NovaSkyPoint Review: Is This AI Trading Platform Legitimate or a Potential Scam?

In this NovaSkyPoint review, Scams Radar examines the platform at novaskypoint.com to help investors decide if it’s safe. Launched in 2025, it claims to provide AI-powered CFD trading with high returns, but concerns arise due to hidden ownership and unrealistic profit promises. Our goal is to provide clear facts to support informed choices.

Table of Contents

Part 1: Ownership and Team Details: What We Found

Ownership transparency is vital for trust. NovaSkyPoint claims independent operation with no major stakeholder over 10%. Yet, no leadership names or bios appear on the site.

Article writers like Ryo Nakamura and Dr. Takeshi Kimura have no online records. Searches on LinkedIn and professional sites yield nothing. This suggests made-up identities.

Company registration checks show no “NovaSkyPoint Inc.” in U.S. or Swiss databases.The CRD number 847392 isn’t listed in FINRA or SEC records, the 415 Mission St, San Francisco address is merely a virtual WeWork office, and the Swiss phone number (+41 61 300 7224) isn’t tied to any verified entity.

These gaps point to untraceable operators. Legitimate firms share team backgrounds to build credibility.

Part 2: Understanding What NovaSkyPoint Offers

NovaSkyPoint positions itself as an advanced trading site. It focuses on AI tools for arbitrage and market scans. Users get real-time data and order routing. The platform targets both new and experienced traders.

Key features include tiered plans and savings options. Educational resources cover risk strategies and terms. Security promises include encryption and authentication. Contact details include an email, phone, and San Francisco address.

2.1 Breaking Down the Compensation Plan

The compensation structure drives user interest. Trading plans start at €250 for basic access. Higher tiers reach €100,000+ for the Diamond level. These promise AI arbitrage and insured profits.

Savings plans offer 4% to 14% monthly returns. Weekly options claim 10% to 14%. Higher deposits unlock better rates and insurance.

Upselling is aggressive. Users face pressure to upgrade for “guaranteed” gains. No license details or audits support these claims. Plans lack ties to real exchanges.

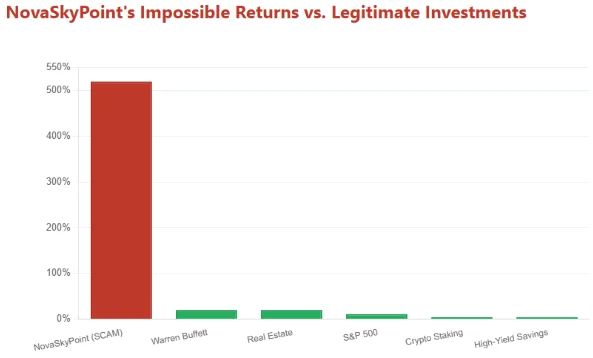

2.2 Why the Promised Returns Cannot Last: Math Explained

High returns sound appealing. But math shows they fail long-term. Take 10% weekly returns.

Formula: Annual return = (1 + weekly rate)⁵² – 1.

For a 10% rate: (1 + 0.10)⁵² – 1 ≈ 14,104%.

For a 14% rate: (1 + 0.14)⁵² – 1 ≈ 90,902%.

For a monthly 4% rate: (1 + 0.04)¹² – 1 ≈ 60%.

For a monthly 14% rate: (1 + 0.14)¹² – 1 ≈ 382%.

These numbers require endless growth. In reality, markets limit yields. Ponzi schemes use new funds to pay old ones. Recruitment must double weekly. After 20 weeks, it needs over a million users. That’s not possible.

Return Type | Claimed Rate | Annualized Yield | Sustainability Issue |

Weekly | 10% | 14,104% | Needs exponential users |

Weekly | 14% | 90,902% | Defies market limits |

Monthly | 4% | 60% | Above real benchmarks |

Monthly | 14% | 382% | Signals fraud |

Part 3: Traffic Patterns and How People View the Platform

Traffic data is limited. The domain’s age—registered September 1, 2025—keeps visits low. Blocked robots.txt hides it from searches.

