Wormald Farms Review: Is This Investment Opportunity Legit or a Risky Scheme?

Investing in sustainable agriculture sounds appealing, but is Wormald Farms a trustworthy option? This Wormald Farms review dives deep into the platform’s legitimacy, focusing on its compensation plan, ownership details, and potential risks. We aim to provide clear, simple insights for anyone considering Wormald Farms investment opportunities. Using data from wormaldfarms.com and public records, along with research from Scams Radar, we’ll uncover red flags, compare returns to legitimate benchmarks, and offer practical advice. Let’s explore whether this platform is a genuine opportunity or a risky venture.

Table of Contents

What Is Wormald Farms?

Wormald Farms promotes itself as a platform for ethical farming investment, emphasizing sustainable agriculture, aquaponics, and cash crops. It claims to deliver financial growth through investment plans and a referral program. The website highlights community impact, global expansion, and high returns, but lacks specific details about operations, making it hard to verify its claims.

Ownership and Transparency

Understanding who runs Wormald Farms is crucial for assessing its legitimacy.

- Claims: The website states it’s headquartered in Edinburgh with a company number (655729) and lists an address in Barnston, Essex (Martels Farmhouse, High Easter Rd, CM6 1NB). Contact is via WhatsApp (+44 7447 974308).

- Public Records: UK Companies House shows Wormald Farms Limited (no. 12516769) registered at the Essex address, but the claimed number 655729 doesn’t match—it’s linked to unrelated entities like Edintree Limited (SC655729) or a dissolved Pizza Boutique Ltd (NI655729). No director names or bios are provided on the site, and executive profiles use generic names with stock photos, lacking LinkedIn or press mentions.

- Red Flag: The mismatched company number and unverifiable management raise serious concerns. Legitimate companies provide clear, traceable registration and leadership details.

Compensation Plan: Promises and Pitfalls

Plan | Investment Range (£) | Duration (Days) | Daily Return | Total Return |

Seedling | 100–1,999 | 30 | 2% | 81.1% |

Graze | 1,000–29,999 | 60 | 3% | 493% |

Owner’s Harvest | 30,000–50,000 | 60 | 4% | 952% |

- Referral Program: Investors earn a 10% bonus for referring others, with top referrers potentially becoming “Company Representatives” or regional managers.

- Claims: Returns are tied to agricultural projects, aquaponics, and global expansion. The site mentions “fixed monthly payments” and “guaranteed consistent returns” but provides no audited financials, crop yield reports, or DeFi contract addresses.

- Red Flags: The 10% referral bonus resembles multi-level marketing (MLM) tactics, relying on new investors to fund payouts. Promises of “ownership” or “shareholder” status lack legal disclosures, a hallmark of unregulated schemes.

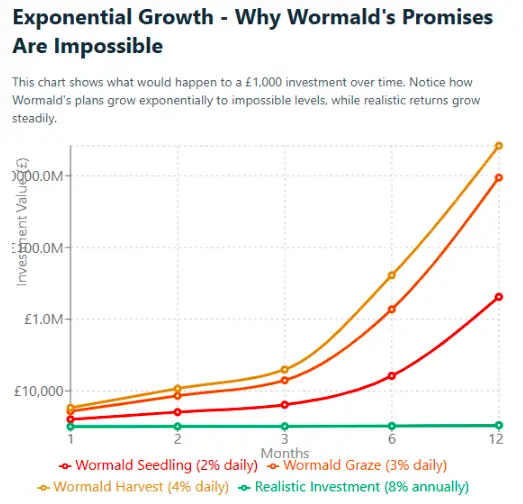

Mathematical Proof of Unsustainability

- Seedling Plan: 2% daily for 30 days yields a compounded return of (1.02)^30 ≈ 1.811, or 81.1% in a month. Annualized, this is (1.02)^365 ≈ 240,000%, far beyond any real agricultural output.

- Graze Plan: 3% daily for 60 days yields (1.03)^60 ≈ 5.93, or 493%. Annualized, it’s (1.03)^365 ≈ 420,000%.

- Owner’s Harvest: 4% daily for 60 days yields (1.04)^60 ≈ 10.52, or 952%. Annualized, it’s unsustainable.

Comparison

- Real Estate: 8–12% annual returns (0.02–0.03% daily).

- Bank Savings: 2.6–4.8% APY (0.007–0.013% daily).

- Crypto Staking: 3–10% APY (0.008–0.027% daily).

- Agricultural Funds: 5–15% annually (NCREIF data shows 2024 farmland returns at –1.03% to 10%).

These plans require exponential new investments to sustain payouts, a classic Ponzi scheme trait. For example, a $1,000 Seedling investment grows to $1,811 in 30 days, needing $811 from new investors to pay out, doubling each cycle.

