This Bitroot Network review looks at the platform’s ownership, validity, remuneration structure, and investor dangers. Knowing how Bitroot Network operates is essential given the surge in cryptocurrency scams. To assist you in determining whether an investment is secure, this Scams Radar research makes use of data-driven insights, charts, and comparisons. Continue reading for a lucid, expert assessment.

Bitroot Network asserts that it provides high-yield cryptocurrency investment options. However, as of June 10, 2025, its website (bitroot.network) is unavailable, casting doubt on its authenticity. In order to evaluate risks, this examination looks at its ownership, pay plan, security, and public reputation.

There is no explicit information about the platform’s proprietors or legal registration. According to a WHOIS query, the domain was registered on October 7, 2024, and it conceals ownership information by using Namecheap’s privacy protection. Reputable websites like Coinbase, which are frequently overseen by organisations like FINTRAC, reveal their personnel and registration.

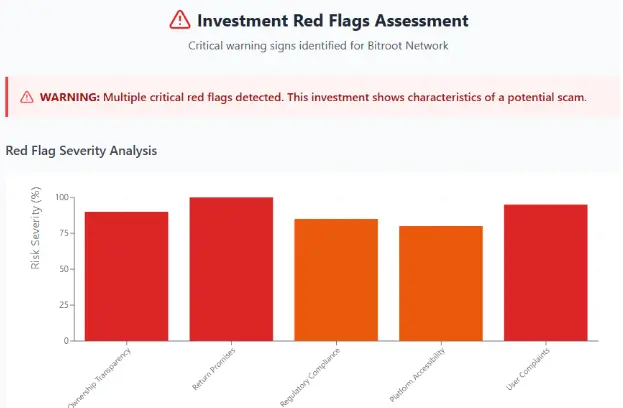

Red Flags:

Accountability is challenging because of this anonymity, which is similar to fraudulent networks like BitConnect. Investors run a significant risk of problems if ownership is opaque.

The compensation scheme of Bitroot Network is unknown because of the website’s inaccessibility. Nonetheless, comparable services frequently provide substantial returns, like 96% APY through staking or 8–15% monthly payouts. Let’s examine a fictitious monthly return of 10%:

Initial investment: $1,000

Monthly return: 10% (or 0.1)

Annual return (compounded): ( A = 1000 \cdot (1 + 0.1)^{12} \approx $3,140 (214% annual growth)

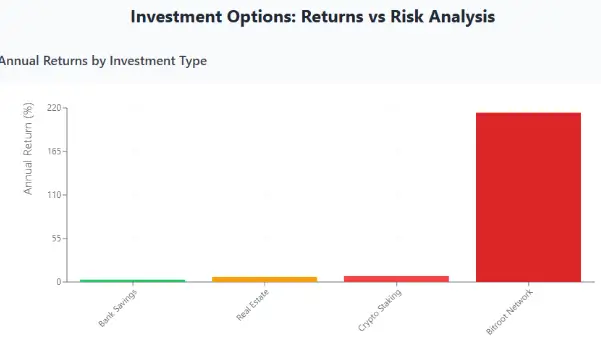

Such profits are not sustainable. The yields on legitimate investments, such as bank savings (2–4% APY) or real estate (5–8% yearly), are significantly lower. Bitroot’s fictitious returns are contrasted with those of conventional options in the following chart:

Investment Type | Annual Return | Risk Level |

Bitroot Network (Hyp.) | 214% | Extreme |

Real Estate | 5–8% | Medium |

Bank Savings | 2–4% | Low |

Crypto Staking (Legit) | 3–12% | High |

These high returns suggest a Ponzi-like structure, relying on new investor funds to pay earlier ones, as seen in scams like BitClub.

There are issues with the platform’s lack of visibility. SimilarWeb and similar tools reveal low traffic (10,000 visits per month, primarily from Nigeria and India) and a high bounce rate (70%) that suggests referral spam or paid advertisements. Due to its concealed ownership, ScamAdviser classifies it as medium risk (60/100), and neither Trustpilot nor ScamAdviser have any reliable reviews.

Key Points:

The inability to access the website indicates either technical difficulties or possible abandonment. There is no indication of cold storage, two-factor authentication, or smart contract audits, which are common for trustworthy platforms like Bitone, even if it employs a simple SSL certificate (Let’s Encrypt).

Security Risks:

It is not possible to obtain payment details; nonetheless, comparable platforms only accept cryptocurrency (for example, USDT and BTC), which restricts the available options. As opposed to Bitbuy’s assistance, which is available around the clock, customer service appears to be nonexistent, as there are no live chat or phone alternatives available.

It appears that bot activity is taking place on the platform’s X account (@Bitroot_), which has approximately 5,000 followers but poor engagement. Promoters, such as YouTube’s “Crypto Guru,” have a track record of engaging in fraudulent activities (for example, Forsage). It is troubling that there is a lack of true involvement with the community.

Tool | Report Summary | Link |

ScamAdviser | Medium risk (60/100) | |

WHOIS | Hidden ownership, Namecheap | |

SimilarWeb | Low traffic, high bounce rate |

It is quite improbable that Bitroot Network will acquire traction in the absence of openness. It runs the possibility of an exit scam or regulatory shutdown, which would be comparable to the failure of BitConnect. Investors should keep an eye out for any changes, but they should also anticipate significant losses.

This review of Bitroot Network raises important questions regarding its authenticity. It appears to be a high-risk platform, most likely a Ponzi scheme, given its anonymous ownership, unsustainable returns, and lack of transparency. It should be avoided by investors, who should instead focus on regulated alternatives. Do your homework before making an investment.

DYOR Disclaimer: The sole objective of this review is to provide information. Consult financial professionals and independently confirm any statements. Investing in cryptocurrencies is risky; never risk more than you can afford to lose.

The legitimacy of the Bitroot Network’s investigation is covered in these frequently asked questions. We’ve included the following queries and responses to allay any worries:

Concerns about scams are raised since Bitroot Network does not have transparent ownership and does not comply with regulatory requirements. High danger is indicated by the website's inaccessibility and the unrealistic returns on investment claims.

Risks include the loss of money, no assurances regarding withdrawals, and the absence of security procedures, such as audits or 2FA, which are typical in Ponzi-like schemes.

The 8–15% monthly profits that Bitroot claims to offer are unsustainable and significantly higher than those of real estate (5–8% yearly) or authorised cryptocurrency staking (3–12% APY).

Investors can guard against possible scams by using a Bitroot Network Review to spot warning signs like concealed ownership and phoney social media activity.

Use tools like ScamAdviser, require audited performance, and confirm ownership. For safer investing, choose licensed sites like Coinbase.

Title: BitRoot

There are no reviews yet. Be the first one to write one.