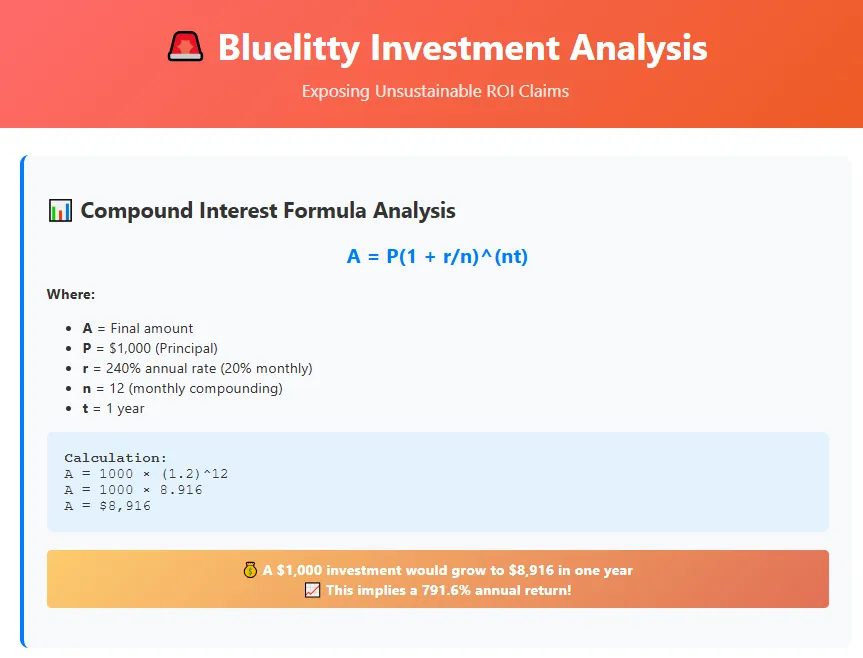

A website’s trust score plays a vital role in assessing its credibility, and Bluelitty currently holds a worryingly low rating—raising serious doubts about its legitimacy. Users are strongly urged to exercise extreme caution.

Major warning signs include minimal web traffic, negative user feedback, possible phishing threats, hidden ownership, vague hosting details, and weak SSL protection.

A trust score this low greatly increases the risk of fraud, data leaks, and other suspicious behavior. It’s essential to investigate these elements thoroughly before interacting with Bluelitty or similar websites.