3FO Review: Is This Platform a Safe Investment Choice?

In this 3FO review, we dive into the platform’s legitimacy, risks, and offerings to help you make an informed decision. Marketed as an affiliate operating system, it blends decentralized finance (DeFi) with earning opportunities. Using public data, user feedback, and expert analysis, we explore ownership, compensation, and more. This 3FO platform review is crafted for everyday readers seeking clear answers about its reliability. For more detailed scam analysis, visit ScamsRadar, where we provide thorough reviews on platforms like 3FO.ai.

Table of Contents

Who Owns the Platform?

The platform operates on an affiliate model with multi-level rewards. Users join via referrals and purchase staking packs like IGNITION or YIELD PLUS. Earnings come from daily on-chain profit sharing, tied heavily to recruitment efforts.

Key components include:

- Boosters: 3x or 4x multipliers linked to BTCC (Bitcoin Code Technology Coin) to enhance weekly yields.

- Staking Packs: Options paying in Ethereum, aimed at steady growth.

- Reward Pool: A $10 million pool for top earners, gamified with badges and leaderboards.

This setup prioritizes building teams over product value, resembling multi-level marketing (MLM). For those searching for “3FO pricing,” costs tie to entry packs, but specifics are unclear. Payments are crypto-only (ETH, BTCC), with no fiat options, limiting accessibility. The lack of a “3FO free trial availability” adds to the opacity.

How Does the Compensation Plan Work?

The platform lacks clear ownership details. No verifiable information about its founders or headquarters appears on its website. Independent sources, like BehindMLM and Danny de Hek, link Odecent to individuals previously tied to Validus, a Dubai-based Ponzi scheme that collapsed in 2023 after warnings from regulators like the Dubai Financial Services Authority (DFSA), ASIC, and FSMA. Key figures include:

- Mansour Tawafi: Former Validus president, reportedly involved in Odecent events.

- Billal Ali, Salman Shahzad, Philippe Moser: Promoters with histories in failed MLMs like Validus, ACN, and NeXarise.

Concern: Ties to Validus and hidden ownership reduce trust in Odecent’s legitimacy.

Are the ROI Claims Realistic?

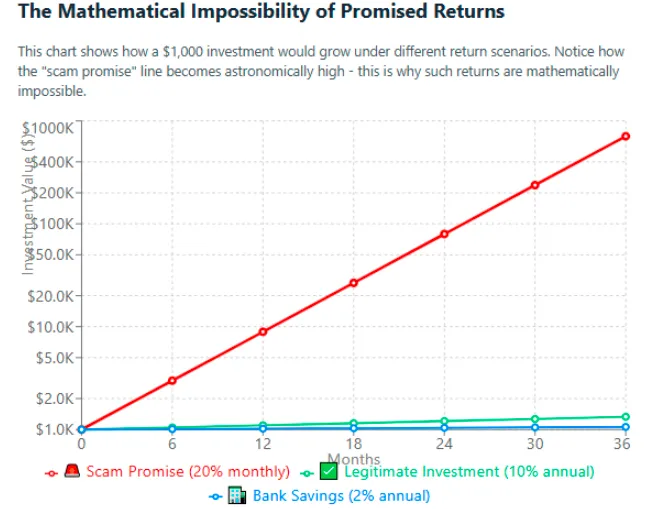

Promised returns are high, often pitched as daily yields. Let’s assume a conservative 1% daily return, based on promotional materials.

Calculation:

Daily rate = 0.01

Annual compound: (1 + 0.01)^365 ≈ 37.78 (3,778% APY)

A $1,000 investment grows to $37,780 in one year.

For 10,000 users investing $1,000 each, the platform needs over $378 million annually to cover payouts. Without verified revenue sources beyond user deposits, this suggests a Ponzi-like structure, collapsing when new sign-ups dwindle.

Investment Type | Typical Annual ROI | Backing |

Bank Savings | 1-5% | Bank reserves |

Real Estate | 5-10% | Physical assets |

Crypto Staking | 5-20% | Protocol fees |

Security and Customer Support Quality

Security details are thin. The site uses basic HTTPS but lacks mention of audits from firms like Certik or multi-signature wallets. For “3FO security and privacy features,” blockchain claims are unverified, raising risks of fund loss.

Customer support is limited to email or Telegram, with no phone or live chat. User reports note slow or no responses, a concern for “3FO customer service quality.” The site loads quickly but offers minimal functionality, like basic dashboards. For “3FO compatibility with devices,” it’s web-based, working on most browsers.

