WeFi Review: Is This Decentralized Banking Platform Legit or a Risky Bet?

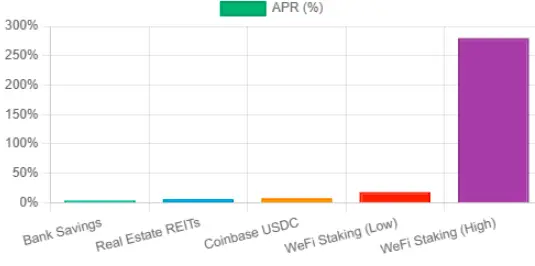

Looking for a WeFi review? WeFi markets itself as a game-changer in decentralized banking, promising seamless global payments, high-yield staking rewards, and a blockchain financial platform for the crypto world. With claims of up to 280% APR and a sleek WeFi ecosystem, it’s tempting. But is it safe?

This comprehensive guide dives into ownership, the wefi.com compensation plan, risks, and sustainability. Using clear math, charts, and comparisons, Scams Radar will help you decide.

Table of Contents

Part 1: Who Owns WeFi? Unpacking the Team and Structure

WeFi operates through three entities, raising questions about its transparent transactions:

- Wefi Payments Limited (Canada): Holds a FINTRAC MSB registration (M23563590) for money services, not a full banking license. This limits deposit protection.

- 3-102-939581 S.R.L. (Costa Rica): Manages WeFi blockchain operations like crypto exchange and storage. Costa Rica’s numbered companies obscure ownership details.

- Nordpal Holding Limited (Hong Kong): Incorporated January 2025 (CR No. 77655270), it focuses on DeFi tools. Its newness adds risk.

This multi-jurisdictional setup complicates accountability. If issues arise, users may struggle to seek recourse across borders. WeFi regulatory considerations remain murky—no banking charter exists, despite the “bank” branding.

1.1 Team & Claimed Backgrounds:

- Reeve Collins (Chairman): Ex-CEO of Tether, tied to stablecoin innovation.

- Maksym Sakharov: Ex-CEO of Exflow, a lesser-known fintech.

- Roman Rossov: Former Product Director at Wise, a global transfer platform.

- Yusuf Mirakhmedov: Ex-COO at Tradeleaf, a trading firm.

- Khaled Suleiman: Ex-CEO of National Bank of Abu Dhabi, adding banking credentials.

These sound impressive, but no LinkedIn profiles or filings confirm current roles. Without proof, these are marketing claims, not facts. WeFi blockchain adoption in 2025 hinges on trust, and unverified teams erode it.

1.2 WeFi Compensation Plan: How It Works

The WeFi ecosystem revolves around the $WFI token, non-custodial wallet, and yield farming. Here’s the breakdown:

1.3 ITO Nodes and Staking

- Initial Token Offering (ITO): Buy nodes for $250 USDT minimum. Nodes “mine” WFI tokens without hardware, promising up to 280% APR.

- Staking Rewards: Lock funds for 6 months to 3 years. Longer locks boost returns. APR formula: (Block Reward × Seconds/Year × WFI Price) / (Total ITO Units × Unit Price) × 100. A $250 node might yield $525 yearly at peak, per docs.

- LayerZero Integration: Enables cross-chain interoperability for asset transfers, but no clear utility outside the platform.

1.4 Energy Loyalty Program

- Energy Farming: Hold or trade to earn Energy, a gamified token. It reduces card fees to 1.5%, boosts WeFi staking and yield farming to 18% APR on stablecoins (coming soon), and adds +10% mining perks.

- Affiliate Rewards: Multi-tier commissions for recruiting. This drives growth but risks Ponzi-like dependence on new funds.

- Global Payments: Cards (virtual, plastic, metal) work at 140M+ merchants with zero FX fees and ATM access. No issuing bank is named, a gap for WeFi transaction transparency and privacy.

The WeFi smart contracts overview suggests rewards rely on token price and new node buys. No external revenue like lending or trading profits backs these yields, a red flag for sustainable finance.

Part 2: Can WeFi’s Returns Hold Up? The Math Says No

WeFi’s 18-280% APR claims sound lucrative. Let’s test them. For 280% APR on $1,000, daily compounding (A = P(1 + r/n)^(nt)) gives:

- Year 1: $1,000 grows to ~$16,440.

- Year 3: ~$4.4 million per dollar.

For 10,000 users at $250 ($2.5M pool), year-one payouts hit $41M. Without real profits, this needs exponential new investors like classic Ponzi math. Even the 18% stablecoin APR (1.196 yearly factor) demands a 1.71x return over three years, far above bank or DeFi norms.

2.1 Comparison Table:

ATOS payments occur via the wallet, with future plans for Netflix/YouTube fees. Trading is via Uniswap, with low liquidity. Support is limited to email (liao@atoshi.org) and social channels (Telegram, WhatsApp). Response quality is unverified. Crypto-only payments and limited support increase financial risks.

