Decentralized Finance system (DeFi) Review Warning Signs Behind 8–10% ROI Promises

DFS (Decentralized Finance System Review ) at thedfs.live markets itself as “The Most Trusted Global system” and advertises “8%–10% per month” plus a 5% welcome reward and layered referral commissions. Its pitch deck repeats those yields and details multi-level bonuses. An “Elite Circle” promising $10,220 on a $1,000 contribution with two referrals in 7 days.

This platform exhibits multiple high-risk hallmarks. Including unrealistic monthly ROI, referral-driven rewards, lack of verified ownership or licensing, and opaque “audit” references. As noted by Scams Radar and other investor-protection agencies. These exact patterns are repeatedly flagged as classic fraud red flags.

Table of Contents

Part 1. What the site actually says

The Decentralized Finance System is presented as an opportunity to earn 8%–10% per month. The rate boosted to 10% if you bring in two new members within seven days. New users are also offered a 5% welcome reward. The project claims to be “100% Decentralized, verified on Binance blockchain, and backed by a professional audit report,” though no proof is provided. Its multi-level reward plan pays from 6% on level one down to 0.5% on level 20, and the flashy Elite Circle promises over $10,000 from a $1,000 entry plus referrals. Withdrawals are split into 75% USDT and 25% DFS Fund, with a 5% developer cut, while promotions mainly run through a Telegram group with around 9,000 members.

1.1 Ownership & transparency check

- Corporate identity: The site & deck do not show a registered company name, directors, physical address, regulator, or license numbers. (Reviewed pages contain slogans and plan tables; no legal imprint.)

- “Audit” claim: The PDF asserts a “world-class professional audit” and “verified source code on Binance blockchain.” It does not link any actual audit report (e.g., CertiK, PeckShield, SlowMist) nor a verifiable contract address to check on BscScan. That is a major gap.

- Licensing: There’s no indication of registration with any financial regulator. Investor-protection resources warn that unlicensed offerings promising guaranteed high returns are a prime fraud red flag.

1.2 Compensation plan anatomy (how outflows stack up)

- Base ROI: 8% monthly, up to 10% if you bring two direct referrals within 7 days.

Level commissions: adding 6% + 1% + 2% + 3% + 3% + 2% + (1% ×5) + (0.5% ×9) = 26.5% of downline volume potentially due across 20 levels.

Elite Circle: $1,000+ contribution + two directs → $10,220 over “9 cycles of 10 (15 days).”

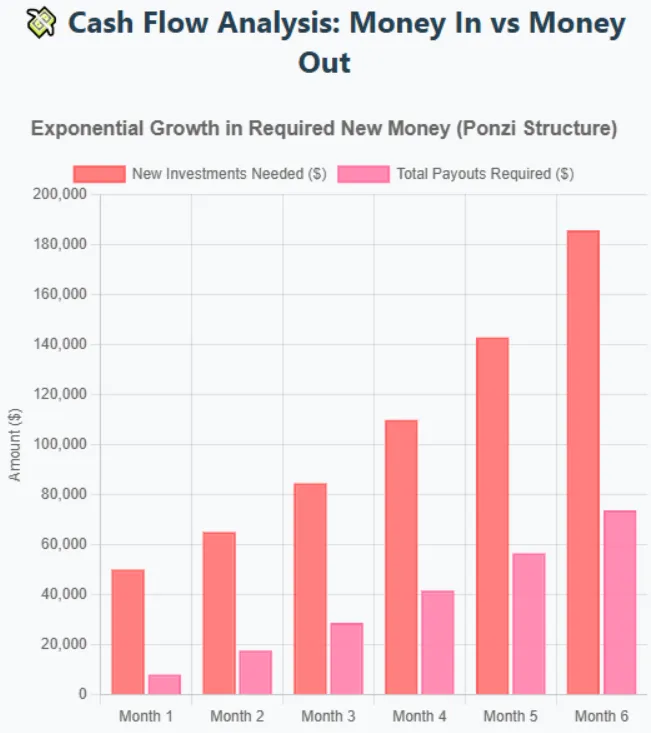

Withdrawal split: 75% USDT immediately + 25% “DFS fund” (20% to users, 5% to developer). - Why this structure matters: the model depends on constant new inflows to fund promised ROI + multi-level bonuses (and a hard 5% developer skim every withdrawal). That cash-flow shape mirrors high-yield investment program (HYIP) patterns regulators warn about.

