This ProXgain review examines the legitimacy of proxgain.com, an online trading platform claiming to offer high returns in forex and cryptocurrencies. Investors seeking reliable opportunities must scrutinize such platforms. This comprehensive analysis covers ownership, compensation plan, traffic trends, public perception, security, payment methods, customer support, technical performance, and ROI claims. Using data, charts, and comparisons, we identify risks and provide clear recommendations for beginners.

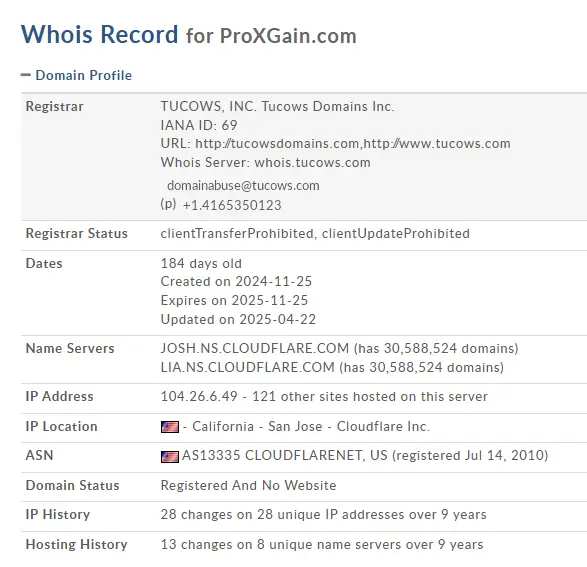

ProXgain claims affiliation with RFlexio Limited, supposedly registered in Comoros. However, checks with the Mwali International Services Authority (MISA) show no evidence of this company’s registration, suggesting a false claim. The Financial Conduct Authority (FCA) issued a warning on May 14, 2025, stating ProXgain lacks authorization in the UK, a major red flag. Legitimate platforms provide verifiable ownership details, such as executive profiles or regulatory licenses. ProXgain’s anonymous ownership and lack of regulatory oversight raise serious concerns about its credibility.

Red Flags:

ProXgain’s compensation plan is vague, with no clear details on its website. Reviews suggest it offers high bonuses, automated trading software, and account management promising “guaranteed high profits.” Such claims are common in scams, luring investors with easy gains. Legitimate brokers disclose transparent fee structures, such as trading commissions or spreads, and avoid guaranteed returns due to market risks. ProXgain’s emphasis on recruitment bonuses and high profits without clear revenue sources points to a potential Ponzi scheme.

Feature | ProXgain Claims | Legitimate Platforms |

Fee Structure | Not disclosed | Transparent (e.g., 0.1% per trade) |

Returns | Guaranteed high profits | No guarantees, risk warnings |

Bonuses | High recruitment bonuses | Minimal, tied to trading volume |

Revenue Source | Unclear, possibly new investor funds | Trading fees, interest, or management fees |

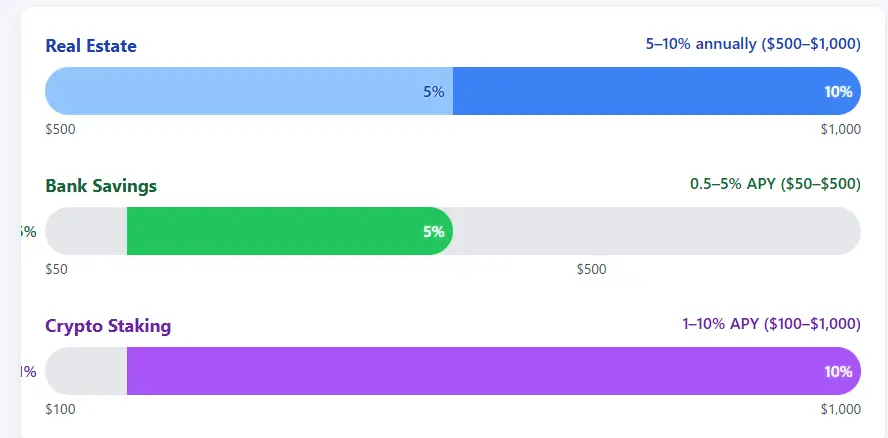

ProXgain promises “guaranteed high profits,” often cited as 10% monthly. Let’s analyze this:

Assumptions:

A $10,000 investment grows to $31,384 in a year, a 213.84% annual return. Compare this to:

Why It’s Unsustainable:

Scamadviser reports proxgain.com has a low Tranco ranking, indicating few visitors. The domain, registered in November 2024, is very new, a common trait of risky platforms. Established brokers have years of operation and steady traffic growth. ProXgain’s short history and low traffic suggest limited trust and market presence.

Trustpilot shows a 4-star rating for ProXgain (49–119 reviews), but many positive reviews seem generic or paid, lacking specifics. Negative reviews highlight serious issues: funds vanishing after withdrawal requests, unresponsive support, and scam accusations. One user stated, “My money disappeared overnight after a withdrawal request.” Another reported confusion over ProXgain’s link to Evansorex, with no clear answers from support. Scam warnings from BrokersView and Unique-Reviews reinforce these concerns.