Public sentiment is negative. A single Trustpilot review (1-star, Aug 20, 2025) criticizes vague info and recruitment focus. Online warnings link it to Siddiqui’s past ventures, with no independent “3FO user experience report” showing positive feedback.

Pros and Cons of the Service

- Offers DeFi tools for earning.

- Gamified features engage users.

Cons

- Hidden ownership details.

- Heavy reliance on referrals.

- Unrealistic return promises.

- Weak customer support.

For “3FO pros and cons,” it may appeal to risk-tolerant users but alarms those seeking stability.

Exploring Alternatives

Safer options include Aave or Compound for DeFi staking, or Binance for crypto yields, all with audited systems and realistic returns. For “3FO alternatives,” these platforms offer transparency and regulatory compliance.

Tips for Using 3FO Effectively

- Start with small amounts.

- Monitor referral performance.

- Stay updated on market trends.

For “Troubleshooting common 3FO issues,” check Telegram channels. “3FO update and new features 2025” mentions summit events, but verify claims independently.

Social Media and Promoters

Promotion happens on X via accounts like @3FOofficial and @ShavezBtcc, pushing yields and events like the AFM NextWave Summit. These accounts also promoted LQUIDPAY and Protocol Yield, flagged as risky. For “User testimonials for 3FO,” most come from affiliates, not neutral users.

3FO Review Conclusion

This 3FO service review reveals significant risks tied to unclear ownership, unsustainable returns, and MLM-like structures. While its DeFi focus may attract some, red flags suggest caution. For 3FO vs competitor reviews, established platforms like Uniswap are safer bets. Check 3FO refund policy explained and terms before engaging, as they’re not clearly stated. Always research independently, consult financial advisors, and only invest what you can afford to lose. This analysis uses public data as of August 28, 2025.

Also, check out our Odecent Review for insights on another platform with similar risks and red flags.

3FO Review Trust Score

A website’s trust score is a critical indicator of its reliability, and0 3FO currently holds an alarmingly low rating—raising serious concerns about its legitimacy. Users are strongly advised to proceed with caution.

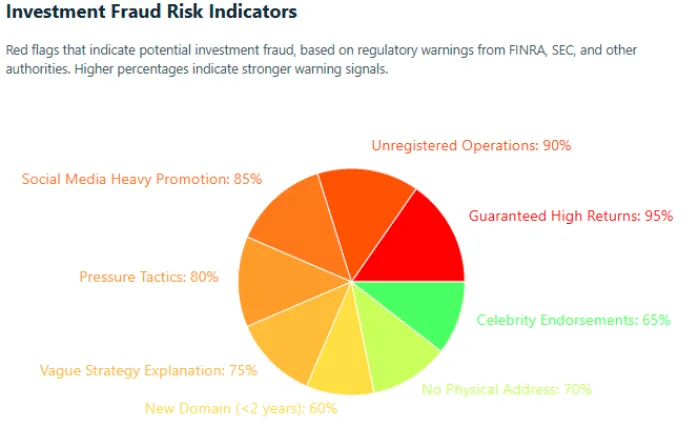

The platform displays several warning signs, such as low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and inadequate SSL protection.

Given its low trust score, the risk of fraud, data breaches, or other security issues is much higher. It is essential to carefully consider these red flags before engaging with 3FO similar platforms.

Positive Highlights

- Website content is available

- No spelling/grammar errors

- Whois data is accessible

Negative Highlights

- Low AI review rating.

- New domain

Frequently Asked Questions About 3FO Review

This section answers key questions about , providing clarity, promoting trust, and addressing concerns regarding the platform’s legitimacy.

3FO is a decentralized finance (DeFi) platform that offers automated trading and gamified investing experiences for its users.

While 3FO presents itself as a legitimate platform, its high ROI promises and lack of transparency raise concerns. Investors should proceed with caution.

The risks include unsustainable ROI claims, lack of transparency, and a heavy reliance on recruitment, which may indicate a Ponzi-like structure.

3FO’s compensation plan primarily revolves around affiliate marketing, rewarding users for recruitment and investment.

A 3FO review helps investors understand the platform's legitimacy, ROI claims, security measures, and potential risks, allowing for informed decisions.

Other Infromation:

Website: 3fo.ai

Reviews:

There are no reviews yet. Be the first one to write one.