Investment | 2025 APY | Backing | Risk |

Bank Savings | 2-5% | FDIC Insured | Low |

Real Estate REITs | 4-8% | Property Income | Medium |

Coinbase USDC | 4-12% | Audited Pools | Medium |

WeFi Staking | 18-280% | Token Inflows | Extreme |

Part 3: Traffic and Public Sentiment: Limited Organic Buzz

WeFi’s traffic briefly surged in Ukraine’s investing lists but dropped 282 ranks recently, per SimilarWeb. Global visits remain low, under 500,000 monthly, driven by paid promos, not organic WeFi blockchain adoption in 2025. The WeFi mobile app features wallet and card tracking, but user adoption lags. Public sentiment is quiet, with minimal independent reviews or community buzz on platforms like Reddit. Promotional X posts see low engagement, weakening WeFi financial accessibility for unbanked claims.

Lack of community chatter hurts WeFi financial accessibility for unbanked claims.

3.1 Social Media and Promoters: Affiliate Hype

X accounts like @wefi_official (10K followers) push ITO nodes. Affiliates (@puffpuffpassJ, @Whenzyofweb3) hype WeFi passive income opportunities. Past promotions: BingX, XorionChain, GoMining. Many lack disclosure, signaling paid shills.

3.2 Security and Technical Checks

WeFi claims non-custodial wallet security and WeFi blockchain security features. But:

- No smart contract audits (CertiK, Hacken).

- No proof-of-reserves or SOC reports.

- Cards need fiat bridges, but no issuer is disclosed, undermining WeFi digital wallet security.

DYOR tools:

- Scamadviser: Uncertain/low trust.

- Scamdoc: 45% average.

- VirusTotal: No malware.

- FINTRAC: Confirms MSB, not a license.

Red Flags at a Glance

Issue | Detail | Risk |

No License | MSB, not a bank | No protection |

High APRs | 280% unsustainable | Ponzi-like |

Team Unverified | No proof of roles | Trust gap |

Referral Focus | Multi-tier commissions | New money reliance |

WeFi vs. Safer Options

WeFi’s DeFi tools promise innovation but lack audits. Comparison:

- Banks: 2-5% APY, insured.

- Real Estate: 6-8%, asset-backed.

- Coinbase/Kraken: 4-12%, regulated.

WeFi partnership with exchanges or AI blockchain platform claims don’t offset risks without transparency.

Future Outlook: What’s Next?

- Base Case: Niche player if yields drop to 10% and audits emerge.

- Bear Case: Collapse in 6-18 months as inflows dry.

- Bull Case: Needs regs, issuer clarity, and real revenue.

Monitor $WFI on CoinMarketCap for price signals.

Conclusion: Stay Safe with WeFi

This WeFi review reveals a risky platform. The WeFi blockchain ecosystem review shows bold claims WeFi Deobank, high staking rewards, and global payments but no audits, licenses, or real revenue. How does WeFi work? It leans on new funds, not profits. For WeFi financial accessibility for unbanked or WeFi passive income opportunities, look elsewhere. Check FINTRAC, test small, and diversify. This isn’t advice to consult experts. Stay cautious in 2025’s crypto landscape. You can also read our latest Atoshi review for further insights into other emerging blockchain projects.

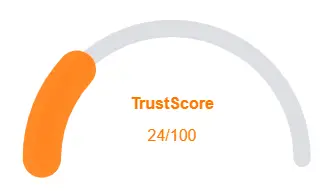

WeFi Review Trust Score

A website’s trust score is a critical indicator of its reliability. WeFi currently holds an alarmingly low rating raising serious concerns about its legitimacy. Users are strongly advised to proceed with caution.

The platform displays several warning signs, such as low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and inadequate SSL protection.

Given its low trust score, the risk of fraud, data breaches, or other security issues is much higher. It is essential to carefully consider these red flags before engaging with WeFi similar platforms.

Positive Highlights

- Content is accessible

- No spelling/grammar errors

- Old archive age

Negative Highlights

- Low AI review rate

- New domain

- Whois hidden

- Not in Tranco top 1M

Frequently Asked Questions About WeFi Review

This section answers key questions about , providing clarity, promoting trust, and addressing concerns regarding the platform’s legitimacy.

No, it’s an MSB-registered platform, not a licensed bank.

Rewards come from WFI tokenomics and new funds, not external profits.

Claims exist, but no issuing bank or processor is disclosed.

No audits, proof-of-reserves, or third-party checks are public.

It’s high risk, test small, verify withdrawals, and diversify.

Other Infromation:

Website: wefi.co

Reviews:

There are no reviews yet. Be the first one to write one.