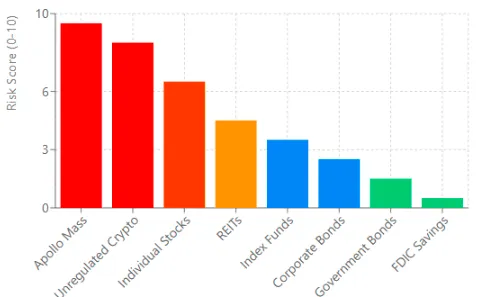

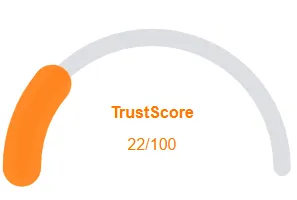

Apollo Mass, an online investment platform, promises high returns through cryptocurrency trading. However, concerns about its legitimacy, ownership, and compensation plan demand attention. This Apollo Mass review offers a clear, detailed analysis for everyday investors, focusing on ownership, compensation structure, and risks, supported by charts and comparisons. To explore more about the platform, visit apollomass.com. For more scam investigations and risk assessments, visit our Scams Radar section.