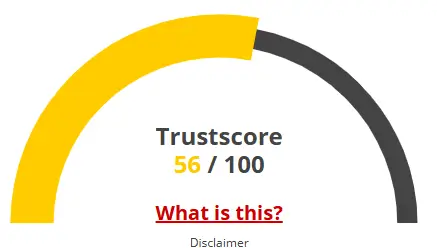

One of the most important measures of a website’s reliability is its trust score. Due to its extremely low rating, Kharpa credibility is seriously questioned. Users should proceed very carefully.

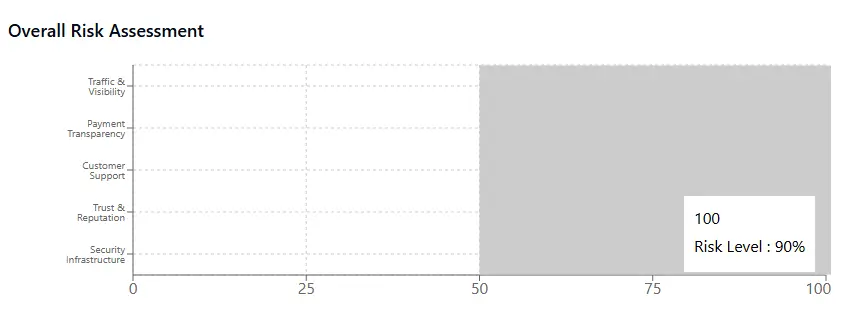

Unknown ownership, ambiguous hosting information, little traffic, unfavourable reviews, phishing threats, and inadequate SSL security are some of the main problems.

A score this low suggests possible data theft, fraud, or shaky operations. Always confirm these details before using Kharpa app or comparable platforms.