Is the ATOSHI Legit blockchain ecosystem or high-risk gamble?

In this comprehensive ATOSHI review, we evaluate the legitimacy of the ATOSHI platform and its ATOS coin, analyzing its ownership, compensation plan, technical transparency, and risks for investors. Based on extensive research, we uncover critical red flags that suggest extreme caution. This analysis of Scams Radar, grounded in factual data, aims to guide potential investors seeking clarity on ATOSHI’s claims of being a revolutionary Web3 ecosystem.

Table of Contents

Part 1: What Is Atoshi?

ATOSHI, hosted at atoshi.org/pch/en/index.html, presents itself as a blockchain-based super-app ecosystem. It offers services like e-commerce, gaming, digital collectibles (ATOSHI Meta), AI tools, a wallet, and a password manager (ATOSHI Key).

The platform claims over 10 million users, 9.6 million daily app activations, and integration with major platforms like Amazon and Alibaba. The ATOS coin powers transactions, rewarding users for activities like gaming, video uploads, and bookings.

1.1 Ownership and Leadership Transparency

Who Runs ATOSHI?

The platform highlights Liao Wang (also known as Leo Wan) as its CEO. He is described as the Executive Chairman of the Beijing Guangzhou Chamber of Commerce and a visiting professor at the China Academy of Management Sciences. A 2018-registered Chinese entity, 阿拓斯(北京)科技有限公司, lists Liao Wang as its legal representative, per Baike records. However, these credentials lack independent verification. No other team members are disclosed, and domain registration details (via WHOIS) are redacted, showing only a UAE address. This opacity contrasts with legitimate projects like Ethereum, which have transparent teams. Limited verifiable information about leadership raises accountability issues. Investors in companies with clear governance, like Binance, benefit from public team profiles.

1.2 Compensation Plan: How Do Users Earn?

ATOSHI’s compensation plan centers on earning ATOS coins through mobile mining, referrals, and ecosystem activities. Here’s a breakdown:

- Mobile Mining: Users mine ATOS via the app without specialized hardware, using a “Power of Device” (PoD) algorithm. The platform claims this is decentralized, but no technical details are provided.

- Referrals: Inviting friends yields 10% of their mining rewards or 23,000 ATOS (~$23 USDT) after KYC and three daily check-ins. This incentivizes recruitment, resembling multi-level marketing (MLM).

- Activity Rewards: Users earn ATOS by playing games, watching/uploading videos on DeTok, or booking services (e.g., hotels via potential Booking.com partnerships). ATOS holders can review videos and share ad revenue.

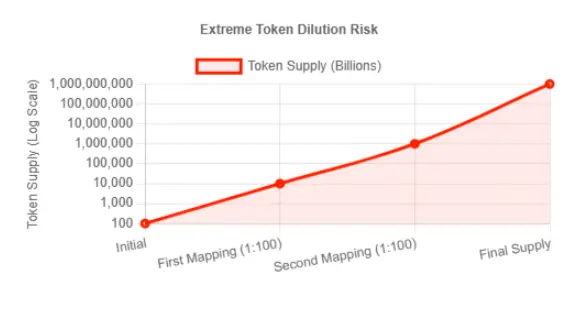

- Tokenomics: Initial supply is 100 billion ATOS, expanding to 1 quadrillion through two 1:100 mappings (1 ERC-20 ATOS = 10,000 mainnet ATOS). This massive supply raises dilution concerns.

- Revenue Hypotheticals: The site suggests that if 1% of 10 million users spend $1 daily on games, revenue could exceed $100,000/day, or $1 million/day from hotel bookings with a $10 commission.

Part 2: ATOSHI’s Unsustainable Compensation Plan and Lack of Technical Transparency

2.1 Sustainability Analysis

The compensation plan relies heavily on user growth and referrals. Let’s examine its viability with simple math:

- Daily Mining: If 10 million users mine $0.10/day, the platform issues $1 million/day in tokens ($365 million/year). Sustaining a $0.052 price (per CoinGecko) requires a $520 billion market cap at 1 quadrillion tokens—five times Bitcoin’s peak market cap.

- Referral Pressure: A 10% referral reward accelerates token issuance. If each user invites one friend, the supply doubles rapidly, diluting value unless new funds pour in exponentially.

- Comparison:

- Bank Savings: 0.5-5% APY (FDIC).

- Real Estate: 4-8% annual returns (CBRE).

- Crypto Staking: 3-12% APY (Binance).

- Bank Savings: 0.5-5% APY (FDIC).

ATOSHI: Implicit 100%+ annual returns are unsustainable without infinite user growth.

Concern: The plan mirrors Ponzi schemes, requiring constant new users to pay rewards. The quadrillion-token supply makes price stability impossible.

2.2 Technical Transparency and Security

ATOSHI claims a custom blockchain in testnet, with a block explorer (scan.atoshi.org) showing centralized “Foundation/Team” wallets. The ERC-20 token trades at ~$0.052 with low volume ($22,000-$72,000 daily). However:

- No Whitepaper: No technical documentation explains the PoD algorithm or blockchain.