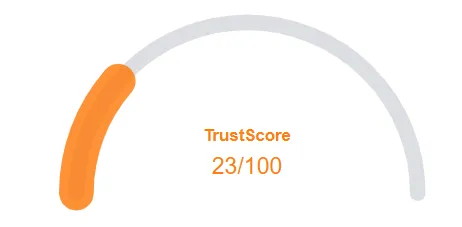

Public views are negative. Scamadviser gives a low trust score due to hidden owners and risks. Scamdoc rates it 25%. GridinSoft flags advance-fee tactics.

YouTube videos warn of lost money. Instagram links it to scam groups like Universal-Miners. The Dutch AFM and Swedish FI issued alerts in October 2025. No positive reviews on Trustpilot or Reddit.

3.1 Security Features and Content Quality

Security claims sound strong. The site uses SSL encryption and MFA. Higher plans offer profit insurance.

But SSL is basic. No audits or reserve proofs exist. Content looks professional, but copies common ideas. No unique data or sources back claims.

Payments likely use crypto for staking. This allows quick, hard-to-reverse transfers. Support is email and phone only. No live help or clear hours.

Technical speed is good. Yet, the focus seems to be on looks, not depth.

Part 4: Key Red Flags to Watch

Several issues stand out:

- No real team or owner details.

- Fake address and unverified CRD.

- Unreal returns are proven unsustainable.

- Regulatory warnings from AFM and FI.

- Hidden WHOIS and new domain.

- Blocked search indexing.

- Links to known scam patterns.

- Aggressive deposit pushes.

- No audits or licenses.

- Generic content without proof.

These match common fraud signs.

4.1 Social Media and Promotion Insights

Social buzz is minimal. No official accounts promote it. Warnings dominate on X from @AutoriteitFM.

Promoter profiles are rare. Some tie to past scams like NovaTech. No organic praise exists. Searches show alerts, not endorsements.

Tools for Your Own Checks

Use these for verification:

- WHOIS: Shows September 2025 registration, hidden owner.

- Scamadviser: Low trust, young site.

- Scamdoc: 25% score, fee scam risks.

- FINRA BrokerCheck: No CRD match.

- IOSCO Alerts: Reflects FI warning.

Safe Alternatives and Advice

Choose regulated paths. Real estate offers 4-10% with effort. Banks provide safe 4-5%. Crypto exchanges like Coinbase give 5-20%.

Avoid deposits here. Report to FINRA or FTC. Verify all claims first.

Final Thoughts on NovaSkyPoint

This NovaSkyPoint review highlights major risks. Hidden owners, impossible math, and warnings suggest avoidance. Stick to proven options for safety. Research fully before any move. This info aims to protect your funds in the 2025 market.

NovaSkyPoint Review Trust Score

A website’s trust score is an important indicator of its reliability. NovaSkyPoint currently reflects a worryingly low rating, raising serious concerns about its legitimacy. Users are strongly urged to exercise caution.

Key red flags include low web traffic, negative user feedback, possible phishing risks, undisclosed ownership, vague hosting details, and weak SSL protection.

With such a poor trust score, the likelihood of fraud, data breaches, or other security issues is much higher. It is crucial to carefully assess these warning signs before engaging with NovaSkyPoint or similar platforms.

Positive Highlights

- Website content is accessible

- According to the SSL check the certificate is valid

Negative Highlights

- This website does not have many visitors

- Cryptocurrency services detected, these can be high risk

- Several spammers and scammers use the same registrar

Frequently Asked Questions About NovaSkyPoint Review

This section answers key questions about BlockDAG Review, providing clarity, addressing concerns, and highlighting issues related to the platform’s legitimacy.

A crypto-mining platform claiming automated BTC/ETH mining and high ROI, but with no verified license or proof of operations.

It's 20-300% ROI in 24-48 hours, and hidden ownership raises major scam concerns.

Real investments like real estate or staking give 5-16% APY; Universal Miners’ 300% in 48 hours is unrealistic.

Use regulated platforms such as Binance Earn or Coinbase Staking with transparent, audited yields.

Both reveal opaque ownership and risky ROI promises, warning investors to proceed with caution.

Other Infromation:

Website: novaskypoint.com

Reviews:

There are no reviews yet. Be the first one to write one.