Aztek Company Review: Is This Investment Platform Trustworthy?

Aztek Company, operating through its platform, markets itself as a provider of cryptocurrency trading and investment solutions, claiming high returns via automated systems. For a detailed scam analysis, visit Scams Radar for a comprehensive review. This Aztek Company review examines its legitimacy, focusing on ownership, compensation plan, security, customer service, and public perception. With multiple red flags suggesting potential fraud, we aim to provide a clear, unbiased analysis for investors seeking aztekplatform.com legitimacy insights.

Table of Contents

Ownership and Transparency Concerns

The platform’s ownership is hidden behind privacy protection services, a common tactic for questionable sites. Registered via Dynadot Inc. on May 9, 2025, the domain’s recent creation contradicts claims of being established in 2016. No verifiable details about founders or executives, such as the alleged CEO “Alexander Griffin,” are provided. His profile, citing an MBA and 15 years of experience, lacks specific institutions or companies, and his image appears to be a stock photo. Legitimate firms like Binance or Coinbase disclose leadership and regulatory details, but Aztek offers none.

- Red Flags:

- Anonymous ownership via privacy protection.

- No regulatory registration with bodies like the SEC or FCA.

- Fabricated CEO profile with unverifiable credentials.

- Claimed 2016 founding contradicts recent domain registration.

- Anonymous ownership via privacy protection.

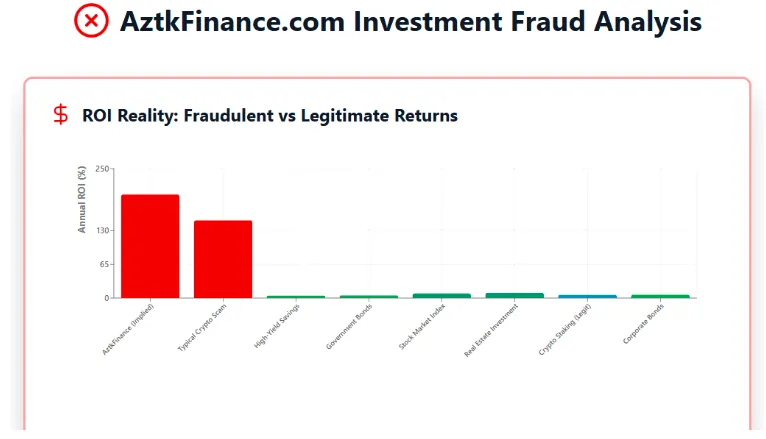

Compensation Plan and ROI Claims

Aztek promotes high returns, with some materials suggesting upto 20–50% monthly gains through automated crypto trading. The compensation plan includes tiered investment packages, where larger deposits yield higher returns, and possibly a referral structure resembling multi-level marketing (MLM). These are hallmarks of High Yield Investment Programs (HYIPs), often Ponzi schemes.

Mathematical Analysis of Returns

Let’s break down the sustainability of a 20% monthly return:

- Formula: ( A = P \left(1 + \frac{r}{n}\right)^{nt} )

- ( P = $10,000 ) (initial investment)

- ( r = 240% ) (20% monthly × 12)

- ( n = 12 ) (monthly compounding)

- ( t = 1 ) (one year)

- ( A = 10,000 \left(1.2\right)^{12} \approx $89,160 )

- ( P = $10,000 ) (initial investment)

A $10,000 investment would grow to $89,160 in one year—an 891.6% annual return. This is unrealistic compared to:

- Bank Savings: 0.5–5% APY

- Real Estate: 8–12% annually

- Crypto Staking (e.g., Binance): 5–15% APY

Such returns require constant new deposits, typical of Ponzi schemes, where early investors are paid with new funds until the scheme collapses.

- Red Flags:

- Unrealistic returns far exceed market norms.

- No transparency on trading strategies or risk management.

- Potential MLM structure incentivizing recruitment over trading.

- Unrealistic returns far exceed market norms.

Security and Technical Performance

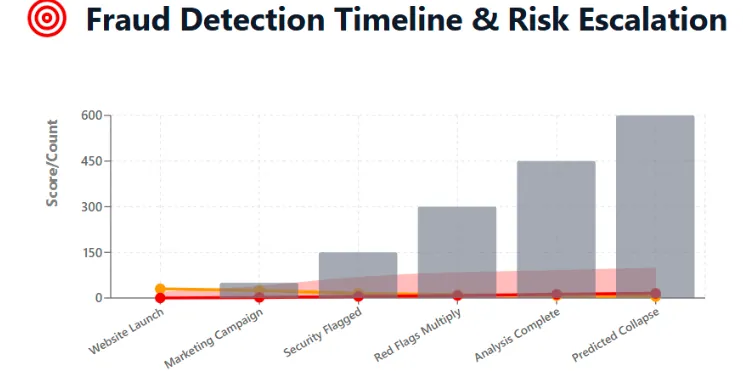

The platform uses a basic SSL certificate, but lacks evidence of third-party security audits, two-factor authentication (2FA), or compliance with standards like ISO 27001. Gridinsoft rates it 1/100 for trust, citing risks like malware and phishing (93/100 score). Scam Detector gives it a 15.5/100 trust score, labeling it high-risk.

- Technical Issues:

- Simplistic site design with generic templates.

- Unstable uptime and shared hosting, per SimilarWeb data.

