As online investment platforms grow in popularity, GreenFarm.lol claims to offer lucrative opportunities. However, this GreenFarm.lol Review critically examines the platform’s legitimacy, risks, and red flags to determine if it’s a safe investment or a potential scam.

Adyptuniverse.com is being promoted by dubious social media personalities on YouTube, Instagram, and Twitter. These accounts have previously promoted scams like Bitconnect and Forsage, raising further concerns about the platform’s legitimacy.

GreenFarm.lol fails to provide any information about its ownership or organizational structure. The website does not disclose details about its founders, team members, or company registration—a significant red flag. Transparent platforms typically share such information to build trust with investors.

Key Concern: The lack of transparency raises serious doubts about GreenFarm.lol’s credibility.

GreenFarm.lol offers investment plans with daily returns ranging from 5% to 10%. Here’s a breakdown of the plans:

Plan 1: Invest 5toreceive5toreceive0.25 daily for 30 days, totaling $7.50.

Plan 2: Invest 10toreceive10toreceive0.55 daily for 25 days, totaling $13.75.

Plan 3: Invest 25toreceive25toreceive1.50 daily for 20 days, totaling $30.

Plan 4: Invest 50toreceive50toreceive3.25 daily for 20 days, totaling $65.

Plan 5: Invest 100toreceive100toreceive7.50 daily for 20 days, totaling $150.

Plan 6: Invest 250toreceive250toreceive21.25 daily for 20 days, totaling $425.

Plan 7: Invest 500toreceive500toreceive47.50 daily for 15 days, totaling $712.50.

Plan 8: Invest 1,000toreceive1,000toreceive100 daily for 15 days, totaling $1,500.

These plans promise weekly returns between 35% and 70%, which are astronomically high compared to traditional investment benchmarks.

Mathematical Analysis of ROI Claims

Consider Plan 8, which offers a 10% daily return over 15 days:

Daily Return: 10% of 1,000=1,000=100

Total Return over 15 Days: 100∗15=100∗15=1,500

Total Profit: 1,500−1,500−1,000 (initial investment) = $500

This implies a 50% profit in just 15 days, which is unsustainable in any legitimate investment scenario.

Key Concern: Such unrealistic returns are a hallmark of Ponzi schemes, where returns are paid using funds from new investors rather than legitimate profits.

Specific traffic data for GreenFarm.lol is unavailable, but the platform’s minimal online presence and lack of user reviews are concerning. Additionally, a warning from Diamond Trust Bank (DTB) Kenya highlights a scam by an entity named ‘Green Farm’ falsely claiming a partnership with DTB to provide loans. While this may not directly reference GreenFarm.lol, the similarity in naming raises significant red flags.

Key Concern: The lack of organic traffic and negative public perception further question the platform’s legitimacy.

GreenFarm.lol employs HTTPS encryption, as indicated by a valid SSL certificate. However, there is no information about additional security measures, such as two-factor authentication (2FA) or third-party audits.

Key Concern: Without verified security protocols, investors’ funds and personal data remain at significant risk.

The content on GreenFarm.lol is generic and lacks depth. The platform provides no detailed information about its operations, investment strategies, or the team behind it. This lack of specificity is often a characteristic of fraudulent platforms attempting to appear legitimate without providing substantive details.

Key Concern: Legitimate platforms typically offer comprehensive information to establish credibility.

GreenFarm.lol does not specify the payment methods it accepts, leaving potential investors uncertain about how to fund their accounts or withdraw earnings.

Key Concern: The lack of transparency increases the risk for investors, as there is no clarity on deposit or withdrawal processes.

The platform offers limited customer support information, with no clear contact details or support channels provided.

Key Concern: Reliable platforms typically provide multi-channel support, including email, phone, and live chat, to assist investors promptly.

While the website’s technical performance appears standard, the absence of comprehensive security features and transparency about technical infrastructure is concerning.

Key Concern: Investors should prioritize platforms with verified security protocols and robust technical infrastructure.

Lack of Transparency: No information about ownership or team members.

Unrealistic ROI: Promised returns of 5-10% daily are unsustainable.

Limited Public Feedback: Minimal online presence and user reviews.

Generic Content: Lack of detailed information about operations and security.

