Atomic Meta Review: Is This Blockchain Platform Legitimate?

Atomic Meta, a new platform in the cryptocurrency space, markets itself as a high-performance blockchain ecosystem. For an in-depth scam analysis, visit Scams Radar for a detailed review. It promises features like staking rewards, AI-driven trading, and tokenized real estate. However, concerns about transparency, sustainability, and legitimacy arise due to limited verifiable data. This review examines whether atomicmeta.com is trustworthy by analyzing ownership, compensation plans, traffic trends, public perception, security, content authenticity, payment methods, customer support, technical performance, and ROI claims. We use clear data, mathematical reasoning, and comparisons to assess risks and provide investor guidance.

Table of Contents

Ownership and Transparency

The ownership of Atomic Meta remains unclear. A WHOIS lookup shows the domain, registered in mid-2025, uses privacy protection, hiding the registrant’s identity. No team members, founders, or company details are disclosed on the website or whitepaper. Legitimate platforms like Binance or Ethereum typically share team profiles and legal registrations to build trust. The absence of this information raises concerns about accountability.

- Key Issue: Anonymous ownership is common in high-risk crypto projects.

- Comparison: Established platforms provide verifiable team and corporate details.

Compensation Plan and ROI Sustainability

Atomic Meta promotes a compensation plan involving staking rewards (22% of token supply), presales, and airdrops. It claims 2.5× returns for passive investors and 4× for active investors over 20 months. Registration requires a referral code, suggesting a multi-level marketing (MLM) structure.

Mathematical Analysis

Assume an investor deposits $1,000 with a promised 4× return ($4,000) over 20 months, with a 5% monthly release ($200/month). For 1,000 investors, the platform needs $200,000 monthly to sustain payouts. Without clear external revenue (e.g., trading fees), this resembles a Ponzi scheme, relying on new investor funds.

Calculation

- Initial investment: $1,000

- Promised return: $4,000

- Monthly payout: $4,000 ÷ 20 = $200

- For 1,000 investors: $200 × 1,000 = $200,000/month

Sustainability Issue

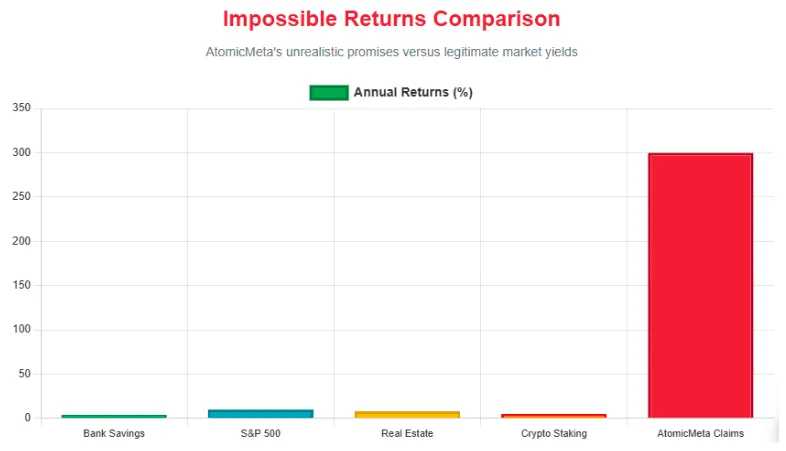

- No legitimate business generates consistent 400% annual returns.

- The platform’s “reverse mirror trading” bot claims to fund buybacks, but no audited profit-and-loss data supports this.

Comparison to Benchmarks

Investment Type | Annual ROI | Risk Level | Backing |

Atomic Meta (Claimed) | 400%+ | Extreme | Unverified trading profits |

Real Estate (Pakistan) | 8–12% | Moderate | Tangible assets |

Bank Deposits | 6–10.5% | Low | Government-backed insurance |

Ethereum Staking | 2–5% | High | Blockchain protocol |

Investment Type | Annual ROI (%) |

Atomic Meta | 400 |

Real Estate | 10 |

Bank Deposits | 8 |

Ethereum Staking | 4 |

Traffic Trends and Public Perception

iMine accepts only cryptocurrencies (BTC, ETH, USDT), with no fiat options, increasing fraud risk. User reports mention withdrawal delays and high fees. Customer support is limited to email, with slow response times (24-72 hours).

iMine Pros and Cons

Traffic analysis via tools like SimilarWeb shows Atomic Meta has low visibility, with minimal visits since its launch in mid-2025. Established platforms like Coinbase have high traffic due to user trust. Public perception is nearly nonexistent, with no reviews on Trustpilot, Reddit, or X. Official social media accounts (@atomic_meta on X, Atomic Meta on Facebook, t.me/atomicmetacommunity on Telegram) focus on presale promotions at $0.045, but lack community engagement.

- Key Issue: Low traffic and no organic discussion suggest limited trust or intentional obscurity.

- Promotion: Paid press releases on sites like First India and Lokmat Times, not independent coverage.

Security and Technical Performance

Atomic Meta uses HTTPS but lacks advanced security like two-factor authentication or cold storage. It claims “audited smart contracts” but provides no audit reports or links. The promised ATMChain and ATMScan explorer are not live, and no GitHub repository exists for code transparency. Technical performance data (uptime, scalability) is unavailable, raising doubts about infrastructure reliability.

