Prime Ten Review: Is It a Legitimate Investment or a Risky MLM Scheme?

Prime Ten markets itself as a high-return investment platform, but serious concerns about its legitimacy demand scrutiny. For an in-depth scam analysis, visit Scams Radar for a detailed review. This Prime Ten review analyzes its ownership, compensation plan, security, customer service, and risks. Using clear data, charts, and comparisons, we aim to help potential investors decide whether primeten.com is safe. Read on to understand why Prime Ten raises red flags and how it compares to legitimate investments.

Table of Contents

What Is Prime Ten?

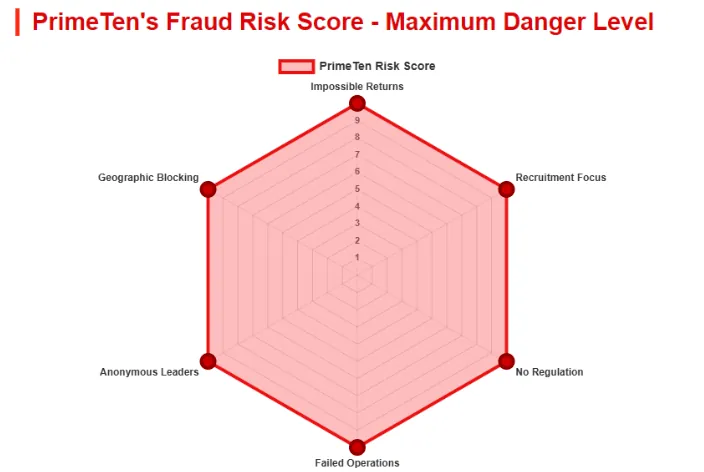

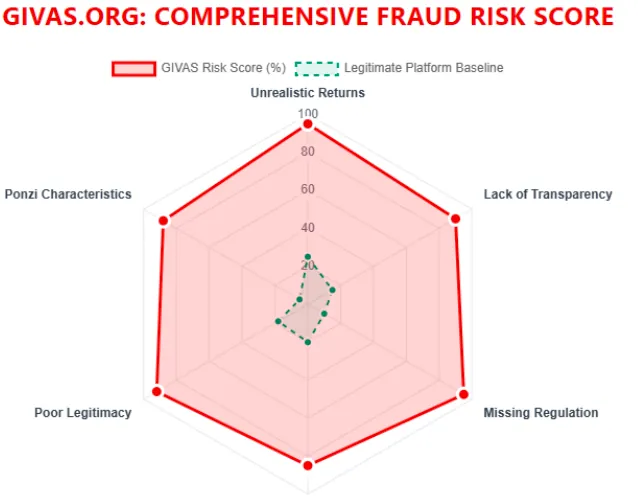

Prime Ten claims to offer daily returns of 0.75% to 5% through investments in crypto, real estate, and other sectors. Its multi-level marketing (MLM) structure emphasizes recruitment, promising up to 750% returns over 150 days. However, regulatory warnings, hidden ownership, and unrealistic ROI claims suggest a high-risk Ponzi scheme.

Ownership and Transparency Concerns

Transparency is critical for trust in investment platforms. Prime Ten falls short here:

- Registered Entities: Claims registration as PrimeTen LLC (New Mexico, USA) and PrimeTen Limited (New Zealand, NZBN 9429052853791, incorporated May 20, 2025). The New Zealand entity lists Joseph Cassar as the sole director, operating from a virtual office at 1 Victoria Street, Wellington.

- Hidden Ownership: The domain, registered via Tucows on March 10, 2025, uses Contact Privacy Inc. to obscure ownership. No executive profiles or verifiable backgrounds are provided.

- Regulatory Issues: New Zealand’s Financial Markets Authority (FMA) issued a scam warning on July 28, 2025, noting PrimeTen’s lack of licensing and geo-blocking of New Zealand IPs. FinCEN’s MSB registration is misleading, as it does not endorse legitimacy.

Red Flag: Unverifiable leadership, shell companies, and regulatory warnings signal potential fraud.

Prime Ten Compensation Plan Explained

Investment Range | Daily ROI | Duration | Total ROI |

$10–$99 | 0.75% | 200 days | 150% |

$100–$499 | 1% | 180 days | 180% |

$500–$4,999 | 1.5% | 160 days | 240% |

$5,000–$24,999 | 2% | 150 days | 300% |

$25,000–$99,999 | 3% | 150 days | 450% |

$100,000+ | 5% | 150 days | 750% |

- Referral Commissions: 7%–15% based on the recruiter’s tier.

- Binary Commissions: 10% of the weaker team’s investment volume, capped daily (e.g., $5,000 for Prime Pinnacle).

- Bonuses: Recruitment bonuses (1%–15%) for 5–250+ recruits; rank bonuses ($50–$10,000).

- No Products: The platform sells no tangible products, relying solely on investor funds.

Red Flag: The focus on recruitment and lack of retail products mirror Ponzi schemes.

ROI Sustainability Analysis

Prime Ten’s ROI claims are unsustainable. For the Prime Pinnacle tier:

- Investment: $100,000

- Daily Return: 5% = $5,000

- 150 Days: $5,000 × 150 = $750,000 (750% ROI)

- Annualized Return: [(1 + 0.05)^365 – 1] × 100 ≈ 1825%

Investment Type | Annual ROI | Risk Level |

Prime Ten | 1825% (claimed) | Extreme |

Real Estate | 5–10% | Medium |

Bank Savings | 3–5% | Low |

Crypto Staking | 5–15% | High |

Mathematical Proof: Sustaining 5% daily returns requires exponential new investments. If one investor recruits two others monthly, by month 10, over 500 investors ($51M at $100,000 each) are needed to cover payouts. This collapses when recruitment slows.

