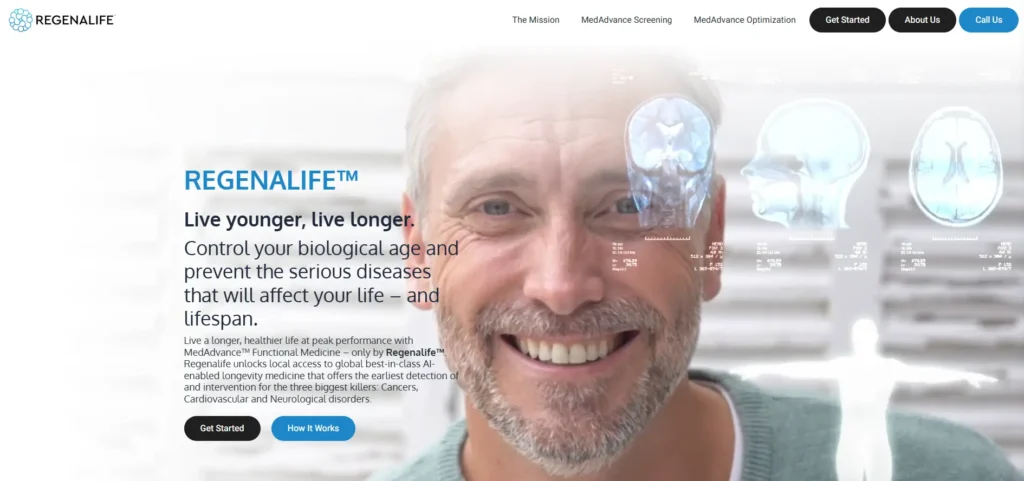

RegenaLife, accessible via regenalife.ca, is a multi-level marketing (MLM) company in the health and wellness sector. It offers organic supplements and a business opportunity for affiliates. This RegenaLife review examines its legitimacy, focusing on ownership, compensation plan, and risks. Scams Radar uses clear charts and data to help potential investors decide if it’s a safe investment. Our analysis ensures transparency, comparing RegenaLife to traditional options like real estate and bank savings.

RegenaLife Marketplace, originally Regeneration USA, was founded in 2008 by Justin Chernalis. Based in Old Tappan, New Jersey, with a Canadian office in Niagara Falls, Ontario, the company is led by CEO Ernie Cadiz. Chernalis has over 30 years in the nutraceutical industry, serving as a board advisor.

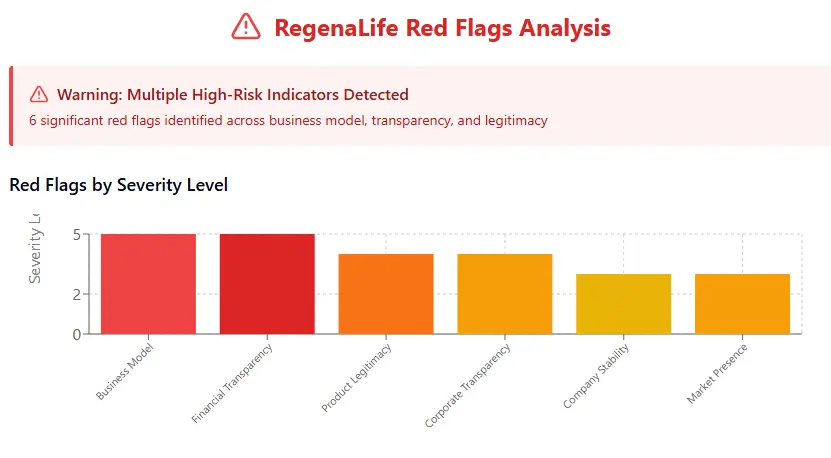

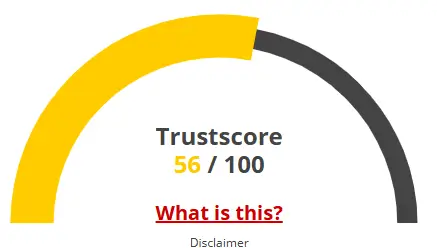

Cadiz brings 27 years of experience in telecom, energy, and real estate but lacks MLM expertise. This gap raises concerns about navigating MLM regulations. The domain regenalife.ca, recently registered, hides ownership via WHOIS privacy, a red flag per Scamadviser’s 73/100 trust score.

RegenaLife’s compensation plan is a unilevel MLM structure, rewarding affiliates for recruitment and product sales. Joining is free, but earning requires Fast Start packages ($99–$549) and a monthly personal volume (PV) of 50, costing about $50. The plan emphasises recruitment over retail, raising Vyb pyramid scheme concerns.

