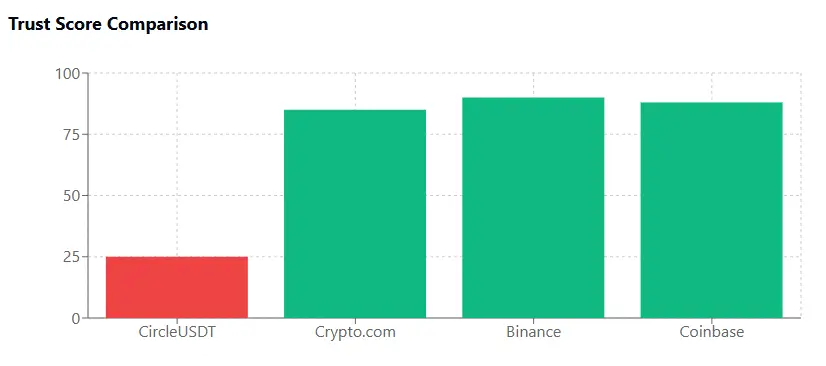

A website’s trust score is a crucial indicator of its credibility. Circle has a very low rating, raising significant concerns about its legitimacy. Users should proceed with extreme caution.

Key issues include undisclosed ownership, unclear hosting details, low traffic, negative reviews, phishing risks, and lack of proper SSL security.

Such a poor score indicates potential fraud, data theft, or unstable operations. Always verify these factors before engaging with Xeta or similar platforms.