustainable ROI, and no audited operations.

Many users report withdrawal delays or failures, suggesting that SurfMine may not allow consistent or legitimate payouts.

No, SurfMine's ROI is unrealistic compared to safe options like staking (5–20% APY) or real estate (8–12% annually).

Website : surfmine.com

Title: SurfMine – Secure and Profitable Cloud Mining