Paladin Mining Review: Is It a Legitimate Investment or a Risky Scheme?

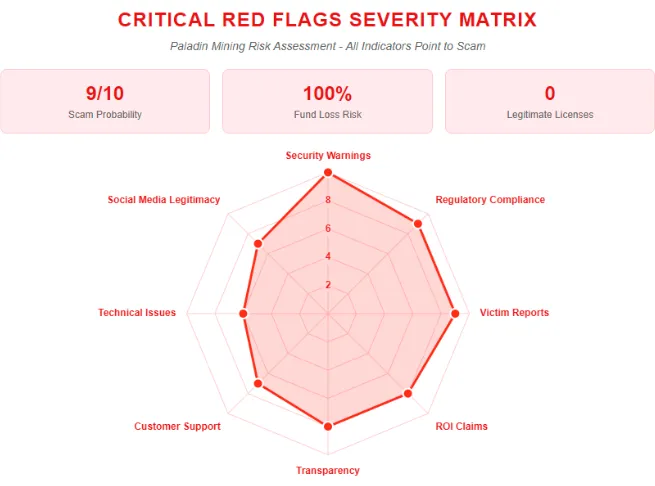

This Paladin Mining review examines the legitimacy and risks of a cloud mining platform claiming to offer high-yield cryptocurrency investments. For an in-depth scam analysis, visit Scams Radar for a detailed review. We analyze ownership, compensation plans, ROI claims, security, public perception, and more to help investors decide if paladinmining.com is trustworthy. Our findings reveal significant concerns about the platform’s credibility and sustainability.

Table of Contents

What Is Paladin Mining?

Paladin Mining presents itself as a cloud mining service for cryptocurrencies like Bitcoin, Ethereum, and Dogecoin. It claims to be operated by Paladin Risk Management Ltd, based in the UK since 2016, with 1.68 million users across 190 countries. However, multiple red flags, including unverifiable ownership and unrealistic returns, suggest potential risks for investors.

Ownership and Company Background

The platform is managed at Suite 4 Castle Farm, Clifton Road, Deddington, UK. This domain is registered by Gname.com Pte. Ltd. in Singapore. In UK business registries, Paladin Risk Management Ltd does not exist. The Australian Securities and Investments Commission (ASIC) or the Financial Conduct Authority (FCA) does not regulate it.

Lack of transparency in ownership is a major concern. Legitimate companies provide clear details about their leadership and registration. Credibility is further clouded by confusion with unrelated entities. LinkedIn profiles or executive profiles are not available, raising doubts.

Key Ownership Red Flags

- Hidden owner identity via privacy service.

- No verifiable UK company registration.

- No regulatory oversight from FCA, SEC, or ASIC.

- Potential name confusion with legitimate businesses.

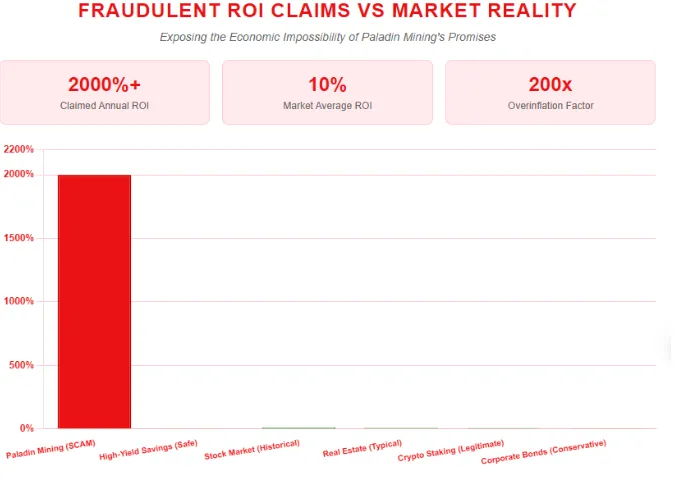

Compensation Plan and ROI Claims

Paladin Mining offers cloud mining contracts with promised daily payouts. Examples include a $15 “free contract” yielding $0.60 daily (4% daily ROI), a $100 “New User” contract yielding $7 in two days (7% ROI), and high-ticket plans promising $7,560–$22,400 in 50 days or up to $7,000 daily. Referral commissions range from 3% to 15%, incentivizing recruitment.

ROI Mathematical Analysis

The platform’s ROI claims are unsustainable. Consider a 4% daily ROI:

- Formula: ( A = P \times (1 + r)^n ), where ( P = $1,000 ), ( r = 0.04 ), ( n = 365 ).

- Calculation: ( A = 1000 \times (1.04)^{365} \approx $1,648,802 ), implying a 1,648,802% annual return.

- A $100 investment at 7% every two days yields over 230,000% annually.

These returns are impossible. Bitcoin mining typically yields 5%–20% annual returns due to high electricity costs, hardware expenses, and market volatility. Such high ROIs suggest a Ponzi scheme, where payouts depend on new investor funds.