- No KYC/AML policies mentioned.

- Simplistic site design with generic templates.

- Red Flags:

- Weak security measures compared to platforms like Kraken.

- High-risk ratings from reputable scam detection tools.

- Weak security measures compared to platforms like Kraken.

Aztek Customer Service and Support

Aztek’s customer service is limited to a generic email (support@aztkfinance.com) and a chatbot, with no live chat or phone support. Users report delayed responses and withdrawal issues, including demands for additional fees. Legitimate platforms like Coinbase offer 24/7 support with clear contact methods.

- Red Flags:

- Unresponsive or evasive support.

- Reports of blocked withdrawals unless fees are paid.

- Unresponsive or evasive support.

Public Perception and Traffic Trends

Public feedback is nearly nonexistent on Trustpilot, Reddit, or Bitcointalk, unusual for a platform claiming substantial returns. Low traffic, per SimilarWeb, suggests limited user engagement, relying on paid promotions from low-follower social media accounts.

- Red Flags:

- No credible reviews or community discussions.

- Promotional accounts lack history or authenticity.

- No credible reviews or community discussions.

Payment Methods and Content Authenticity

The platform accepts only cryptocurrencies (e.g., Bitcoin, Ethereum), which are irreversible, increasing fraud risk. Legitimate platforms offer fiat options via regulated processors. Content uses buzzwords like “AI-powered trading” and “guaranteed profits” without verifiable data or whitepapers.

- Red Flags:

- Crypto-only payments with potential fee scams.

- Generic, AI-generated content lacking substance.

- Crypto-only payments with potential fee scams.

Comparison to Competitors

Investment Type | Annual ROI | Risk Level | Regulatory Oversight |

Aztek Company | 240–600% | Extreme | None |

Bank Savings | 0.5–5% | Low | FDIC Insured |

Real Estate | 8–12% | Medium | Regulated |

Binance Staking | 5–15% | High | SEC/FCA Compliant |

Aztek’s claims dwarf those of regulated alternatives, lacking oversight or risk disclosures.

Social Media and Promotions

No verified social media profiles promote Aztek. Low-follower accounts on X, often recently created, push generic crypto content, sometimes linked to other HYIPs like BitGraphTrade.com. This suggests a network of fraudulent promotions.

Recommendations for Investors

- Avoid Investment: Do not deposit funds due to extreme risks.

- Choose Regulated Platforms: Opt for Coinbase, Kraken, or Binance.

- Verify Legitimacy: Check SEC, FCA, or CFTC registrations.

- Use DYOR Tools: ScamAdviser, WHOIS, and Crypto Scam Tracker.

- Report Issues: Contact SEC (www.sec.gov) or CFTC if affected.

Future Outlook

Aztek is likely a short-lived scam, potentially shutting down within 6–18 months. Regulatory crackdowns, like Europe’s MiCA, may limit such platforms’ lifespans. Investors should prioritize transparency and compliance.

Aztek Company Review Conclusion

This Aztek company review reveals a platform with fabricated leadership, unsustainable returns, and no regulatory oversight. Its high-risk ratings, lack of customer support, and vague content make it a likely Ponzi scheme. Investors seeking Aztek legitimacy should avoid it and choose regulated alternatives. Similar red flags were identified in our Bit Graph Review, further highlighting common scam patterns. Always conduct thorough research to protect your funds.

DYOR Disclaimer: This review is for informational purposes only and not financial advice. Verify all claims independently and consult a financial advisor before investing. Cryptocurrency carries significant risks.

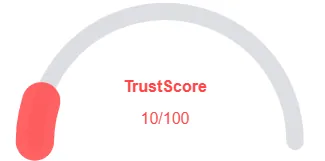

Aztek Company Review Trust Score

A website’s trust score plays a vital role in evaluating its credibility, and Aztek Company a dangerously low rating—raising serious concerns about its legitimacy. Users are strongly advised to proceed with caution.

The platform presents several warning signs, including low traffic, poor user reviews, potential phishing threats, hidden ownership, unclear hosting information, and weak SSL security.

Given this low trust score, the chances of fraud, data breaches, or other harmful activity increase significantly. It’s essential to assess these red flags carefully before engaging with Aztek Company or similar platforms.

Let me know the next company name whenever you want a swap.

Positive Highlights

- Content is accessible

- No spelling or grammar errors

Negative Highlights

- Low AI review count

- New domain

- Hidden Whois info

Frequently Asked Questions About Aztek Company Review

This section answers key questions about , providing clarity, promoting trust, and addressing concerns regarding the platform’s legitimacy.

No, Aztek Company raises significant concerns about its legitimacy due to its vague ownership details, unrealistic returns, and lack of transparency.

Investing in Aztek Company carries risks such as unrealistic return promises, potential withdrawal issues, and possible involvement in fraudulent activities.

Aztek Company claims to generate high returns through automated cryptocurrency trading systems, but there is no verifiable proof of these systems operating effectively.

No, Aztek Company is not regulated by any financial authority, which is a major red flag for potential investors looking for a secure investment platform.

It is advisable to avoid investing in Aztek Company due to its lack of transparency, suspicious claims, and multiple red flags indicating it may be a fraudulent platform.

Other Infromation:

Reviews:

There are no reviews yet. Be the first one to write one.