On its website, CopyHub omits leadership and ownership details.

On October 10th, 2024, CopyHub’s website domain (“app.copyhub.trade”) was privately registered.

Additional investigation finds that CopyHub lists “Kameron Kodzokov” as its CEO:

There is no Kameron Kodzokov outside of CopyHub’s marketing. He is thus a strong contender to be Boris’ CEO.

This is related to the fact that Boris CEO fraudsters are usually Ukrainian or Russian.

As always, you should carefully consider joining and/or transferring any funds if an MLM firm is not transparent about who owns or operates it.

There are no retailable goods or services offered by CopyHub.

Only the CopyHub affiliate membership itself may be promoted by affiliates.

In order to invest money with “a trader,” CopyHub affiliates must pay a fee.

CopyHub promises “consistent monthly returns of 8-10%” in exchange for investment.

Keep in mind that any ROI withdrawals are subject to a 38% fee from CopyHub. This charge is deducted until returns for the cost of accessing the ROI tier are received.

Fees paid by recruited affiliate investors are linked to CopyHub’s multilevel marketing business.

Every CopyHub investment tier cost is associated with a matrix tier measuring 3 by 10.

A CopyHub affiliate is positioned at the top of a 3×10 matrix, with three spots immediately behind them:

The initial level of the matrix is made up of these three places. Each of these first three slots is divided into nine more positions to create the second level of the matrix.

Each matrix’s levels three through ten are created in the same way, with each subsequent level containing three times as many spots as the one before it.

As said, there is a matrix tier that correlates to each CopyHub pricing tier. This indicates that the 3×10 matrix has eight levels.

CopyHub affiliates pay the appropriate investment tier ($10–10,000) to purchase into each tier.

Positions in an unlocked matrix tier are filled by fees paid by affiliates who have been recruited both directly and indirectly and who are also purchasing into the tier.

The level of the matrix at which a new fee-paying affiliate is positioned determines the commission payments made from these fees:

Please take note that CopyHub only allows affiliates to get up to 40% of their own investment in MLM commissions.

After this threshold is reached, more investment is needed to continue making money. Higher fees must be paid for this.

Additionally, take heed of CopyHub’s marketing, which says:

Users have three days from the date of expiry to renew their subscription.

If this isn’t done, the user’s account will be disabled until it is renewed and they will lose their place in the matrix.

There is no indication of when the fees paid will expire.

It seems that Core Various affiliate membership is free. There are no minimum investment amounts mentioned.

The website boasts of disrupting the global financial environment and changing the face of money in the future. Scammers often utilize such inflated claims to entice unwary people.

Limited verifiable information about the business, its employees, or its actual location is available on the website. Reputable financial sites often provide clear details about how they operate.

The website provides a number of high-risk financial services, including cryptocurrency arbitrage and flash loans, but it does not clearly comply with regulations or sufficiently describe the hazards involved.

As is typical in cryptocurrency frauds, the website advertises CLHC, its native coin. Platforms that actively advertise their own coins might raise suspicions among investors.

Testimonials from people in other nations are included on the website, however they can be faked to give it a false impression of validity.

Without hard proof of present performance, the comprehensive strategy and aspirational goals for the future, such as branching out into other industries, may be a ploy to draw in investment.

It seems that invested monies are stored inside CopyHub as I was unable to find any evidence that the firm has an API trading program.

The standard “lulz can’t touch our money” deception model would be the substitute for this.

Regardless of the methodology, CopyHub is engaging in a securities offering when it asks for investment with the promise of 8% to 10% each month.

CopyHub does not provide proof that it has registered with any jurisdiction’s financial authority.

Unlike advertising promises such as these…

In addition to being required by law, it is securities and commodities fraud to neglect to register with authorities and provide reports.

This has to do with CopyHub’s fictitious Boris CEO and other unlawful activities. The MLM portion of CopyHub is a pyramid scam as nothing is advertised or offered for sale to retail clients.

Apart from the fraudulent investment scheme that involves “trading,” CopyHub also operates a Ponzi scam that uses an internal token “staking” methodology.

In order to conduct “staking programs” and “revenue-sharing opportunities,” CopyHub developed the Trade Flow Token. “Ponzi schemes” are what this is code for.

Staking durations are 90 days (bonus 1%), 180 days (bonus 2%) or 365 days (bonus 4%), even though TradeFlow staking returns are computed yearly.

The Trade Flow Token was created on the “trade-flow.io” domain, which was registered on September 7th using an unfinished Bucharest address.

Currently, fresh investment is the only substantiated source of income coming into CopyHub.

If ROI withdrawals were paid with fresh investment, CopyHub would be a Ponzi scam.

Like other MLM Ponzi scams, fresh money will stop coming in as soon as affiliate recruiting stops.

CopyHub will ultimately fail as a result of this deprivation of ROI money.

Ponzi schemes’ mathematical foundation ensures that most participants lose money when they fail.

When distributions are converted to Trade Flow Tokens exclusively, keep an eye out for the beginning of CopyHub’s demise.

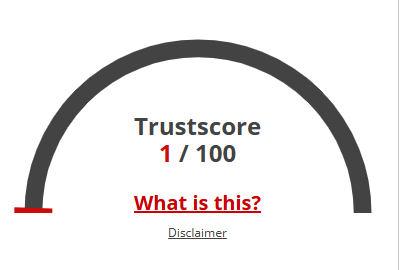

Given Beonbit very low trust score, there is a good chance that the website is a hoax. Use caution when accessing this website!

Our algorithm examined a wide range of variables when it automatically evaluated Beonbit, including ownership information, location, popularity, and other elements linked to reviews, phony goods, threats, and phishing. All of the information gathered is used to generate a trust score.