Converge is an EVM blockchain designed for institutional and retail use of DeFi products and real-world assets.

For retail and institutional investors looking to access the DeFi and tokenization economies, stablecoin developer Ethena Labs and real-world asset (RWA) tokenization firm Securitize are introducing a new blockchain.

The upcoming Converge blockchain is an Ethereum virtual machine that will give retail investors access to “standard DeFi applications.” It will also focus on institutional-grade offerings that will help connect DeFi opportunities with traditional finance, according to an announcement made on March 17.

On March 17, the Converge blockchain was revealed during the Tokenize NYC conference. Cointelegraph is the source.

Among the products Converge will provide at launch are Ethereal, Morpho, Maple Labs, Pendle, and Horizon from Aave Labs.

With over $2 billion made on many blockchains, Securitize’s increasing market share in the tokenization space will help Converge’s RWA infrastructure. One year after its introduction, BlackRock’s USD Institutional Digital Liquidity Fund (BUIDL) has more than $1 billion in net assets, the firm recently said.

Anchorage, Copper, and RedStone, Securitize’s newest partner, will all provide custodian assistance for the Converge blockchain.

Converge will enable users to stake ENA, Ethena’s native governance token, on the DeFi side. The network’s gas tokens will be USDe, USDE$1.00, and USDtb stablecoins issued by Ethena.

Related: The implications for cryptocurrency of the BlackRock CEO’s request for the SEC to “rapidly approve” the tokenization of bonds and equities

As businesses seek to streamline their processes and seize new revenue possibilities, institutional DeFi—the use of regulatory-compliant DeFi technologies by conventional financial institutions—seems to be gaining steam.

Institutional DeFi “has the potential for growth and transformative impact,” according to JPMorgan, which was initially skeptical of blockchain technology and the $85,470 Bitcoin price.

With firms like McKinsey predicting a $2 trillion tokenization industry by 2030, RWAs are speeding up this development.

In an interview with Cointelegraph, Michael Bucella, co-founder of Neoclassic Capital, said that RWAs are drawing large investors due to the fact that they solve “pricing inefficiencies” in both digital and conventional assets.

For TradFi, it means exposure to underpriced volume or mispriced credit facilities (i.e., cost of capital). That means low-volume, safe assets to crypto-natives,” Bucella added.

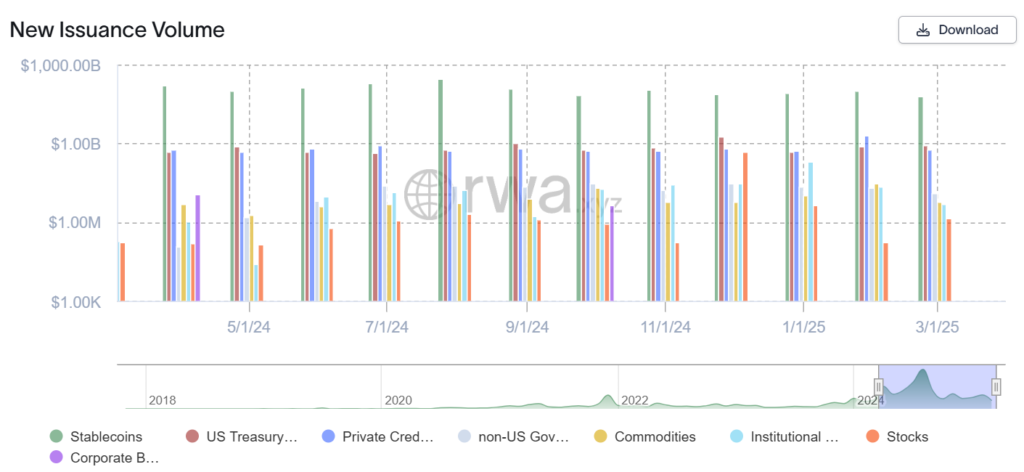

According to industry estimates, the whole RWA market has grown to over $240 billion, including stablecoins, which are onchain representations of fiat currencies.

According to RWA, the entire value of RWAs onchain, excluding stablecoins, is rapidly nearing $20 billion among more than 90,500 holders.xyz.

Source: Michael Saylor

The company’s Bitcoin yield is now 6.9%, which is far below than its 15% goal for 2025, according to the Strategy website.