Ambiguous Payment Methods: No clear information on accepted payment options.

Poor Customer Support: Limited and unreliable communication channels.

Key Concern: These red flags make GreenFarm.lol a high-risk and potentially fraudulent platform.

The returns promised by GreenFarm.lol are substantially higher than those offered by traditional investment avenues:

Real Estate: 8-12% annually

Bank Savings Accounts: 0.5-2% annually

Legitimate Crypto Exchanges: 4-10% APY for staking

Key Concern: Such discrepancies are often indicative of high-risk or fraudulent schemes.

Avoid High-Risk Platforms: Be wary of platforms promising exceptionally high returns with minimal risk.

Conduct Thorough Research: Investigate the platform’s background and verify claims.

Consult Financial Advisors: Seek professional advice before investing.

Report Suspicious Activity: Notify financial regulators about potential scams.

GreenFarm.lol exhibits multiple red flags, including a lack of transparency, unrealistic ROI claims, and unverified security measures. These factors suggest the platform is high-risk and potentially fraudulent. Investors should avoid this platform and consider safer, regulated alternatives.

This GreenFarm.lol Review is based on publicly available information and does not constitute financial advice. Always conduct your own research (DYOR) and consult a professional before investing.

Always research before investing. Use these tools to verify legitimacy:

WHOIS Lookup: https://whois.domaintools.com

SimilarWeb: https://www.similarweb.com

ScamAdviser: https://www.scamadviser.com

Trustpilot: https://www.trustpilot.com

Reddit Discussions: https://www.reddit.com

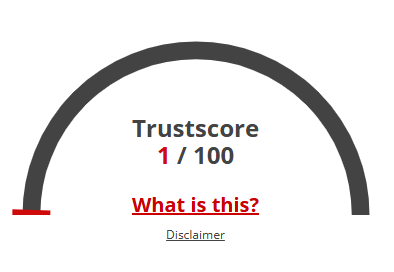

Given Green Farm Very low trust score, there is a good chance that the website is a hoax. Use caution when accessing this website!

Our algorithm examined a wide range of variables when it automatically evaluated Green Farm, including ownership information, location, popularity, and other elements linked to reviews, phony goods, threats, and phishing. All of the information gathered is used to generate a trust score.

GreenFarm.lol is an online platform claiming to offer high-yield investment opportunities, primarily through cryptocurrency arbitrage trading. It promises daily returns of 5-10%, which are significantly higher than traditional investment options.

No, GreenFarm.lol raises several red flags, including anonymous ownership, no regulatory compliance, and unrealistic returns. These factors suggest it is not a legitimate investment platform and may be a scam.

Unrealistic Returns: Promising 5-10% daily returns is unsustainable and indicative of a Ponzi scheme.

Lack of Transparency: No verifiable ownership or company registration details.

No Regulatory Oversight: Not registered with financial authorities like the SEC or FCA.

Unclear Payment Methods: No information about deposit or withdrawal options.

Poor Security: Claims of encryption and 2FA are unverified by third-party audits.

Ownership: GreenFarm.lol is anonymous, while legitimate platforms are transparent.

Regulation: GreenFarm.lol is unregulated, whereas legitimate platforms are licensed and compliant.

Returns: GreenFarm.lol promises 5-10% daily returns, while legitimate platforms offer 6-12% annually.

Security: GreenFarm.lol lacks verified security measures, unlike legitimate platforms with 2FA, audits, and insurance.

Support: GreenFarm.lol offers limited support, while legitimate platforms provide multi-channel assistance.

GreenFarm.lol exhibits classic Ponzi scheme traits, such as:

Promising unrealistically high returns.

Relying on new investor funds to pay earlier investors.

Lacking a legitimate business model or revenue source.

Operating with no transparency or regulatory oversight.

Title: Green Farm

https://scamsradar.com/zarraz-world-review-risks-red-flags-and-warnings/

https://scamsradar.com/snowealth-com-review-legit-or-scam-truth-revealed/

https://scamsradar.com/tensorium-ai-review-unrealistic-returns-and-risks/

https://scamsradar.com/ozonespace-io-review-key-concerns-and-red-flags-for-investors/

https://scamsradar.com/bigone-trading-review-risks-red-flags-and-roi-claims/