User Feedback:

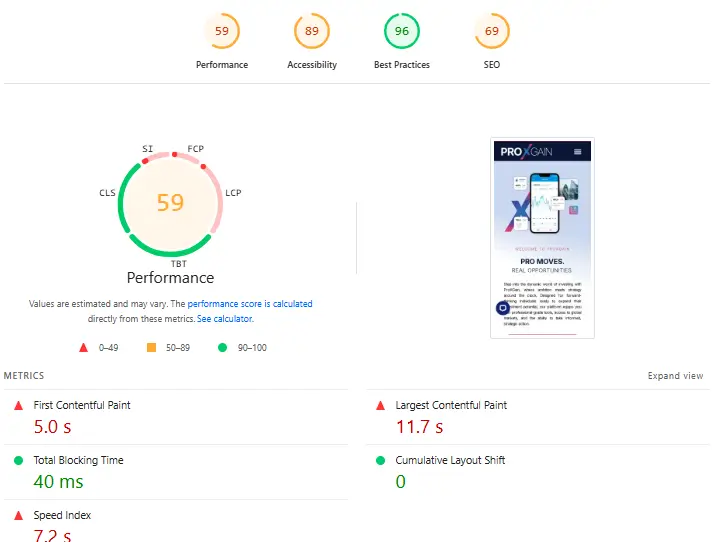

ProXgain provides no details on security measures like SSL encryption or two-factor authentication (2FA). Legitimate platforms prioritize AML/KYC compliance and robust security. Scamadviser’s low trust score flags potential risks, such as hidden server locations. No technical performance data (e.g., uptime or trade execution speed) is available, unlike reputable brokers offering 99.9% uptime.

ProXgain reportedly requires deposits to personal crypto wallets, not trading accounts, displaying virtual credits to mimic profits. This bypasses regulated payment systems, making fund recovery nearly impossible. Legitimate platforms use bank transfers or verified crypto exchanges. The website’s professional look masks unverifiable claims, such as high profits or RFlexio Limited ties, indicating low content authenticity.

Users report poor customer support, with delayed or no responses to withdrawal requests. One user noted, “They kept saying a success manager would contact me, but no one did.” Persistent calls without addressing queries, like the Evansorex link, suggest aggressive tactics. Reliable brokers offer 24/7 support via multiple channels.

Using the analysis framework, ProXgain scores high risk:

Risk Factor | Score | Reason |

Domain Age | 50 | Recent registration (Nov 2024) |

ROI Sustainability | 90 | Unrealistic 213% annual return |

Customer Reviews | 70 | Withdrawal issues, scam claims |

Regulatory Compliance | 90 | No license, FCA warning |

ProXgain’s red flags suggest a short lifespan, likely collapsing within 6–12 months if it relies on new investor funds. Regulatory scrutiny may accelerate this. Monitor scam reports and FCA updates.

ProXgain.com shows multiple warning signs: no regulation, unverifiable ownership, unrealistic returns, and poor customer support. Mathematical analysis proves its ROI claims are unsustainable. Investors should avoid this platform and choose regulated alternatives to protect their money.

Disclaimer: This ProXgain review is for informational purposes only, not financial advice. Conduct your own research using tools like Scamadviser and regulatory databases. Consult financial advisors and avoid unregulated platforms. Markets are risky, and past performance doesn’t guarantee future results.

Answers to frequently asked questions about the validity of the ProXGain Networks study may be found here. To ease your concerns, we have included the following questions and answers:

ProXgain lacks regulation from authorities like the FCA and has no verifiable ownership, raising serious concerns. User reviews report issues like withdrawal delays and scam allegations, suggesting it’s not a safe investment option. Always choose regulated brokers for security.

ProXgain’s unregulated status, unverifiable affiliation with RFlexio Limited, and reports of funds disappearing after withdrawal requests indicate high risk. Its promise of guaranteed high returns is unsustainable, pointing to potential Ponzi scheme tactics.

Unlike regulated platforms like Binance or Interactive Brokers, ProXgain has no licensing, vague compensation plans, and poor customer support. Its 213% annual ROI claims far exceed realistic market returns (e.g., 5–10% for real estate), making it highly suspicious.

User reviews highlight significant withdrawal issues, with funds reportedly vanishing or delayed for months. Legitimate brokers process withdrawals promptly through regulated payment methods, unlike ProXgain’s use of personal crypto wallets, which complicates recovery.

When reading a ProXgain review, check for regulatory warnings, ownership transparency, and realistic ROI claims. Verify information with tools like Scamadviser and FCA databases. Be cautious of fake positive reviews and focus on user experiences with withdrawals and support

Title: ProXGain – Pro Moves. Real Opportunities.

There are no reviews yet. Be the first one to write one.