- Key Issue: Unverified security claims increase risks of hacks or fund loss.

- Comparison: Platforms like Kraken provide audited security and transparent code.

Content Authenticity and Payment Methods

The website’s content is vague, using buzzwords like “revolutionary” and “lightning-fast” without technical details. No whitepaper or roadmap provides clarity on the Atomic Meta ecosystem. Payment methods are crypto-only (BNB, ETH, stablecoins), with no fiat options or refund policies, limiting recourse for investors. The no-KYC policy raises regulatory concerns.

- Key Issue: Generic content and crypto-only payments are common in high-risk platforms.

Customer Support

Atomic Meta claims 24/7 live chat and Telegram support, but no contact details (email, phone) are provided. Users must connect wallets to access features, which is risky without verified support channels.

- Key Issue: Lack of accessible support leaves investors vulnerable.

Social Media and Promoters

Official accounts (@atomic_meta on X, Atomic Meta on Facebook, t.me/atomicmetacommunity) focus on presale hype. No credible influencers endorse the project, and promotions appear on low-authority sites, not tier-1 crypto media.

- Key Issue: Lack of reputable endorsements suggests limited credibility.

DYOR Tool Reports

- ScamAdviser: No trust score; site too new or obscure.

- ScamDoc: No report available.

- URLVoid: No blocklist data.

- Token Sniffer: No token listed, despite claims of ATM/ATMC coin.

Key Issue: Absence from DYOR tools indicates minimal due diligence.

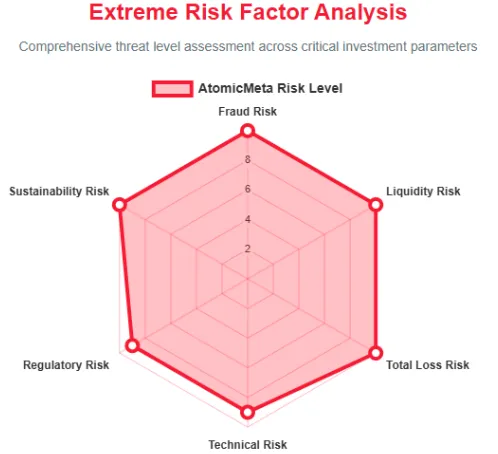

Red Flags Summary

- Anonymous ownership and no team transparency.

- Unsustainable 400%+ ROI claims, resembling Ponzi dynamics.

- Low traffic and no public reviews.

- Unverified security and no live blockchain explorer.

- Crypto-only payments with no KYC.

- Generic content and paid press promotions.

Future Outlook

Atomic Meta is unlikely to succeed without transparency, audits, and a live blockchain. It may attract early investors with presale hype but risks collapse if withdrawals slow. Regulatory scrutiny in 2025 could also shut it down, as seen with past scams like Bitconnect.

Future Outlook

- Avoid investing until Atomic Meta provides team details, audited contracts, and a live explorer.

- Use DYOR tools (ScamAdviser, Token Sniffer) to monitor updates.

- Opt for regulated platforms like Binance or real estate investments for safer returns.

- If invested, attempt to withdraw funds and document all transactions.

Atomic Meta Review Conclusion

This Atomic Meta review highlights significant risks due to its lack of transparency, unsustainable ROI claims, and minimal online presence. Investors should approach with extreme caution, prioritizing platforms with proven track records and regulatory compliance. For a better understanding of similar high-risk projects, you can also read our detailed iMine Review. Conduct thorough research before engaging with the Atomic Meta cryptocurrency platform to protect your funds.

DYOR Disclaimer

This analysis, based on data as of August 13, 2025, is for informational purposes only and not financial advice. Always conduct your own research (DYOR) using tools like ScamAdviser and CoinMarketCap. Cryptocurrency investments are volatile, and you bear full responsibility for your decisions.

Atomic Meta Review Trust Score

A website’s trust score plays a vital role in evaluating its credibility, and Atomic Meta a dangerously low rating—raising serious concerns about its legitimacy. Users are strongly advised to proceed with caution.

The platform presents several warning signs, including low traffic, poor user reviews, potential phishing threats, hidden ownership, unclear hosting information, and weak SSL security.

Given this low trust score, the chances of fraud, data breaches, or other harmful activity increase significantly. It’s essential to assess these red flags carefully before engaging with Atomic Meta or similar platforms.

Let me know the next company name whenever you want a swap.

Positive Highlights

- Website content accessible

- Website security enabled

- No spelling or grammar errors

Negative Highlights

- Low AI review rate

- New domain

- New archive

- Whois hidden

Frequently Asked Questions About Atomic Meta Review

This section answers key questions about , providing clarity, promoting trust, and addressing concerns regarding the platform’s legitimacy.

No. Atomic Meta raises concerns due to limited transparency, lack of verifiable ownership, and unrealistic ROI promises.

It claims to provide staking rewards, AI-driven trading, and tokenized real estate investments, but there’s no solid proof of these operations.

No. Atomic Meta is not registered or licensed with any recognized financial regulator, making it a high-risk investment choice.

Risks include possible financial loss, unverified services, lack of regulation, and unsustainable return claims.

It’s not recommended. The platform’s lack of transparency, risky promises, and absence of regulatory oversight make it unsafe for investors.

Other Infromation:

Reviews:

There are no reviews yet. Be the first one to write one.