Aurum Review: Is Aurum Foundation a Legitimate Investment Opportunity?

This Aurum review examines the platform’s legitimacy, ownership, compensation plan, and risks. For an in-depth scam analysis, visit Scams Radar for a detailed review.

Aurum Foundation, accessible at aurum.foundation, presents itself as a decentralized fintech platform offering AI-powered crypto products and high returns. However, concerns about transparency, unsustainable ROI claims, and hidden ownership raise red flags. Read on to explore whether aurum foundation is a safe investment, covering features, compensation, security, and more, with clear insights and comparisons to legitimate platforms.

Table of Contents

What Is Aurum Foundation?

Aurum Foundation claims to provide innovative crypto solutions, including AI-driven trading, staking, and a proprietary blockchain. It promises monthly returns of 9.48% to 15.01%, far exceeding typical investment benchmarks. However, multiple red flags suggest it may operate as a high-risk scheme, possibly a Ponzi.

Ownership and Transparency

The platform lists team members like Al Rizqi (business development), Dr. Bryan (blockchain expert), and Drei Menza (trading operations). It also mentions a CEO, Jan Kroger (aka Krogan Jan-Burkhard), and a recent appointee, Bryan Benson. Other promoters include Sal Khan and Ahmad Zen, linked to failed ventures like TLC Trading and Earn World.

- Concerns: No verifiable credentials (e.g., LinkedIn, academic records) exist for these individuals. The domain, registered on August 1, 2024, via Namecheap with privacy protection, hides ownership details. Claims of Hong Kong registration (AURUM FOUNDATION LIMITED, #77289699) lack public verification due to registry paywalls.

- Red Flag: Anonymous leadership and ties to collapsed schemes raise doubts about trustworthiness.

Compensation Plan and ROI Claims

Aurum’s compensation plan involves tiered investments with referral incentives, resembling a multi-level marketing (MLM) structure. Key details include:

Tier | Investment Range | ROI Share | Monthly ROI Claimed |

Basic | $100–$249 | 60% | 9.48% |

Comfort | $1,000–$2,499 | 70% | ~12% |

Ultimate | $50,000–$99,999 | 95% | 15.01% |

- Penalties: A 35% fee applies for withdrawals within a year, plus a 1% ROI withdrawal fee.

- Referral Bonuses: 15% for Level 1, 10% for Level 2, and 5% for Level 3 referrals, emphasizing recruitment over trading profits.

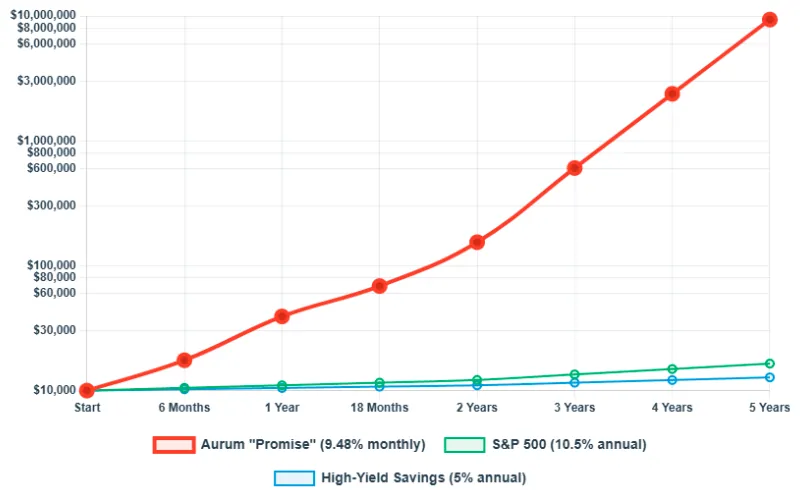

Are the ROI Claims Sustainable?

Aurum promises 100–590% annual returns, far exceeding legitimate benchmarks:

- Real Estate: 8–12% annually

- Bank Savings: 1–5% APY

- Crypto Staking: 3–8% APY (e.g., Coinbase)

Mathematical Analysis

For a $1,000 investment at 15% monthly ROI:

- Year 1: $1,000 × (1.15)¹² = $5,350

- Year 2: $5,350 × (1.15)¹² = $28,622

- Year 5: $1,000 × (1.15)⁶⁰ = $156,866,442

This exponential growth requires unsustainable new investor funds, typical of Ponzi schemes. For 1,000 investors at $1,000 each, monthly payouts of $150,000 require $2.66M in new capital annually, assuming no trading profits.

