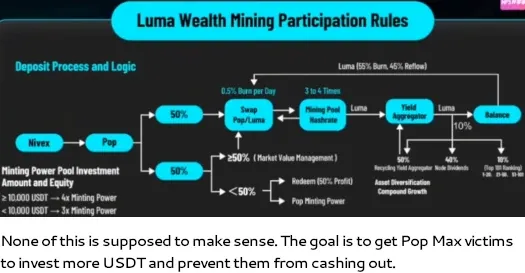

In October 2025, the Pop Max Ponzi scheme, a Dubai-based MLM crypto investment model launched earlier this year, has collapsed, per. Victims are now being redirected to Luma Protocol, hosted on dapp.lumaprotocol.io, with the root .io domain registered on August 29, 2025, per. Pop Max solicited USDT investments with returns in PUSD tokens, convertible to POP social tokens (PPT) for cashouts, but conversions were disabled weeks ago, trapping funds, per. Luma Protocol introduces a mining-based investment tied to POP tokens, withdrawable via Nivex, a dubious Dubai-based exchange, per.

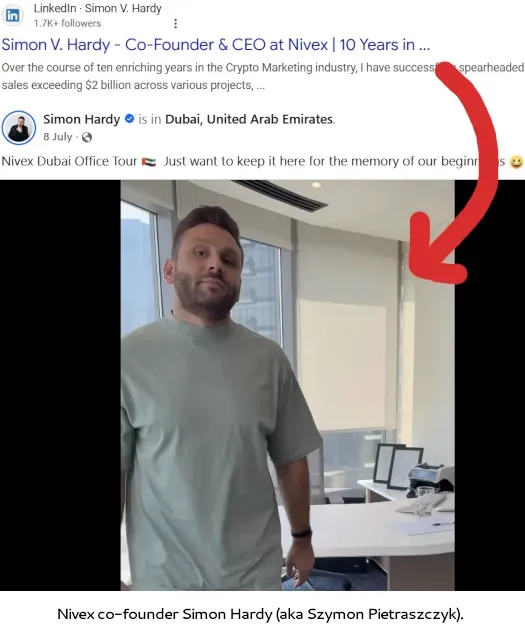

Nivex, co-founded by Simon Hardy (aka Szymon Pietraszczyk) and Becky Choi (aka Becky Cai), is linked to Luma Protocol as a joint development with Pop Max, per. Hardy and Cai, serial MLM Ponzi promoters behind schemes like DEFI Money Club, Meta Force, GPBots, and SolaRoad, are suspected of orchestrating the reboot, per. Chinese scammers presented as Pop Max co-founders, including Nicholas Wan (aka Ruicheng Wan), interviewed by promoter Sal Khan in July 2025 at Nivex’s Dubai offices, suggest broader involvement, per.

Luma Protocol emerges as new recruits dwindle, shifting Pop Max to extracting more from existing victims through endless token launches and manipulable conversion hoops, per. Nivex’s role in withdrawals enables prolonged milking, with potential for additional scams if Luma delays collapse, per. This tactic mirrors Forsage ($340M losses) and GSPartners ($1B+ losses), per. Bitcoin (BTC) ($113,234) and Ethereum (ETH) ($4,070) remain unaffected, per CoinMarketCap, but MLM Ponzi exposure erodes DeFi trust, per.

Avoid Pop Max, Luma Protocol, and Nivex due to exit-scam risks, per. Verify platforms via sec.gov or BaFin databases, per. Diversify into USDC or ETH with stop-losses below BTC’s $112,000, per TradingView. Follow @TheBlock__ on X for scam alerts. Dubai’s lax oversight enables such schemes, but global warnings like BaFin’s on Cryptex signal crackdowns, per. Victims should report to DOJ or SEC, per.