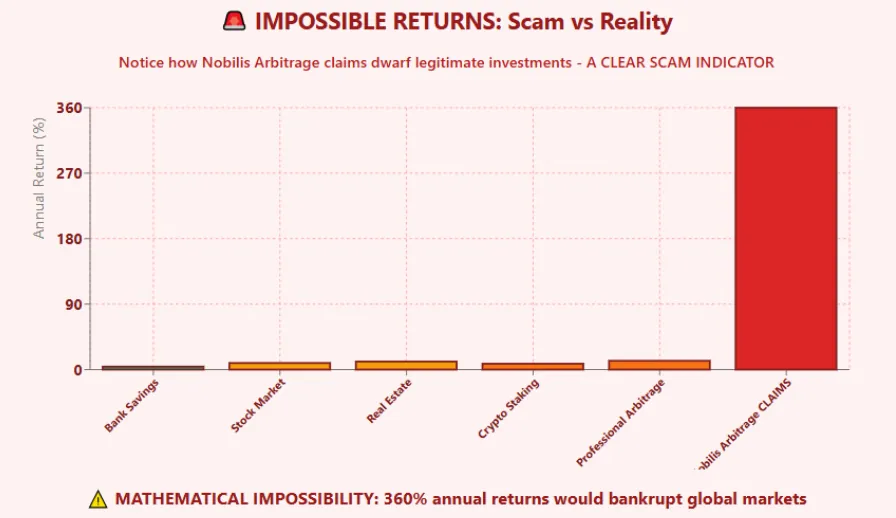

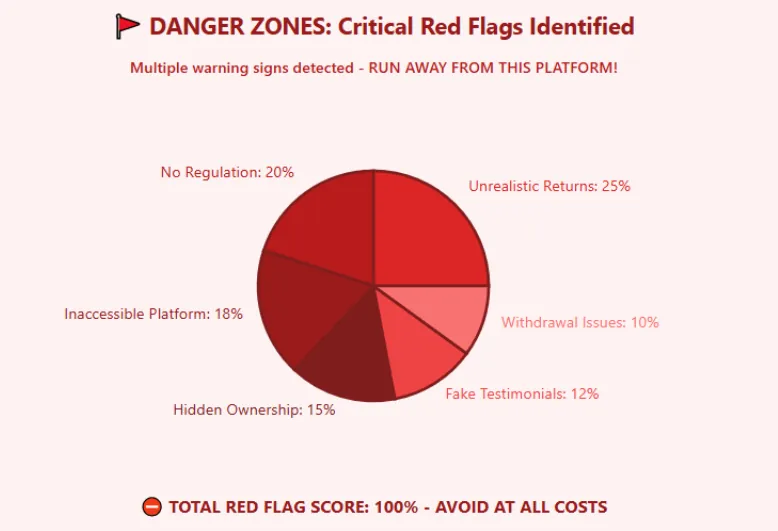

Investing in platforms like Nobilis Arbitrage, which promise high returns through crypto arbitrage, demands caution. This Nobilis Arbitrage Review explores the platform’s legitimacy, ownership structure, compensation plan, and investor risks. With no verifiable details and multiple red flags, the project raises major concerns. For more evaluations of similar platforms, visit our Scams Radar section.