Givas Review: Is This Platform Legitimate or Risky?

This Givas review examines the platform’s legitimacy, focusing on its compensation plan, ownership, and risks. For an in-depth scam analysis, visit Scams Radar for a detailed review. Launched in December 2024, the platform claims to be a digital education and earnings hub. However, serious concerns arise about its sustainability and transparency. Read on to understand whether givas.com is a safe option or one to avoid.

Table of Contents

What Is Givas?

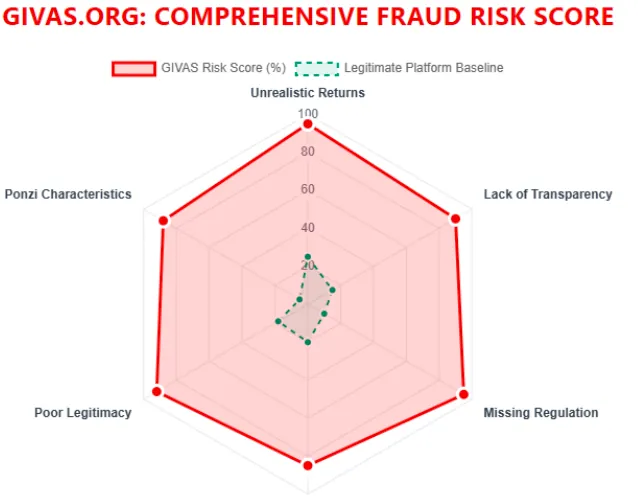

Givas presents itself as an affiliate marketing and global pool system offering passive income for a one-time fee. It promises high returns through a matrix cycler model. Despite claims of supporting charitable causes, the platform lacks verifiable details, raising doubts about its authenticity.

Ownership and Transparency Concerns

The platform’s ownership is unclear. The domain was privately registered on December 12, 2024, hiding details about its founders or executives. No company registration or leadership profiles are disclosed, which is unusual for legitimate platforms. This anonymity suggests potential risks, as investors cannot verify the team’s credibility.

- No named founders or executives

- Privately registered domain

- No verifiable business registration

This lack of transparency is a major red flag, common in high-risk schemes.

Compensation Plan Breakdown

Givas operates a six-tier matrix cycler requiring a $12 entry fee ($10 entry, $2 gas fee) or a $30 Pro Plan. Participants earn by recruiting others to fill matrix positions. Below is the payout structure:

Matrix Type | Entry Cost | Payout | Admin Fee |

3×2 | $10 | $20 | $26 |

3×2 | — | $40 | $52 |

3×3 | — | $250 | $308 |

3×3 | — | $900 | $1,672 |

3×3 | — | $2,500 | $5,560 |

3×3 | — | $15,000 | $32,990 |

Earnings depend on recruitment, not product sales, as Givas offers no retailable products. This structure resembles a pyramid scheme, where payouts rely on new participants.

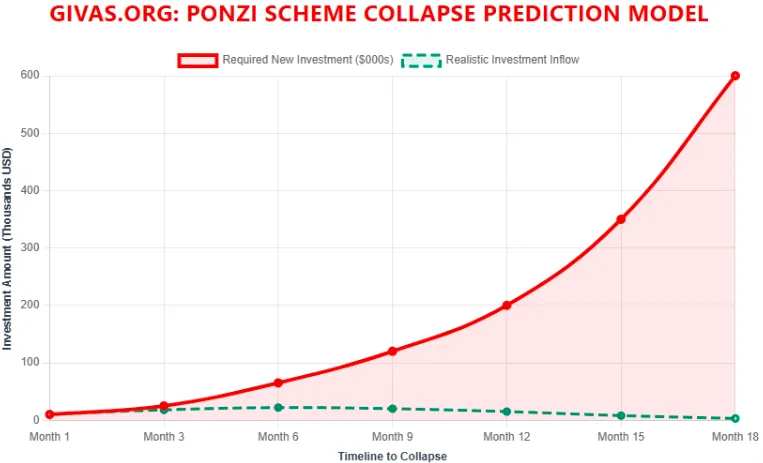

Why the Returns Are Unsustainable

The platform’s promise of $15,000 from a $10 investment is unrealistic. For Tier 6 (3×3 matrix), 39 participants are needed, each paying $10, totaling $390. The payout is $15,000, creating a $14,610 deficit. To sustain this, thousands of new recruits are required per cycle:

- Formula: New recruits needed = (Payout + Admin Fee) / Entry Fee

- Tier 6 Calculation: ($15,000 + $32,990) / $10 = 4,799 recruits

Comparing Givas to Legitimate Investments

Givas’ claimed 150,000% ROI dwarfs legitimate options:

- Real Estate: 5-10% annual ROI, backed by tangible assets.

- Bank Savings: 4-5% APY, FDIC-insured for safety.