Part 2. Sustainability math (prove it with numbers)

2.1 Compounding alone breaks plausibility

- 10% monthly compounded: 1.1012=3.13841.10^{12} = 3.13841.1012=3.1384 → 214% annual gain.

- 8% monthly compounded: 1.0812=2.51821.08^{12} = 2.51821.0812=2.5182 → 152% annual gain.

This yields eclipse bank, T-bill, real-estate, and blue-chip DeFi staking by orders of magnitude.

Referral outflows add strain

Even without compounding, the plan advertises 26.5% possible network commissions on contributions (plus 5% welcome, up to 10% monthly, and the Elite cash ladder). Payout liabilities can easily exceed a project’s organic earnings unless new money arrives.

Elite Circle arithmetic

Paying $10,220 on a $1,000 contribution (with two $1,000 directs) implies 10.22× gross rewards across short cycles. Without verifiable external revenue. That it can’t be funded sustainably by trading/yield alone. The only way it persists is continuous recruitment, a hallmark of schemes regulators call out.

Investor-protection context

SEC and CFTC alerts list “high returns with little or no risk,” “guarantees,” and complex referral pay as classic red flags especially in crypto.

2.2 Benchmarking: real-world returns vs 8–10% per month

- U.S. savings (national average): ~0.61% APY; best high-yield accounts ~4%–5% APY.

- FDIC national rate caps: plain-vanilla products range ~0.39%–2.51% depending on product/term (Aug 2025).

- Coinbase rewards (staking/holding): ETH ~1.86% APY; USDC ~4.10% APY (variable). Even Coinbase’s “up to” pages cite APY—per year, not per month.

- Real estate: long-horizon returns often in mid-single to low-double-digit APY depending on vehicle/market cycle (e.g., REIT long-term figures near ~11% historically, with volatility). Which is annual, not monthly.

8–10% monthly is an order of magnitude above mainstream finance and reputable crypto yields. This risk shows the gap.

Part 3. Behind the Hype: What Public Perception Misses About Security

3.1 Public Perception

- Telegram: Official channel “B.THEDFS.LIVE” shows ~9,355 members. Telegram-only growth is typical for HYIPs due to lax moderation and easy viral referrals.

- YouTube ref links: Multiple videos pitch “DFS Business Plan” with referral URLs pointing to thedfs.live dashboard.

3.2 Security & Technical Posture

When looking at DFS, the security setup shows several warning signs. The platform directs users to deposit USDT (BEP-20) using wallets like MetaMask, Trust Wallet, or SafePal. While familiar, these transfers are irreversible, leaving investors no safety net if funds are lost. DFS also claims to be “audited and verified”, yet it provides no contract address or audit report that users can check on BscScan.

Without this, there’s no way to confirm who controls the contract. Whether it allows minting or draining funds, or if it can be paused or altered. The site itself is a simple, image-heavy landing page with minimal legal or compliance details, a setup often seen in short-lived HYIP projects. Even the U.S. Treasury has cautioned that many services marketed as decentralized lack true protections. DFS fits that pattern like bold claims of being “100% decentralized,” but no verifiable proof to back it up.

3.3 Content authenticity & messaging red flags

- Boilerplate DeFi explainers (what is blockchain/BEP-20/smart contracts) pad the deck but don’t prove revenue generation.

- Superlatives like “World’s Best & Only Smart Contract” and “World’s First 100% Decentralized Verified Smart Contract” are unverifiable. It contradicts by the absence of links to audits/contracts.

Part 4. Money In, No Way Out: Payments, Support & Traction

4.1 Payment rails & custody risk

- USDT (BEP-20) contributions are final disputes/chargebacks are not available.

- Withdrawal split (75% USDT / 25% “DFS fund”) adds friction and locks value inside the system. The 5% developer cut on withdrawals is a hard tax on exit liquidity.

4.2 Customer support

- Contact: A Telegram icon and a generic “Terms and conditions” link. There is no transparent support SLAs, registered entity, or complaints process a material customer care risk.