- Limited Code: GitHub repos (atos-genesis-contract, atos-chain) exist but show minimal activity.

- Security Claims: The wallet uses “state-of-the-art encryption” and biometrics, but no audits (e.g., Certik) verify this. Real-name KYC raises privacy concerns.

- Scamadviser: 75/100 for the main domain, but the invite subdomain scores low, signaling scam risks.

Concern: Unaudited technology and centralized holdings increase risks of hacks or insider dumps.

Part 3: ATOSHI’s Falling Traffic, Doubtful Metrics, and Weak Support System

3.1 Traffic and Public Perception

SimilarWeb reports atoshi.org has a global rank of ~1.5 million, with 50,000-100,000 monthly visits (15% decline recently). App downloads (100K-500K on Google Play) don’t align with 10 million user claims. Public sentiment on Reddit and Bitcointalk is skeptical, with scam accusations, while X posts (@atoshiofficial, 154K followers) focus on referrals. Inflated user metrics and negative community feedback undermine credibility.

3.2 Payment Methods and Support

ATOS payments occur via the wallet, with future plans for Netflix/YouTube fees. Trading is via Uniswap, with low liquidity. Support is limited to email (liao@atoshi.org) and social channels (Telegram, WhatsApp). Response quality is unverified. Crypto-only payments and limited support increase financial risks.

3.3 Investment in Companies and Growth Potential

ATOSHI seeks to invest in companies with vast potential users, accepting ATOS payments with discounts, and showing high business growth potential. This angel investment model aims to expand the ecosystem but lacks details on funded companies or terms. Unverified investment claims and vague criteria reduce trust.

Red Flags

Before diving deeper, it’s crucial to spotlight the red flags that cast serious doubt on ATOSHI’s legitimacy and long-term sustainability:

- Massive 1 quadrillion token supply.

- Referral-driven model resembling MLM.

- No whitepaper or audits.

- Centralized wallet holdings.

- Unverified user metrics and partnerships.

- Regulatory risks due to KYC and lack of licenses.

DYOR Tools and Social Media

- Tools: Use Etherscan for token tracking, ScamAdviser (75/100 main domain), and SimilarWeb for traffic.

- Social Media: @atoshiofficial (X), Atoshi Foundation (Facebook, 57K likes). Promoters like @LeftHouseCrypto also push Pi Network-style projects, indicating a pattern of speculative shilling.

Future Outlook

ATOSHI may gain traction in emerging markets, but its mainnet delay (Q2 2026), regulatory hurdles, and dilution risks suggest a likely price crash (50-80% post-listing). It could fade like Pi Network or face shutdown.

ATOSHI Review Conclusion

This ATOSHI review concludes that while the project markets itself as a revolutionary Web3 ecosystem, its unsustainable tokenomics, opaque leadership, and Ponzi-like referral model overshadow its ambitious claims. Investors interested in blockchain ventures or ATOS payment systems should instead focus on audited, transparent projects with verifiable business models. The risks here far outweigh any potential upside. For broader context, also check our ECOX Review on Scams Radar to see similar patterns of concern.

Recommendation: Avoid investing. Focus on regulated assets or established cryptocurrencies.

Disclaimer: This review is for informational purposes only, not financial advice. Always conduct your own research (DYOR) before investing. Cryptocurrencies carry high risks, and you could lose your entire investment.

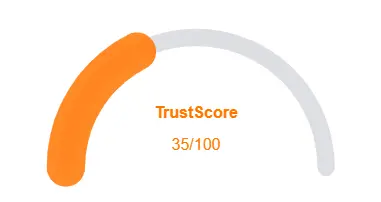

ATOSHI Review Trust Score

A website’s trust score is a critical indicator of its reliability. ATOSHI currently holds an alarmingly low rating raising serious concerns about its legitimacy. Users are strongly advised to proceed with caution.

The platform displays several warning signs, such as low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and inadequate SSL protection.

Given its low trust score, the risk of fraud, data breaches, or other security issues is much higher. It is essential to carefully consider these red flags before engaging with ATOSHI similar platforms.

Positive Highlights

- Website content accessible

- No spelling/grammatical errors

- Domain age: Old

- Archive age: Old

Negative Highlights

- Low AI review rating

- Whois data hidden

- Domain not in top 1M on Tranco list

Frequently Asked Questions About ATOSHI Review

This section answers key questions about , providing clarity, promoting trust, and addressing concerns regarding the platform’s legitimacy.

ATOSHI is a blockchain ecosystem offering services like e-commerce and gaming, but with unclear transparency.

ATOSHI lacks audits, transparency, and verified ownership, raising serious concerns

Risks include MLM-style referrals, unsustainable tokenomics, and no audits or whitepaper.

Unlike regulated investments, ATOSHI lacks investor protection and transparency.

No, it’s a high-risk investment with red flags. Safer regulated options are better.

Other Infromation:

Website: atoshi.org

Reviews:

There are no reviews yet. Be the first one to write one.