According to a Bitpanda poll, despite growing investor demand and legal certainty across the area, less than 20% of European banks provide crypto services.

According to a recent poll by bitcoin investing platform Bitpanda, less than one in five European banks and financial institutions provide digital asset solutions, suggesting that they may be grossly underestimating the demand for cryptocurrency services.

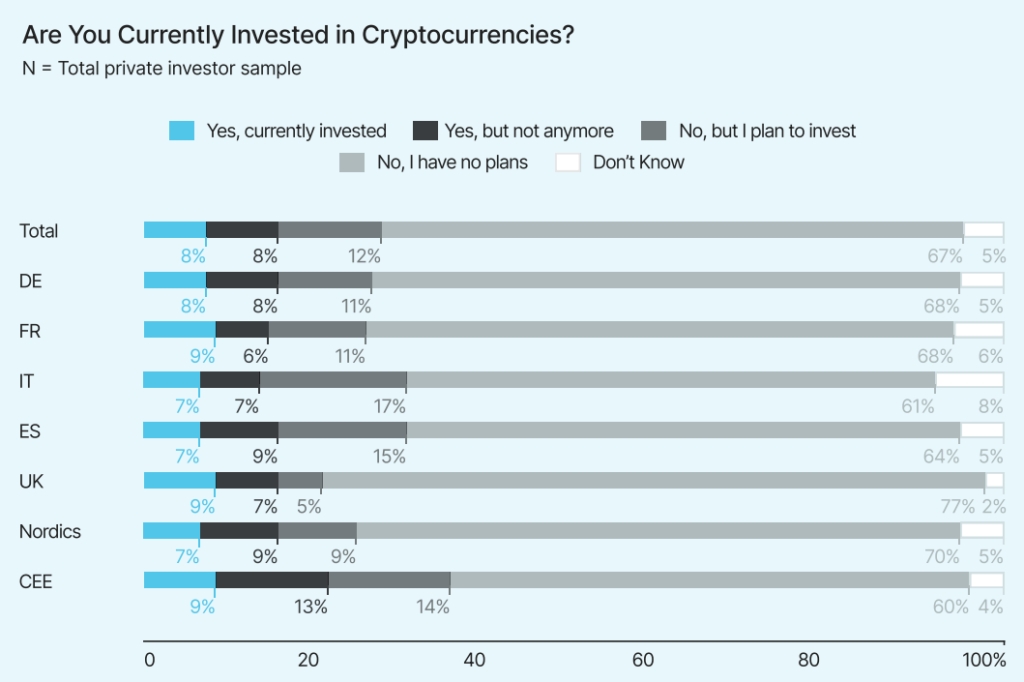

More than 40% of business investors now own cryptocurrencies, and another 18% want to do so in the near future, according to a research that polled 10,000 retail and business investors in 13 European nations.

However, just 19% of financial institutions polled said that their customers had a high need for cryptocurrency products, indicating a 30% discrepancy between perceived and real investor interest.

EU private investors’ cryptocurrency holdings by nation. Bitpanda, the source

Furthermore, just 19% of European financial institutions polled provide crypto services, despite the fact that more than 80% of them recognize the rising significance of crypto.

Related: With his most recent acquisition, Michael Saylor’s strategy has surpassed 500,000 Bitcoin.

However, some European banks are acknowledging the increasing demand for digital assets; according to a poll, 18% of financial institutions want to increase the range of crypto services they provide, especially those pertaining to crypto transfers.

According to Lukas Enzersdorfer-Konrad, deputy CEO of Bitpanda, “European financial institutions are aware that cryptocurrency is here to stay, but the majority are still not providing services that meet investor demand.”

He told Cointelegraph that the primary obstacles to adoption are internal, such as a “lack of resource or knowledge,” rather than external ones, like regulations. “These can be overcome, and the challenge to financial institutions is clear: go and check your revenue outflows,” he said. Customers’ financial movements are visible, demonstrating the genuineness of the desire for cryptocurrency.

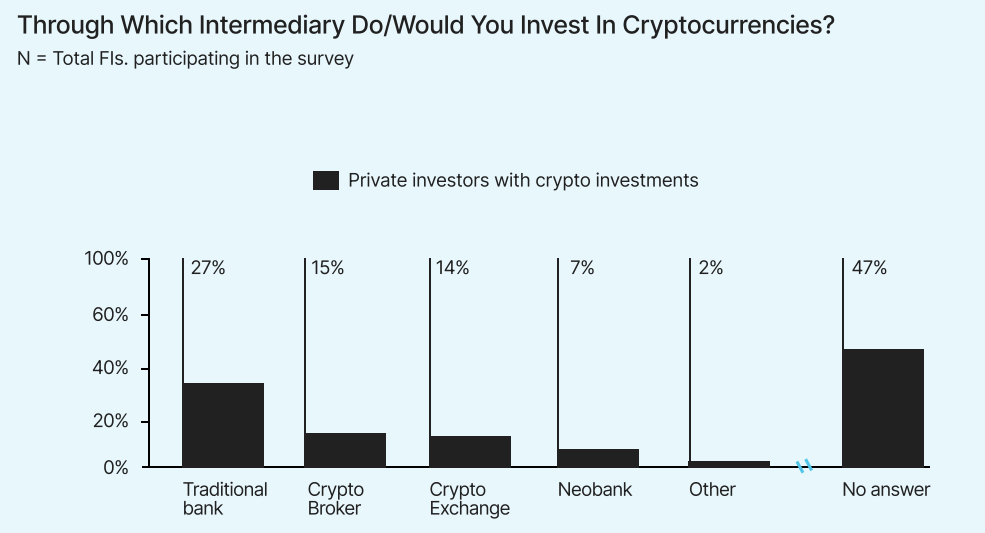

Private investors’ partner preferences in relation to cryptocurrency investments. Bitpanda, the source

Given that 27% of study participants would rather invest in cryptocurrencies via a regular bank and just 14% would choose a crypto exchange, more bank-sponsored cryptocurrency products might boost the adoption of cryptocurrencies in Europe.

By contrast, conventional banks were only the third most popular alternative (27%), with 36% of business investors choosing to invest via an exchange.

Related: Global adoption of cryptocurrency payments being hampered by security concerns – Survey