Retail Profits: Earn margins on product sales (wholesale vs. retail).

Residual Commissions: 3–20% on downline sales across seven levels.

Fast Start Bonuses: $7.50–$25 per recruited affiliate’s package purchase.

Rank Advancement Bonuses: $75–$8,000 for higher ranks (e.g., Bronze to Black Diamond).

Coded Infinity Bonus: Pays on an infinite downline with two retail customers (15 PV each).

Check Match Bonuses: 5–15% on team earnings (levels 1–3, requires 1,500 PV in three levels).

Level | Commission Rate | Example Earnings ($50 PV per Affiliate) |

1 | 20% | $10 per affiliate |

2 | 10% | $5 per affiliate |

3 | 10% | $5 per affiliate |

4 | 5% | $2.50 per affiliate |

5 | 5% | $2.50 per affiliate |

6 | 4% | $2 per affiliate |

7 | 3% | $1.50 per affiliate |

RegenaLife promotes “massive residual income” via a “3×3” recruitment model (each affiliate recruits three others monthly). Let’s calculate its feasibility.

Assumptions

Calculation

Why It’s Unsustainable

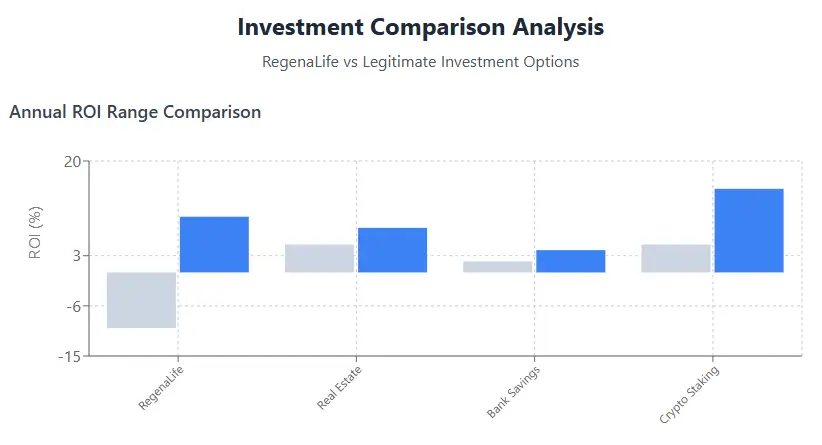

RegenaLife’s claims don’t match stable investments.

Investment Type | Annual ROI | Risk Level |

RegenaLife | -10% to 10% | Very High |

Real Estate | 5–8% | Medium |

Bank Savings | 2–4% | Low |

Crypto Staking | 5–15% | High |

Crypto Staking: $100,000 at 10% APY earns $10,000/year, volatile but transparent.

RegenaLife may face regulatory scrutiny by 2026 due to its MLM structure, similar to Herbalife. Market decline is likely by 2027 due to competition and dropout rates. A shift to e-commerce could help, but product differentiation is critical.

This RegenaLife review reveals a high-risk MLM with unsustainable returns. Its recruitment-focused plan, hidden ownership, and unverified products outweigh benefits. Compared to real estate (5–8% ROI) or bank savings (2–4% APY), RegenaLife offers little value. Avoid this opportunity and prioritise transparent investments. Always do your own research to protect your finances.

Disclaimer: This RegenaLife review is for education only, not financial advice. Conduct your own research, verify claims, and consult professionals before investing. MLMs are risky, and past results don’t guarantee future success.

The subject of how to verify the correctness of the RegenaLife crypto network’s conclusions is addressed by these frequently asked questions. To help ease your concerns, we have included the following queries and responses:

RegenaLife is a multi-level marketing (MLM) company selling organic supplements and health products. It offers an affiliate programme for earning through sales and recruitment.

RegenaLife operates as an MLM, not a scam, but its recruitment-heavy model raises pyramid scheme concerns. Most affiliates earn less than $1,000 annually, per industry data.

The unilevel plan pays 3–20% commissions on seven levels, with bonuses for recruitment and rank advancement. Earnings depend heavily on recruiting, requiring a $99–$549 Fast Start package.

Experts, like those at BehindMLM, flag RegenaLife for its recruitment focus, lack of income disclosure, and unverified product claims, suggesting high financial risk for affiliates.

RegenaLife’s supplements lack FDA or Health Canada approval. Claims about preventing diseases like cancer are unverified, raising concerns about product efficacy and safety.

Title: Regenalife

There are no reviews yet. Be the first one to write one.