- Crypto Staking: 4-8% APY on platforms like Coinbase, regulated but volatile.

Traffic and Public Perception

As a new platform, Givas lacks significant traffic data on tools like SimilarWeb. Its promotion relies heavily on YouTube and Telegram, targeting regions like Nigeria and India. Trustpilot shows a 4.1-star rating from five reviews, but their overly positive tone suggests possible manipulation. Scam detection sites like Scamminder label Givas as a potential fraud due to its pyramid-like structure.

Security and Technical Performance

Givas uses a free ZeroSSL certificate, adequate but less secure than premium options. No details on data protection or compliance with KYC/AML standards are provided. The site’s simple design and lack of uptime guarantees raise concerns about reliability.

Payment Methods and Customer Support

Payments are crypto-only (e.g., USDT), which are irreversible and risky. Weekly payouts, called “Saturday Blessing,” create a false sense of reliability. Customer support is limited to an email (help@givas.org) and a UK phone number (+447837287098), with no live chat or ticketing system.

Content Authenticity

Givas claims ties to NGOs and poverty alleviation but provides no proof. Its association with the UN’s GIVAS initiative is misleading, as they are unrelated. This lack of verifiable impact undermines its credibility.

Promoters and Their History

YouTube channels like “Waisu Tech” and “Get Funded Tribe” promote Givas, often alongside other high-risk schemes. Their focus on exaggerated earnings and lack of transparency aligns with typical MLM marketing tactics.

Social Media Promotion

Promotions appear on platforms like X (@RorySingh1), YouTube (Intelligence Commissioner), and fake accounts on Facebook and TikTok using AI-generated celebrity endorsements (e.g., Elon Musk). These accounts often have histories of promoting scams like BitConnect or ALR Miner, reinforcing suspicions of coordinated fraud.

Red Flags to Watch For

- Anonymous ownership

- Recruitment-based earnings

- Unrealistic 150,000% ROI claims

- Crypto-only payments

- Misleading charitable claims

- Limited security and support

Future Outlook

Givas is likely to collapse within 6-18 months due to recruitment saturation. Regulatory scrutiny may increase, especially in regions with strict MLM laws, potentially leading to shutdowns by mid-2026.

Recommendations for Investors

- Avoid Investment: The pyramid-like model and lack of transparency make Givas high-risk.

- Explore Safer Options: Consider real estate, bank savings, or regulated crypto staking.

- Verify Claims: Demand proof of charitable impact or regulatory compliance.

- Use Trusted Platforms: Choose investments with robust security and clear leadership.

DYOR Disclaimer

This Givas review is for informational purposes only and not financial advice. Conduct your own research using tools like ICANN WHOIS, ScamAdviser, and SSL Labs. Consult a licensed financial advisor before investing, as all investments carry risks.

Conclusion

This Givas review highlights serious concerns about its legitimacy. Its pyramid-like compensation plan, anonymous ownership, and unrealistic returns make it a risky choice. Compared to regulated investments like real estate or bank savings, Givas’ model is unsustainable. Investors should avoid it and prioritize transparent, regulated alternatives. Stay informed and protect your financial future with thorough research, and explore related insights in our Paladin Mining Review for a broader perspective.

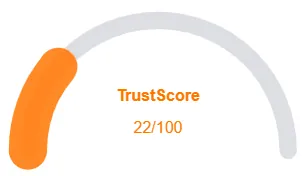

Givas Review Trust Score

A website’s trust score plays a vital role in evaluating its credibility, and Givas a dangerously low rating—raising serious concerns about its legitimacy. Users are strongly advised to proceed with caution.

The platform presents several warning signs, including low traffic, poor user reviews, potential phishing threats, hidden ownership, unclear hosting information, and weak SSL security.

Given this low trust score, the chances of fraud, data breaches, or other harmful activity increase significantly. It’s essential to assess these red flags carefully before engaging with Givas or similar platforms.

Let me know the next company name whenever you want a swap.

Positive Highlights

- Website content accessible

- Archive age old

- Whois data accessible

Negative Highlights

- Low AI review rate

- New domain

Frequently Asked Questions About Givas Review

This section answers key questions about , providing clarity, promoting trust, and addressing concerns regarding the platform’s legitimacy.

No. Givas raises concerns due to its unclear ownership, lack of transparency, and questionable sustainability.

It claims to be a hub for digital education and earnings, but its business model and revenue sources are not clearly verified.

No. Givas is not licensed or registered with any recognized financial or regulatory body, increasing the risk for participants.

Risks include potential loss of funds, unsustainable earning promises, lack of regulation, and limited business transparency.

It’s not recommended. The platform’s unclear operations, sustainability issues, and absence of regulatory oversight make it unsafe for investors.

Other Infromation:

Reviews:

There are no reviews yet. Be the first one to write one.