CoinFast Review: Is This ICO Platform Safe for Investors?

This CoinFast review on Scams Radar examines the legitimacy of a platform offering token launches on the Solana blockchain. CoinFast (coinfast.fun) promises an easy, low-cost way to create custom tokens, but concerns about transparency, security, and potential crypto scams remain. Our analysis explores ownership, compensation plans, platform security, and other key features.

Table of Contents

What Is CoinFast?

CoinFast markets itself as a user-friendly tool for creating Solana-based tokens without coding. It claims to simplify token launches with features like “copy trending tokens” and automatic revoke options. However, the platform raises concerns due to its lack of transparency and reported issues, such as wallet drainage. Let’s explore its key aspects

Ownership: Who Runs CoinFast?

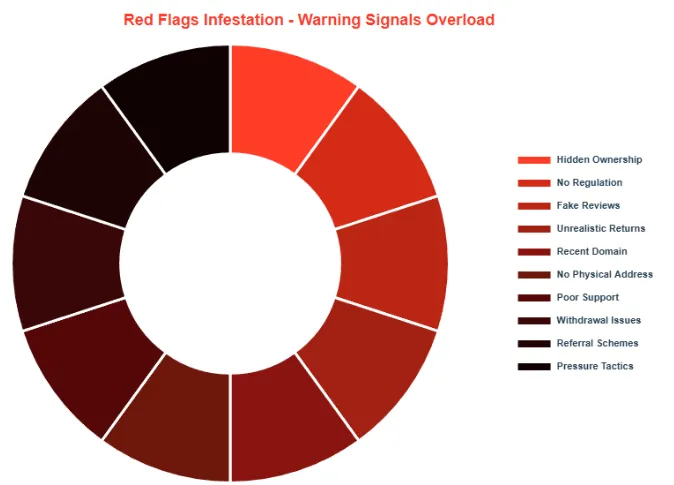

CoinFast provides no clear information about its owners or team. The domain, registered on January 19, 2025, through Namecheap, uses a privacy service (Withheld for Privacy ehf, Iceland) to hide ownership details. This lack of transparency is a major red flag. Legitimate platforms disclose their company, address, and team to build trust. Without this, investors face risks, as there’s no accountability if funds are lost.

Key Ownership Issues

- No company name or physical address listed.

- No team bios or verifiable credentials.

- Uses privacy protection to conceal owners.

Compensation Plan: How Does CoinFast Pay?

CoinFast’s compensation model is unclear on its website. Sources like ICOholder suggest it distributes 50% of transaction fee profits to token holders monthly, paid in Ethereum. However, there’s no detailed fee structure, profit calculation, or audited financials. This vagueness resembles Ponzi schemes, where payouts depend on new investors.

Let’s break down the math. If CoinFast earns $10,000 monthly from a 1% fee on $1,000,000 in transactions, it shares $5,000 among token holders. For 1,000 holders, each gets just $5 monthly—far from the “high returns” promised. Without transparent revenue data, this model is unsustainable.

Investment Type | Annual Return | Risk Level | Regulation |

CoinFast (Claimed) | 100-2400% | Total Loss | None |

Real Estate | 8-12% | Medium | SEC-Regulated |

Bank Savings | 1-5% | Very Low | FDIC-Insured |

Crypto Staking | 3-15% | High | Varies |

Security and KYC Compliance

CoinFast lacks details on security measures, such as smart contract audits or KYC compliance. Reports from Trustpilot and Reddit highlight wallet-draining incidents when users connect Solana wallets like Phantom. This suggests potential vulnerabilities or malicious code. Legitimate platforms use audited contracts and robust encryption, which CoinFast does not disclose.

- Security Red Flags:

- No public smart contract audits.

- No KYC/AML compliance details.

- User reports of instant fund loss.

- No public smart contract audits.

User Interface and Platform Reliability

CoinFast claims an easy-to-use interface for token launches, but its technical performance is questionable. Users report downtime and slow responses. The site uses modern hosting (Amazon AS16509), but low traffic (global rank #2,759,138) indicates limited engagement. Without server uptime data or bug-bounty programs, reliability is uncertain.

Customer Support and Payment Methods

CoinFast offers no clear customer support channels—no email, phone, or live chat. Users on Trustpilot report unresponsive support after fund losses. Payments require Solana wallet connections (e.g., Phantom) and SOL for token minting, costing ~0.5 SOL per launch, per Reddit. Unverified claims of fiat (USD, EUR) and crypto (BTC, ETH) support raise doubts.

Public Perception and Social Media

Public sentiment is negative. Trustpilot has five reviews, mostly warning of scams. Reddit’s Solana subreddit (59 votes, 166 comments) labels CoinFast a scam due to wallet issues. A YouTube video by “Crypto Ninja” (600,000 views) and an Instagram reel by “Crypto Profitz” promote quick profits, but users suspect fake endorsements. No credible X accounts (e.g., @coinfastx) provide verifiable team details.

