Hyperliquid Review: Legit Layer 1 DeFi or Fake?

In this Hyperliquid review for 2025, we dive into a standout player in decentralized finance. Hyperliquid stands out as a high-speed Layer 1 blockchain built for trading. It powers perpetual futures and spot markets with real utility.

But watch out scam sites like gethyperliquid.xyz mimic it to trick users. Scams Radar break it down step by step.

Table of Contents

Part 1: What Makes Hyperliquid a Top DeFi Trading Platform?

Hyperliquid launched in late 2024 as a dedicated chain for fast, low-slippage trades. It handles over $1 billion in daily volume, often topping DeFi perps charts. The platform uses a Central Limit Order Book for precise matching, much like centralized exchanges but fully on-chain.

1.1 Key features include:

- Zero gas fees for perps and spot trades, bridged via tools like Stargate.

- HyperBFT consensus, delivering 0.07-second block times and up to 200,000 TPS.

- HyperEVM compatibility, letting devs build EVM apps that tap into core liquidity.

- Permissionless listings through HIP proposals, now with auctions for new markets.

This setup bridges traditional finance speed with DeFi transparency. Traders get 50x leverage on assets like BTC and ETH, plus memecoins. TVL sits at $753 million, with vaults offering copy trading at 8% APY.

1.2 Elements of Hyperliquid's

Feature | Hyperliquid Benefit | Comparison to Other DEXs |

Trade Execution Speed | Sub-second finality | Faster than dYdX (1-2s) |

Daily Volume (2025 Avg.) | $7-10B | 75% of on-chain perps |

Gas Fees | Zero for core trades | Vs. 0.01 ETH on Arbitrum |

Assets Supported | 100+ (perps/spot) | More than GMX (50+) |

Part 2: Who Runs Hyperliquid? Team Profiles and Ownership Insights

Hyperliquid keeps a lean team of 11, led by co-founder Jeff Yan. Yan, a former Jump Trading quant, built high-frequency systems before crypto. His background in low-latency trading shaped HyperCore’s order book. The group bootstrapped without VC funding, paying no salaries pre-launch a nod to product focus.

Other key members

- Engineers (5 total): Rust and Solidity experts from Jane Street and Citadel, handling HyperBFT and EVM integration.

- Non-tech (6): Community managers and ops pros, driving 388,000 users.

Ownership ties to the Hyper Foundation, a non-profit transitioning to full community governance. No insider dumps; vesting locks 70% of allocations. This setup builds trust in a space full of opaque projects.

Part 3: Hyperliquid $HYPE Token: Utility and Tokenomics Breakdown

The $HYPE token fuels the ecosystem. It acts as gas for HyperEVM, enables staking for fee discounts, and supports governance via HIP votes. Total supply caps at 1 billion, with no inflation. Airdrops distributed 31% to early users, valued at $1.2 billion at launch.

Tokenomics focus on deflation:

- 97% of fees buy back and burn $HYPE.

- Staking rewards tie to protocol revenue, yielding 8-12% APY.

- Allocation: 31% community, 24% ecosystem, 20% rewards, 15% liquidity, 10% foundation.

Current price hovers at $57, with $14.7 billion market cap and 43% staked. This buyback model has burned 30 million tokens since launch, boosting scarcity.

3.1 HYPE Utility

HYPE Utility | Details |

Staking Rewards | Tiered: 0.035% to 0% fees reduction |

Governance | Vote on HIPs for upgrades |

Burns | $600M+ annualized from fees |

Part 4: Real Rewards: Hyperliquid Staking and Compensation Plan

Forget pyramid schemes, Hyperliquid’s rewards stem from real revenue. Stake $HYPE for tiered benefits: Lower fees (down to zero) and vault yields. No recruitment needed; it’s pure utility.

4.1 Staking details:

- APY: 8-12% via Harmonix vaults, backed by treasuries.

- Tiers: Bronze (1% stake) to Diamond (10%+), unlocking builder codes for 0.1% referrals.

- Payouts: Weekly, from 97% fee share, $42.9 million in August alone.

This contrasts sharply with fake sites pushing MLM tables. Legit plans like Hyperliquid’s sustain via volume growth, not endless recruits

4.2 Plans

Staking Tier | Min. Stake (% Circ.) | Fee Discount | Extra Perks |

Bronze | 1% | 0.025% | Basic voting |

Silver | 5% | 0.015% | Vault access |

Gold | 10% | 0.01% | Referral boosts |

Diamond | 20%+ | 0% | HIP priority |

Part 5: Trading Fees, Volume, and Tech Performance on Hyperliquid

Fees start at 0.025% maker/taker, dropping with stakes. Daily volume hit $17 billion in peaks, with $1.3 trillion cumulative. How to trade on Hyperliquid? Bridge assets, connect wallet, and go, sub-second execution via HyperBFT.

Performance graph

Month (2025) | Avg. Daily Volume | TVL Growth | Key Upgrade |

Jan | $5B | +20% | Staking tiers live |

May | $8B | +35% | HyperEVM reads |

Sep | $10B | +40% | CoreWriter writes |

5.1 Security, Audits, and Community Governance in Hyperliquid

Hyperliquid passed audits from Cyfrin and OtterSec, with a $1 million bug bounty. No major exploits, though a 2024 probe tested resilience. Validators number 21, with slashing for downtime.

Community governance shines: HIP-3 auctions let stakers list assets, sharing 50% fees. Hyperliquid community governance ensures upgrades like USDH stablecoin (95% yields to burns) come from users.

Hyperliquid security and audits build E-E-A-T: Transparent code on GitHub, real-time stats at stats.hyperliquid.xyz.

