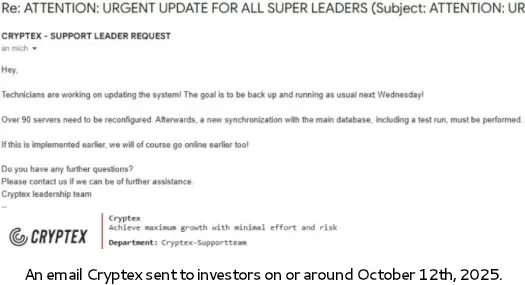

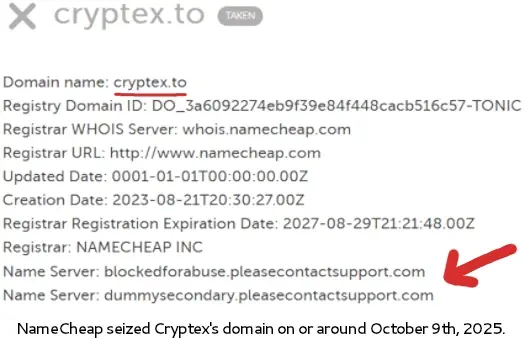

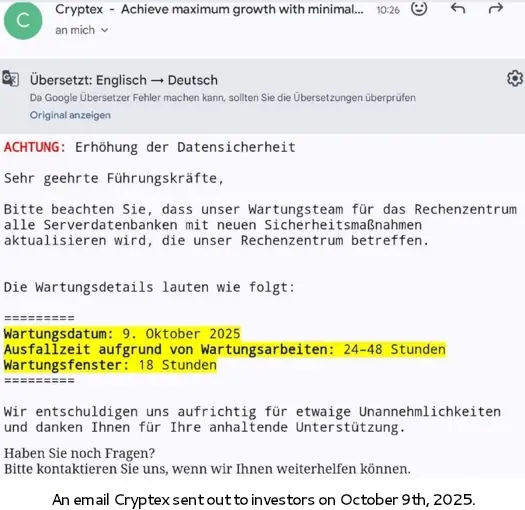

On October 9, 2025, Cryptex‘s primary domain, cryptex. To, was seized by its registrar, NameCheap, rendering the website inaccessible due to suspected fraud and unverifiable ownership. WHOIS records show NameCheap changed the nameservers to abuse placeholders, breaking DNS resolution. Instead of disclosing the seizure, Cryptex emailed investors claiming a 24- to 48-hour “data security enhancement” for server maintenance, followed by excuses about “encrypting data offline.”. These ruses continued through the weekend, likely as admins attempted (and failed) to reclaim the domain from NameCheap, per.

By October 13, 2025, Cryptex registered bytnex.io and secure-bytnex.io through TLD Registrar Solutions, an ICANN-accredited provider, signaling a full reboot as Bytnex, per. This came after NameCheap refused to release cryptex.to, confirmed by October 14, per. Updates between October 13–15 were delayed while transferring hosting. Bytnex mirrors Cryptex‘s MLM structure, promising staking returns funded by new investments, per Trustpilot reviews, labeling it a “significant SCAM” with manipulated payouts. X posts from @Decripto_org highlight ASIC’s September 19, 2025, alert against Cryptex for unlicensed services in Australia, per.

Cryptex/Bytnex, believed to originate in Europe based on early targeting of Germany and Austria, has drawn multiple fraud warnings:

As of September 2025, Cryptex had ~330,000 monthly visits, with traffic from the U.S. (33%), Germany (15%), Canada (8%), Switzerland (8%), and Hungary (5%), per. Bytnex targets similar markets, but NameCheap may share seizure details with TLD Registrar Solutions, risking further domain actions.

Cryptex/Bytnex exemplifies MLM Ponzi tactics, promising daily ROI (e.g., 4%–114%) via “smart contracts” without real revenue, relying on recruitment, per. Victim losses exceed $100M, with complaints of frozen withdrawals and fake profits, per. This reboot mirrors schemes like Forsage ($340M losses), amid rising global warnings. Bitcoin (BTC) ($113,234) and Ethereum (ETH) ($4,070) remain stable, per CoinMarketCap, but such fraud erodes DeFi trust.

Investors should verify platforms via BaFin (bafin.de), ASIC (asic.gov.au), and FMA (fma.gv.at), per. Avoid MLM staking; diversify into USDC or ETH with stop-losses below BTC’s $112,000, per TradingView. Follow @TheBlock__ on X for updates. Bytnex’s survival is uncertain, but repeated warnings signal its Ponzi core, per.