Investment Type | Annual ROI (%) |

Aurum Foundation | 100–590 |

Real Estate | 8–12 |

Bank Savings | 1–5 |

Crypto Staking | 3–8 |

Security and Technical Setup

Aurum claims AES-256 encryption, TLS 1.3, and a secure Web 3.0 wallet. However, it lacks:

- Third-party audits (e.g., CertiK)

- Multi-factor authentication details

- Transparent custody policies

The site uses a basic SSL certificate and Cloudflare hosting but operates via a subdomain (backoffice.aurum.foundation), suggesting instability. User reports of app freezing and slow bid times indicate poor performance.

Red Flag: No verifiable security audits or robust technical infrastructure.

Public Perception and Trust

- Trustpilot: 25 reviews, 4.3/5 stars, praise ease of use but report slow withdrawals and poor support. Reviews seem marketing-driven, lacking critical depth.

- ScamAdviser: Scores 86/100 but flags hidden WHOIS data and AI-generated content. GridinSoft rates it 77–94/100, advising caution.

- BehindMLM: Labels Aurum a crypto Ponzi scheme due to its MLM structure.

Red Flag: Suspiciously positive reviews and low trust scores highlight risks.

Social Media and Promoters

Promotional accounts like @CryptoGuruX (3,200 followers), @Web3Ventures (4,800 followers), @CryptoGainsDaily (Instagram), and @PassiveIncomeCrypto (Telegram) push Aurum alongside questionable projects like aurum-chain.io and BitcoinEvolution. These accounts show low engagement and patterns of paid promotion.

Red Flag: Promoters with histories of endorsing failed schemes lack credibility.

Payment Methods and Compliance

Aurum uses crypto (e.g., USDT) and mobile money for transactions, bypassing KYC requirements. No regulated payment processors (e.g., MoonPay) are disclosed, increasing fraud risks. The absence of SEC, FCA, or MiCA compliance is concerning.

Red Flag: Lack of regulatory oversight and anonymous transactions.

Comparison to Legitimate Investments

Investment Type | Annual ROI | Risk Level | Regulation |

Aurum Foundation | 100–590% | Extremely High | None |

REITs | 8–12% | Medium | SEC |

Bank CDs | 1–5% | Very Low | FDIC |

Crypto Staking | 3–8% | High | Partial |

Red Flags Summary

- Anonymous ownership with unverifiable team credentials

- Unrealistic 100–590% annual ROI claims

- MLM structure reliant on recruitment

- 35% withdrawal penalties lock in funds

- No regulatory compliance or audits

- Low traffic (#1,051,458–1,302,825 globally)

- Suspicious social media promotions

Recommendations

- Avoid Investment: High Ponzi scheme risks make Aurum unsuitable for investment.

- Withdraw Funds: If invested, attempt immediate withdrawals despite penalties.

- Use Regulated Platforms: Choose exchanges like Coinbase for transparent 3–8% APY.

- Verify with DYOR Tools: Check ScamAdviser, SEC EDGAR, and blockchain explorers.

- Report Issues: Contact regulators like the SEC or FCA if affected.

Future Outlook

Aurum’s model suggests a collapse within 6–24 months as new investor funds dwindle. Regulatory crackdowns (e.g., MiCA, 2026) may target such platforms, limiting their lifespan. Investors face near-certain losses without legal recourse.

Aurum Review Conclusion

This Aurum review reveals a platform with unsustainable promises and significant risks. Its opaque ownership, MLM structure, and lack of regulation align with Ponzi scheme characteristics. Similar concerns have also been raised in our detailed Alure Trading Review, highlighting comparable red flags. Investors should prioritize regulated alternatives and conduct thorough research. Always consult financial advisors before investing in crypto platforms.

Aurum Review Trust Score

A website’s trust score is a critical indicator of its reliability, andAurum currently holds an alarmingly low rating—raising serious concerns about its legitimacy. Users are strongly advised to proceed with caution.

The platform displays several warning signs, such as low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and inadequate SSL protection.

Given its low trust score, the risk of fraud, data breaches, or other security issues is much higher. It is essential to carefully consider these red flags before engaging with Aurum or similar platforms.

Positive Highlights

- Archive Age is quite old

Negative Highlights

- Website content inaccessible

- Low AI review rate

- Newly registered domain

- Whois details hidden

- Domain not in Tranco top 1M

Frequently Asked Questions About Aurum Review

This section answers key questions about , providing clarity, promoting trust, and addressing concerns regarding the platform’s legitimacy.

No. Aurum Foundation raises concerns due to limited transparency, hidden ownership, and unverified claims of high returns.

Aurum promotes AI-powered crypto trading, staking, and fintech products, but there is no verifiable evidence of sustainable profits.

No. Aurum Foundation is not licensed or registered with any recognized financial regulator, increasing risk for investors.

Risks include potential loss of funds, hidden ownership, unverified ROI claims, and lack of regulatory oversight.

It is not recommended. The platform’s lack of transparency, regulation, and unrealistic promises make it a high-risk investment.

Other Infromation:

Reviews:

There are no reviews yet. Be the first one to write one.