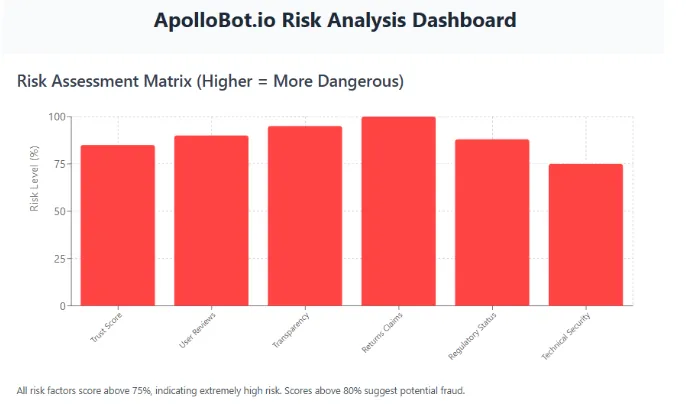

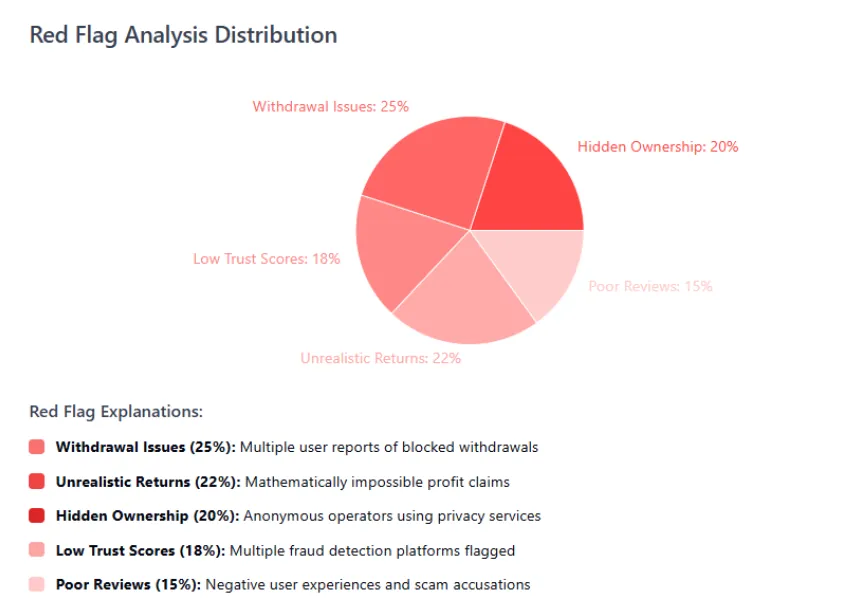

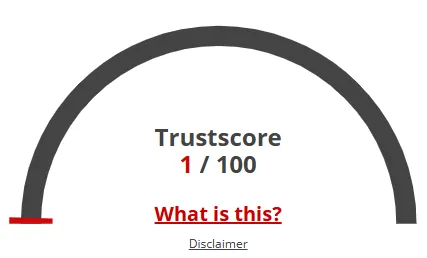

This ApolloBots review on Scams Radar examines the legitimacy of the crypto trading bot hosted at apollobots.io, which promises high returns through AI-driven strategies. We analyze its ownership, compensation plans, security measures, user experiences, and ROI claims to help investors make informed decisions. With clear charts and simple language, we uncover the hidden risks and compare the platform to trusted investment options like real estate, banks, and regulated crypto platforms.