5.2 Spot the Scam: Why gethyperliquid.xyz Fails the Hyperliquid Review Test

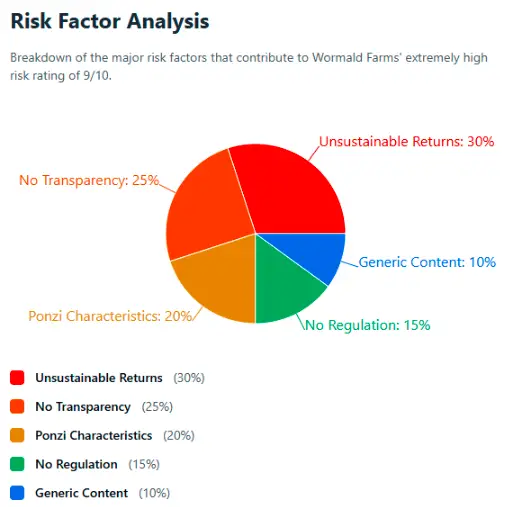

Impersonators like gethyperliquid.xyz prey on buzz. Registered mid-2025 with hidden WHOIS, it offers generic text, no docs, no trades. Its “plan” hints at 3.5-7% daily ROI via vague “bridging.”

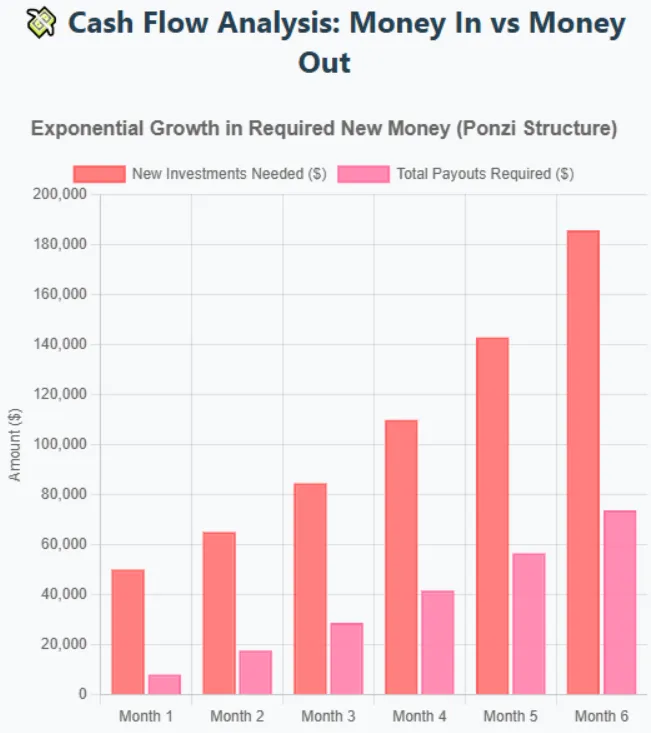

Math proves unsustainability: $1,000 at 3.5% daily compounds to $2,806 in 30 days, $22,097 in 90, and $1.4 trillion yearly. Ponzi math needs infinite inflows, collapsing when recruits dry up.

5.3 Red flags:

- Opaque owners, no team bios.

- Crypto-only payments, ghost support.

- Zero traffic (under 1K visits/month), bot-driven X promo from handles like @cryptoking_official (pushing past flops like OrbitToken).

- Fake MLM tables with placeholders like “123 123 HYPE.”

Public perception? X threads call it a “pig butchering” trap. Real Hyperliquid? Bullish sentiment, with Circle eyeing validation.

5.4 ROI Comparison

ROI Comparison | Annual Yield | Risk | Sustainability |

Hyperliquid Staking | 8-12% | Medium | Revenue-backed |

Bank Savings | 4-5% | Low | Guaranteed |

Real Estate | 8-10% | Medium | Illiquid |

gethyperliquid.xyz Claim | 1,000%+ | Extreme | Ponzi collapse |

Conclusion: Bet on Real Hyperliquid for 2025 Gains

This Hyperliquid review 2025 confirms its spot as a DeFi leader. With strong tokenomics, proven tech, and community drive, it eyes $40 billion FDV on upgrades like protocol expansions. Skip fakes stick to app.hyperliquid.xyz. Diversify, stake wisely, and DYOR. Hyperliquid DeFi ecosystem projects like vaults and AI funds signal bright times ahead.Now Visit Infinite X Review.

DYOR Disclaimer: This is informational only, not advice. Consult pros; crypto risks loss.

Hyperliquid Review Trust Score

A website’s trust score is a critical indicator of its reliability. Hyperliquid currently holds an alarmingly low rating raising serious concerns about its legitimacy. Users are strongly advised to proceed with caution.

The platform displays several warning signs, such as low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and inadequate SSL protection.

Given its low trust score, the risk of fraud, data breaches, or other security issues is much higher. It is essential to carefully consider these red flags before engaging with Hyperliquid similar platforms.

Positive Highlights

- Website content accessible

- No spelling/grammatical errors

- Domain age: Old

- Archive age: Old

Negative Highlights

- Low AI review rating

- Whois data hidden

- Domain not in top 1M on Tranco list

Frequently Asked Questions About Hyperliquid Review

This section answers key questions about , providing clarity, promoting trust, and addressing concerns regarding the platform’s legitimacy.

It offers HyperBFT for speed, zero gas fees trading, and HyperEVM for smart contracts.

Use the CLOB for low-slippage perps up to 50x leverage on 100+ pairs.

Faster execution and higher volume than GMX or dYdX, with full on-chain books.

31% supply dropped to users in Nov 2024, sparking 39% MoM price growth.

97% fees rebuy $HYPE, burning to deflate supply amid $600M annual revenue.

Other Infromation:

Website: hyperfoundation.org

Reviews:

There are no reviews yet. Be the first one to write one.