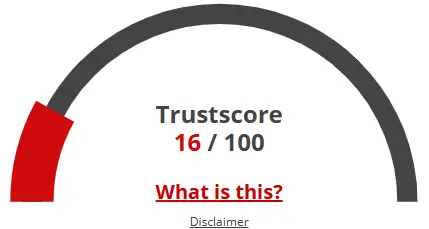

A website’s trust score is a critical measure of its reliability. Smarts Money holds an alarmingly low rating, raising significant doubts about its legitimacy. Users are strongly urged to exercise extreme caution.

Key warning signs include minimal web traffic, poor user feedback, possible phishing risks, anonymous ownership, vague hosting information, and weak SSL encryption.

Such a low trust score significantly heightens the risk of fraud, data compromise, and other suspicious activities. It’s essential to thoroughly verify these elements before engaging with Smarts Money or any similar online service.