Investment Type | Annual Return (%) | Risk Level |

Wormald Farms (2% daily) | ~240,000 | Extremely High |

Real Estate | 8–12 | Moderate |

Bank Savings | 2.6–4.8 | Low |

Crypto Staking | 3–10 | High |

Agricultural Funds | 5–15 | Moderate |

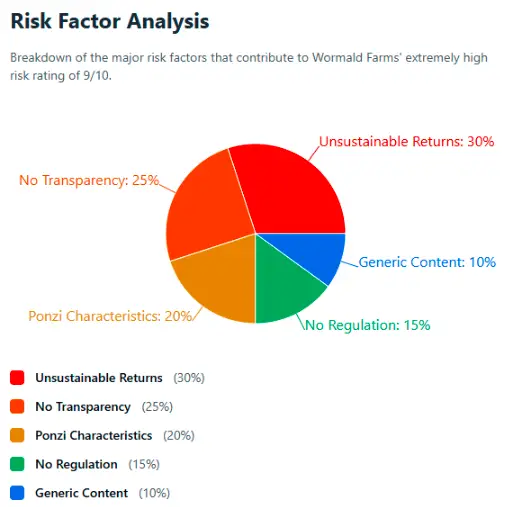

Other Risk Factors

- Traffic: Likely low organic traffic, relying on paid ads or social media referrals (verify via SimilarWeb or SEMrush).

- Reviews: Only four recent Trustpilot reviews (all 5-star) suggest astroturfing. No independent forum discussions or critical reviews were found.

- Social Media: No verified promoters on X or other platforms. WhatsApp-centric contact is a red flag, as regulators warn of its use in scams.

Security and Technical Performance

- Security: The site likely uses HTTPS (standard in 2025), but broken elements (e.g., Swiper slider on Projects page) indicate poor quality control.

- Performance: Generic design and potential slow load times suggest minimal infrastructure investment. Check with GTmetrix or PageSpeed Insights.

Content Authenticity

- Issues: Generic testimonials, stock photos, and vague claims about “no competitors” or “99% satisfaction” lack evidence. No farm locations or production data are provided.

- Red Flag: Unverifiable metrics and buzzwords like “DeFi” without blockchain proof.

Payment Methods and Support

- Payments: Likely crypto-only, offering no chargeback recourse, a common scam tactic.

- Support: WhatsApp-only contact is inadequate for a financial platform. No named representatives or response SLAs were found.

Recommendations for Investors

- Verify Ownership: Check Companies House for registration (12516769) and director details. Avoid platforms with mismatched or hidden ownership.

- Demand Proof: Request audited financials, farm leases, or DeFi contract addresses. Reject vague promises.

- Use DYOR Tools: Run scans on URLVoid, ScamAdviser, VirusTotal, and Trustpilot. Search X for “Wormald Farms investment” to find promoters.

- Start Small: If testing, invest the minimum to assess payouts, but expect losses.

- Choose Alternatives: Opt for regulated options like REITs (4–8% returns), index funds (7–10%), or government bonds (2–5%).

Future Outlook

If legitimate, Wormald Farms needs transparent ownership, audited returns, and regulatory compliance to gain trust. However, its current structure suggests a short-lived scheme, likely collapsing within 6–12 months when new investor funds slow. Historical ag-Ponzi cases (e.g., worm or cattle scams) show similar patterns.

Wormald Farms Review Conclusion

This Wormald Farms review reveals a platform with unsustainable promises and significant red flags. Its high daily returns, vague business model, and lack of verifiable ownership mirror Ponzi schemes. Investors should avoid depositing funds and prioritize regulated alternatives. For further insights, you can also check our OptimAI Review to compare similar risks. Always conduct thorough research before investing.

DYOR Disclaimer: This analysis is for informational purposes only, based on public data as of September 10, 2025. It is not financial advice. Verify all claims using tools like Companies House, ScamAdviser, and Trustpilot, and consult a licensed financial advisor. Never invest money you cannot afford to lose.

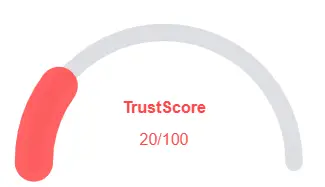

Wormald Farms Review Trust Score

A website’s trust score is a critical indicator of its reliability, and0 Wormald Farms currently holds an alarmingly low rating—raising serious concerns about its legitimacy. Users are strongly advised to proceed with caution.

The platform displays several warning signs, such as low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and inadequate SSL protection.

Given its low trust score, the risk of fraud, data breaches, or other security issues is much higher. It is essential to carefully consider these red flags before engaging with Wormald Farms similar platforms.

Positive Highlights

- Website content accessible

- No spelling or grammar errors

Negative Highlights

- Low AI review rate

- New archive

- Hidden WHOIS data

Frequently Asked Questions About Wormald Farms Review

This section answers key questions about , providing clarity, promoting trust, and addressing concerns regarding the platform’s legitimacy.

Wormald Farms is an online platform claiming to offer agricultural investment opportunities with promises of consistent returns.

Wormald Farms shows red flags such as inconsistent company registration details and vague ROI claims, raising questions about its legitimacy.

The platform claims profits come from agricultural projects but provides no verifiable audited reports or transparent financial data.

A Wormald Farms Review highlights risks like unrealistic returns, reliance on referrals, lack of regulation, and unclear ownership details.

No, the claimed consistent returns are far higher than realistic benchmarks in farming, banking, or crypto investments, making them unsustainable.

Other Infromation:

Website: wormaldfarms.com

Reviews:

There are no reviews yet. Be the first one to write one.