Comparison to Legitimate Investments

Investment Type | Annual ROI | Risk Level |

Real Estate | 5%–12% | Medium |

Bank Savings (Pakistan) | 4%–10% | Low |

Crypto Staking (Coinbase) | 2%–6% | Medium |

Paladin Mining (Claimed) | 1,000%+ | Extreme |

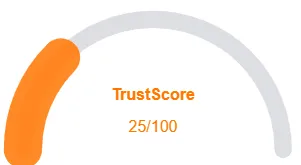

Public Perception and Trust Scores

Public feedback is largely negative. ScamAdviser rates it 0/100, citing hidden ownership and negative reviews. Gridinsoft and MalwareTips label it a cryptocurrency scam, noting fake testimonials and withdrawal issues. Trustpilot shows a 4.2/5 score, but patterns suggest manipulated reviews. A YouTube review by Intelligence Commissioner highlights user complaints about blocked withdrawals. One outlier, EvenInsight, claims a 95/100 safety score, but this lacks supporting evidence.

Trust Score Summary

Source | Trust Score | Notes |

ScamAdviser | 0/100 | Hidden ownership, scam warnings |

Gridinsoft | 1/100 | Cryptocurrency scam |

Trustpilot | 4.2/5 | Possible manipulated reviews |

MalwareTips | Scam | Fake metrics, withdrawal issues |

Security and Technical Performance

The platform uses a basic SSL certificate from Google Trust Services, ensuring encrypted communication but not legitimacy. Hosted by CloudFlare, it benefits from fast loading times, but frequent domain changes and user-reported account lockouts suggest instability. No two-factor authentication or blockchain transaction transparency is provided, increasing risks.

Payment Methods and Customer Support

Paladin Mining accepts cryptocurrencies (BTC, ETH, USDT, etc.) and claims to support credit cards, but crypto’s irreversible nature makes it scam-friendly. Users report withdrawal delays, with excuses like verification issues. Customer support, advertised as 24/7, is unresponsive, with emails to info@paladinmining.com often unanswered.

Social Media Promotion

Promotions appear on platforms like X (@RorySingh1), YouTube (Intelligence Commissioner), and fake accounts on Facebook and TikTok using AI-generated celebrity endorsements (e.g., Elon Musk). These accounts often have histories of promoting scams like BitConnect or ALR Miner, reinforcing suspicions of coordinated fraud.

Social Media Red Flags

- Fake influencer accounts with referral links.

- Paid promotions on CoinCentral and GlobeNewswire, not independent journalism.

- History of promoting known scams.

Recommendations for Investors

- Avoid Investment: The platform’s unrealistic returns, hidden ownership, and withdrawal issues indicate high risk.

- Report Issues: Contact local cybercrime units or regulators like the FCA if funds are lost.

- Use Regulated Platforms: Opt for licensed exchanges like Coinbase or Binance for crypto investments.

- Secure Funds: Store cryptocurrencies in non-custodial wallets to avoid platform risks.

Paladin Mining Review Conclusion

This Paladin Mining Review reveals a platform with alarming red flags: unverifiable ownership, unsustainable ROI claims, and poor customer support. Compared to real estate (5%–12%), bank savings (4%–10%), or crypto staking (2%–6%), its promised 1,000%+ annual returns are impossible. Investors should avoid this platform and prioritize regulated alternatives. For more insight into similar high-risk operations, you can also read our detailed Team Builder BTC Review. Always verify claims with tools like ScamAdviser or FCA’s register to protect your funds.

DYOR Disclaimer

This review is for informational purposes only and not financial advice. Conduct your own research (DYOR) before investing in any platform. Cryptocurrency investments are high-risk. Verify regulatory status, read independent reviews, and consult professionals to make informed decisions.

Paladin Mining Review Trust Score

A website’s trust score plays a vital role in evaluating its credibility, and Paladin Mining a dangerously low rating—raising serious concerns about its legitimacy. Users are strongly advised to proceed with caution.

The platform presents several warning signs, including low traffic, poor user reviews, potential phishing threats, hidden ownership, unclear hosting information, and weak SSL security.

Given this low trust score, the chances of fraud, data breaches, or other harmful activity increase significantly. It’s essential to assess these red flags carefully before engaging with Paladin Mining or similar platforms.

Let me know the next company name whenever you want a swap.

Positive Highlights

- Website content accessible

- No spelling or grammar errors

- Domain age old

- Archive age old

Negative Highlights

- Website content accessible

- Whois hidden

- Not in Tranco top 1M

Frequently Asked Questions About Paladin Mining Review

This section answers key questions about , providing clarity, promoting trust, and addressing concerns regarding the platform’s legitimacy.

No. Paladin Mining raises concerns due to hidden ownership, lack of regulation, and unrealistic high-yield ROI claims.

It claims to offer profits through cloud-based cryptocurrency mining, but there is no verifiable proof of real mining operations or revenue sources.

No. Paladin Mining is not licensed or registered with any recognized financial or regulatory body, making it a high-risk investment.

Risks include possible loss of funds, unverified business activities, lack of investor protection, and an unsustainable return model.

It’s not recommended. The platform’s red flags, absence of transparency, and questionable ROI promises make it unsafe for investors.

Other Infromation:

Reviews:

There are no reviews yet. Be the first one to write one.