4.3 Traffic & traction signals

- The minimal web footprint (single landing page, Telegram push, referral videos) suggests promotion > product. Lack of transparent analytics or third-party traffic profiles is common in programs optimized for rapid inflow phases.

Part 5. The Survival Guide: What Happens Next, How to Protect Yourself, and Tools to Verify the Truth

5.1 What likely happens next (pattern-match prediction)

HYIP-style programs often show:

- Fast early payouts (funded by new contributions).

- Tighter withdrawal rules (e.g., internal tokens/“fund” balances).

- Bonuses/contests to spur recruitment (e.g., Time-Bound Rewards).

- Delays/halts as inflows slow, followed by site turnover or migration to a new brand.

DFS’s own time-bound rewards and Elite Circle accelerants match this script.

5.2 Recommendations (if you’re evaluating this)

- Do not rely on screenshots or PDFs. Demand verifiable audit links (e.g., CertiK). The exact contract address to inspect on BscScan (privileged functions, owner keys, upgradeability).

- Refuse “guaranteed” or “monthly high yield” pitches. SEC/CFTC warnings exist for a reason.

- Benchmark against reality as if banks pay ~0.6% APY and reputable staking yields. 1%–5% per year, any 8–10% per month pitch requires extraordinary proof.

- If you still proceed, limit to “can-lose” money and assume no recourse. Prefer custody you control and transparent, regulated venues.

- Consider safer yield sources (FDIC/NCUA-insured HYSA/CDs, Treasuries) while rates remain elevated.

5.3 DYOR toolbox & the checks we ran

- Official site: headline claims, plan tables, withdrawal rules.

- Official PDF (screenshots in this review): monthly ROI, level rewards, Elite Circle, withdrawal split.

- Telegram (linked onsite): B.THEDFS.LIVE group (~9,355 members).

- YouTube promos with referral parameters (examples).

- Investor-protection alerts (SEC/CFTC red flags for guaranteed/high returns and crypto schemes).

- Benchmark rates: National savings average & high-yield ranges; Coinbase staking & USDC rewards.

Decentralized Finance System Review Conclusion

The review of DFS (Decentralized Finance System) makes one thing clear that a platform shows nearly every hallmark of a high-yield investment scam unrealistic 8–10% monthly returns, referral-driven payouts, unverifiable audit claims, and weak transparency. Promises like turning $1,000 into $10,220 in days simply don’t align with real-world banking, staking, or investment benchmarks.

With payments locked in irreversible USDT transfers and withdrawals skimmed by developer cuts, investor risk is extreme. As always, if it sounds too good to be true, it usually is. But Scams Radar warns and empowers readers that do your own research before investing. For comparison, you can also check our detailed Whale Syndicate Review to see how similar Ponzi-style structures operate.

DYOR Disclaimer: This analysis is informational, not financial advice. Verify claims independently via BscScan, regulators, or trusted platforms. Crypto investments risk total loss; we’re not liable for your decisions. Scams Radar

Decentralized Finance System Review Trust Score

A website’s trust score is a critical indicator of its reliability. Decentralized Finance System currently holds an alarmingly low rating raising serious concerns about its legitimacy. Users are strongly advised to proceed with caution.

The platform displays several warning signs, such as low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and inadequate SSL protection.

Given its low trust score, the risk of fraud, data breaches, or other security issues is much higher. It is essential to carefully consider these red flags before engaging with Decentralized Finance System similar platforms.

Positive Highlights

- Content accessible, no errors.

- Accessible and error-free content.

Negative Highlights

- Low AI score

- New archive

- Hidden WHOIS data

Frequently Asked Questions About Decentralized Finance System Review

This section answers key questions about , providing clarity, promoting trust, and addressing concerns regarding the platform’s legitimacy.

There’s no linked contract address or audit to verify decentralization or admin privileges. Marketing claims alone aren’t proof.

No. Staking yields on large networks or USD-pegged assets are typically 1%–5% APY, per year not per month.

Guaranteed-sounding high monthly ROI paired with multi-level referral pay and no verifiable audit. These match Ponzi/HYIP red flags in SEC/CFTC advisories.

Other Infromation:

Website: thedfs.live

Reviews:

There are no reviews yet. Be the first one to write one.