Security and Technical Performance

- SSL Certificate: Uses Cloudflare, but this is standard, even for scams.

- Geo-Blocking: Blocks New Zealand IPs, evading regulatory scrutiny.

- Content Issues: AI-generated text and “BitzBank” branding suggest recycled scam templates.

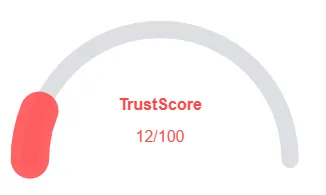

- Trust Scores: ScamAdviser and Gridinsoft rate it 1/100 due to hidden ownership and young domain (5 months).

Red Flag: Poor transparency and technical inconsistencies raise doubts.

Prime Ten Customer Service and Payment Methods

- Support: Emails (info@primeten.co, support@primeten.co) bounce, and the phone number (+64220409669) is non-functional. Communication relies on Telegram/WhatsApp.

- Payments: Crypto-only (BTC, USDT, etc.), with a 10% withdrawal fee and reported delays.

- User Experience: Complaints highlight withdrawal issues and high-pressure recruitment by figures like “Jessica Meir.”

Red Flag: Non-responsive support and crypto-only payments increase risk.

Public Perception and Social Media

- Regulatory Warnings: FMA labels PrimeTen a scam, citing unlicensed operations.

- Reviews: Trustpilot shows one review (3.7/5), calling it a “brilliant scam.” Sites like BehindMLM flag it as a Ponzi.

- Social Media: Telegram (@PrimeTenOfficial, 2,600+ subscribers) focuses on hype. The YouTube channel was deleted after minimal activity.

Red Flag: Negative reviews and deleted social channels suggest fraud.

Prime Ten Pros and Cons

Pros | Cons |

Attractive website design | Unregulated and unlicensed |

High return promises | Hidden ownership |

Unrealistic ROI claims | |

Poor customer service |

Comparing Prime Ten to Other MLM Programs

Unlike regulated platforms like Binance (5–15% APY), PrimeTen’s 1825% annualized ROI is implausible. It mirrors scams like BitConnect and BEONBIT, which collapsed after promising similar returns.

Prime Ten Regulation and Scam Warnings

The FMA’s July 2025 warning confirms PrimeTen’s lack of licensing. Its FinCEN MSB registration is not a regulatory endorsement, a common misrepresentation in scams.

How to Contact Prime Ten Customer Support?

Attempts to reach PrimeTen via email or phone fail. Telegram and WhatsApp are the only channels, often used by recruiters pushing aggressive tactics.

Prime Ten Refund Policy

No clear refund policy exists. Crypto transactions are irreversible, and withdrawal issues are widely reported.

Is Prime Ten a Scam or Legitimate Business?

The evidence—unrealistic returns, hidden ownership, regulatory warnings, and MLM structure—points to a Ponzi scheme, not a legitimate business.

Recommendations

- Avoid Investment: PrimeTen’s risks outweigh any potential benefits.

- Report Issues: Contact authorities like the FMA or SEC if approached.

- Choose Regulated Options: Opt for platforms like Coinbase or traditional banks.

- Research Thoroughly: Use ScamAdviser, Trustpilot, and regulator databases.

Prime Ten Review Conclusion

This Prime Ten review reveals a high-risk MLM scheme with no verifiable legitimacy. Its 750% ROI claims are mathematically impossible, and red flags like hidden ownership, regulatory warnings, and poor customer service confirm its fraudulent nature. Investors should steer clear and prioritize regulated alternatives. Conduct your own research to safeguard your finances, and see our detailed Givas Review for related insights.

DYOR Disclaimer: This Prime Ten review is for informational purposes only. Always verify information with regulators like the FMA, consult financial advisors, and never invest more than you can afford to lose.

Prime Ten Review Trust Score

A website’s trust score plays a vital role in evaluating its credibility, and Prime Ten a dangerously low rating—raising serious concerns about its legitimacy. Users are strongly advised to proceed with caution.

The platform presents several warning signs, including low traffic, poor user reviews, potential phishing threats, hidden ownership, unclear hosting information, and weak SSL security.

Given this low trust score, the chances of fraud, data breaches, or other harmful activity increase significantly. It’s essential to assess these red flags carefully before engaging with Prime Ten or similar platforms.

Let me know the next company name whenever you want a swap.

Positive Highlights

- Website content accessible

- Online fraud prevention tool

- No spelling or grammar errors

Negative Highlights

- Low AI review rate

- New domain

- New archive

- Hidden Whois data

Frequently Asked Questions About Prime Ten Review

This section answers key questions about , providing clarity, promoting trust, and addressing concerns regarding the platform’s legitimacy.

No. Prime Ten raises concerns due to unclear ownership, unrealistic ROI promises, and a lack of transparency in its operations.

It claims to provide high-return investment opportunities, but its revenue sources and business model are not clearly verified or regulated.

No. Prime Ten is not licensed or registered with any recognized financial regulator, making it a high-risk choice for investors.

Risks include potential loss of funds, unsustainable return promises, lack of investor protection, and possible scam indicators.

It’s not recommended. The platform’s red flags, lack of regulation, and questionable ROI claims make it unsafe for investors.

Other Infromation:

Reviews:

There are no reviews yet. Be the first one to write one.