- Promotional Red Flags:

- Fake success stories and influencer promotions.

- Pressure to “act fast” for high returns.

- No verified social media profiles.

- Fake success stories and influencer promotions.

ROI Claims: Why They Don’t Add Up

CoinFast’s promise of high returns (e.g., 50% monthly) is unrealistic. Using the compound interest formula ( A = P(1 + r/n)^{nt} ), a $1,000 investment at 50% monthly yields $129,746 in one year—impossible without constant new funds, a Ponzi scheme trait. Compare this to real estate (8-12%), bank savings (1-5%), or crypto staking (3-15%), which are regulated and transparent.

Red Flags Summary

- Hidden ownership and no regulatory licenses.

- Unrealistic ROI promises (100-2400% annually).

- Wallet-draining reports and no security audits.

- Unresponsive customer support.

- Recent domain (January 2025) with low traffic.

DYOR Tools and Resources

Use these tools to verify platforms like CoinFast:

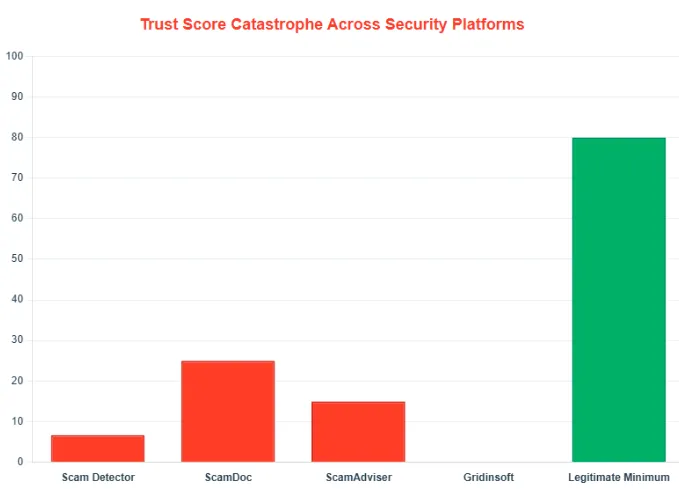

- ScamAdviser: Low trust score for CoinFast.

- Gridinsoft: Flags as “unsettled” with risks.

- Trustpilot: Check user reviews for patterns.

- SEC.gov: Verify regulatory status

Future Outlook

CoinFast is unlikely to gain legitimacy without transparency and audits. It may face browser blacklisting or regulatory shutdowns within 6-12 months, as seen with similar scams. Operators could rebrand under a new domain, a common tactic.

Conclusion: Should You Trust CoinFast?

This CoinFast review reveals a high-risk platform with hidden ownership, unsustainable returns, and serious security concerns. Avoid connecting wallets or investing, as the risk of total loss is significant. Opt for regulated platforms like Coinbase for safer crypto staking (3–15% APY). Always research thoroughly, check regulatory status, and use secure wallets. For a related case, you can also read our MaoPay Review to see similar red flags. For personalized advice, consult a financial advisor.

DYOR Disclaimer

This CoinFast review is for informational purposes only, not financial advice. Cryptocurrency investments carry high risks, including total loss. Conduct your own research, verify platform credentials, and consult professionals before investing.

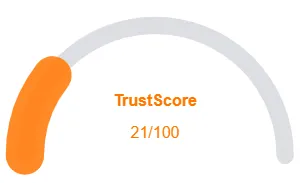

CoinFast Review Trust Score

A website’s trust score is a critical indicator of its reliability, and0 CoinFast currently holds an alarmingly low rating—raising serious concerns about its legitimacy. Users are strongly advised to proceed with caution.

The platform displays several warning signs, such as low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and inadequate SSL protection.

Given its low trust score, the risk of fraud, data breaches, or other security issues is much higher. It is essential to carefully consider these red flags before engaging with CoinFast similar platforms.

Positive Highlights

- Content accessible

- No spelling/grammar errors

- No suspicious patterns

Negative Highlights

- Low AI review rate

- New domain

- New archive

- Hidden Whois data

- Not in Tranco top 1M

Frequently Asked Questions About CoinFast Review

This section answers key questions about , providing clarity, promoting trust, and addressing concerns regarding the platform’s legitimacy.

CoinFast is a platform that enables users to launch custom tokens on the Solana blockchain with low costs and simplified processes.

While CoinFast promises easy token creation, our CoinFast Review on Scams Radar identifies potential risks, including security gaps and lack of regulatory clarity.

CoinFast allows users to create and deploy tokens on Solana, but unclear guidelines and hidden fees may pose risks to new investors.

Key risks include potential scams, unsustainable promises, limited transparency, and security vulnerabilities that could affect both funds and tokens.

Our review advises caution. Investors should conduct thorough research, understand the platform’s risks, and consider safer, verified alternatives for ICO investment.

Other Infromation:

Website: COINFAST.FUN

Reviews:

There are no reviews yet. Be the first one to write one.