Institutional investors, such as pension funds, who have been reluctant to participate in cryptocurrency, may find “cover” from a US crypto reserve.

According to Cointelegraph, President Donald Trump’s two postings on his proposals for a US cryptocurrency reserve “triggered a marketwide rebound” in cryptocurrencies on March 2, with the global world value rising by almost 7% to $3.04 trillion.

On closer inspection, however, a crypto strategic reserve—likely modeled after the US Strategic Petroleum Reserve, established in the 1970s during the Arab oil embargo—raises more concerns than it does answers.

What kinds of cryptocurrency would make up the “reserve” and whether the US would buy cryptocurrency for the reserve rather than just adding to its stock of seized cryptocurrency when law enforcement conducts seizures were topics of debate, if not misunderstanding.

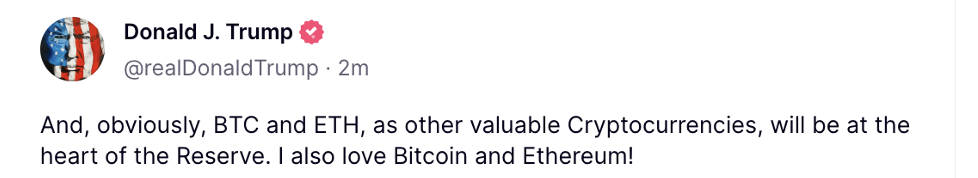

Trump’s two tweets on the Truth Social platform were criticized for their sequence. Curiously, the original article only included the three tokens with the lowest market capitalizations in the predicted reserve: Cardano ADA ($0.9251), Solana SOL ($147.10), and XRP ($2.58).

The president made another remark a few minutes later, seemingly out of the blue, mentioning the two biggest cryptocurrencies, Ether ($2,229) and Bitcoin ($89,704).

The president’s own memecoin was introduced on Solana, thus that platform may have been more prominent, according to some critics, whether it is fair or not.

The introduction of cryptocurrencies astonished other members of the crypto community. Since Bitcoin was the oldest, safest, most popular, and best-capitalized cryptocurrency, some people believed that the US would eventually maintain a strategic reserve of the cryptocurrency. However, a reserve that also has altcoins?

Anthony Pompliano, the founder and CEO of Professional Capital Management, stated on March 3 that the choice to establish a broad crypto strategic reserve was an unforced mistake that would be regretted later. “At the expense of the American taxpayer, it appears that we are receiving a haphazard assortment of speculative tools that will enrich the insiders and creators of these coins.”

Pompliano went on to say that cryptocurrency tokens like as ETH, SOL, XRP, and ADA just do not match the “reserve” paradigm. They resemble technology stocks more than the hard currency or natural resources that usually make up strategic reserves (Canada, for example, maintains a strategic reserve of maple syrup, which is a less common product).

The New York Times reported that Ripple, “whose XRP token is one of the five that Trump said would be included…donated $45 million to an industry-wide PAC that sought to help elect Trump and other Republicans.” “Skeptics say the most obvious winner is Trump himself, who has rolled out a crypto venture of his own that carries millions of dollars in tokens set to be included in the reserve,” the article said.

Related: Should a US crypto reserve include ADA, SOL, or XRP?

However, others argued that these cryptocurrencies more accurately represent the trajectory of blockchain-based currencies. For instance, one reader who took issue with Pompliano’s letter’s approach pointed out that Cardano is “more energy efficient, cost-efficient, deterministic, decentralized, scalable, and able to handle programmability today” than Bitcoin.

The addition of cryptocurrencies to a state-backed reserve is a “double-edged sword” with advantages and disadvantages, according to Yu Xiong, a professor and director of the Surrey Academy for Blockchain and Metaverse Applications at the Surrey Business School, University of Surrey.

He told Cointelegraph that a multi-asset reserve provides more diversification and less dependence on Bitcoin, which now makes up over half of the market value of cryptocurrencies.

“Technological diversity is represented by Solana’s high-speed transactions [65,000 TPS] and Ethereum’s DeFi ecosystem [~$50 billion total value locked].”

The addition of cryptocurrencies acknowledges the wider applications of blockchain technology. He stated that during Russia’s 2022 invasion, Ukraine collected $135 million in cryptocurrency contributions using ETH, SOL, and other currencies.

However, there may also be drawbacks, such as regulatory ambiguity. For example, Ripple continues to face legal action from the SEC. According to Xiong, “a government holding these tokens could face backlash.”

Risks to liquidity are another issue. Government acquisitions or sales might cause cryptocurrency values to skyrocket or plummet because of how little these currencies are exchanged.

Naturally, the trading volume of Bitcoin is higher than that of the other currency. Bitcoin’s volume across all platforms was $54.8 billion in a recent 24-hour period, whereas ETH, XRP, SOL, and ADA were $23.4 billion, $5.5 billion, $5.4 billion, and $3.6 billion, respectively. This might suggest that some of the altcoins lack “depth for large scale reserves,” according to Xiong.

Related: With so many resolutions, why is the Ripple SEC lawsuit still pending?

Fears of market manipulation may then increase as a result. Xiong told Cointelegraph, using CoinGlass models, that “selling 3% of Bitcoin’s supply (~$5.5 billion) could crash prices by 15%, but the US Treasury’s 2014 sale of 30,000 Silk Road BTC caused minimal disruption.