On October 23, 2025, Australia’s Securities and Investments Commission (ASIC) issued a securities fraud warning against Bellator Life, adding it to the Investor Alert List, per ASIC’s official announcement. ASIC alleges that Bellator Life, operating via a Hong Kong corporate address, is offering or advertising financial services to Australian consumers without an Australian financial services license or credit license, nor authorization from a licensed entity. The warning flags Bellator Life’s YouTube channel and Twitter profile as sources of unlicensed promotions, urging investors to avoid engagement to prevent potential losses.

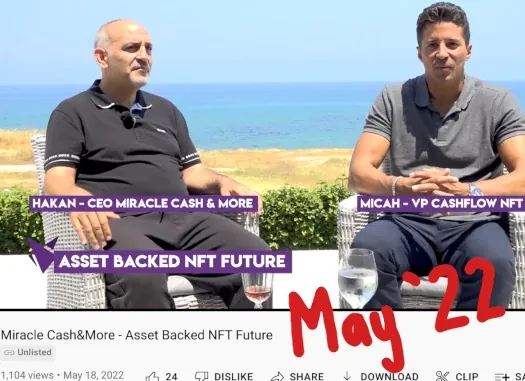

Bellator Life is identified as a reboot of the collapsed CashFlow NFT Ponzi scheme, which promised high yields through NFT investments but defrauded investors of millions, per prior ASIC and international alerts. Related entities include Miracle Cash & More, which received a fraud warning from New Zealand’s Financial Markets Authority (FMA) in June 2025 for similar unlicensed operations. Bellator Life is fronted by Micah Theard, a former OneCoin Ponzi promoter convicted in the $4 billion scheme, and Hakan Torehan, a convicted fraudster, per U.S. DOJ records. The scheme operates as an MLM crypto Ponzi, recruiting affiliates with promises of passive income, while insiders allegedly siphon funds, per.

Since its launch, Bellator Life has introduced Miracle Neo money laundering cards, a Ponzi app powered by Iterato, and instructions for promoters to conceal ties to third-party financial partners. These moves aim to evade scrutiny while expanding recruitment, mirroring tactics in CashFlow NFT. ASIC’s warning emphasizes that unlicensed entities like Bellator Life pose significant risks, including total loss of investments, and advises reporting suspicious activity to ASIC via asic.gov.au. International regulators, including the SEC and FMA, have issued similar alerts, accusing Bellator Life of operating unregistered securities offerings.

As of September 2025, Bellator Life’s website attracted ~202,000 monthly visits, primarily from the U.S. (71%) and Dominican Republic (29%), per SimilarWeb data. Bellator Life is not registered to offer securities in the U.S. or Dominican Republic, exposing investors to fraud risks under the Securities Act of 1933 and local laws. ASIC’s action aligns with global crackdowns on MLM crypto Ponzi schemes, such as Forsage ($340 million losses) and OnPassive ($108 million SEC settlement), per. The warning could trigger further investigations by the SEC and FBI, potentially leading to asset freezes and victim restitution by 2026.

Investors should immediately cease engagement with Bellator Life and report losses to ASIC at asic.gov.au/report or the SEC at sec.gov/complaint. Verify platforms via ASIC’s Professional Registers and FINRA’s BrokerCheck. Bitcoin (BTC) ($113,234) and Ethereum (ETH) ($4,070) remain unaffected, per CoinMarketCap, but Bellator Life highlights crypto fraud risks. Diversify into USDC or ETH with stop-losses below BTC’s $112,000, per TradingView. Follow @TheBlock__ on X for real-time regulatory updates. ASIC’s warning serves as a stark reminder to prioritize licensed investments amid rising Ponzi schemes in 2025.