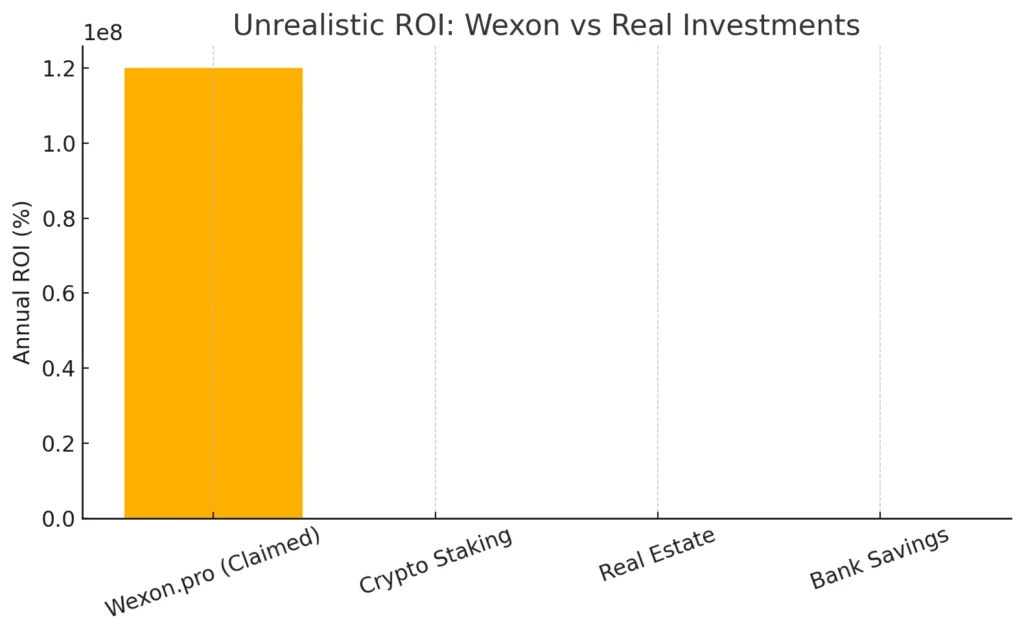

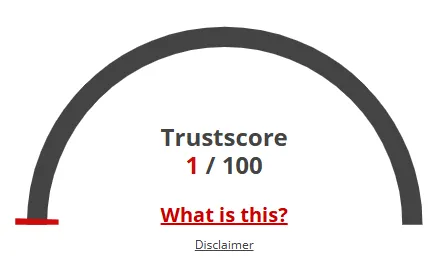

This Wexon review examines the legitimacy of the investment platform, focusing on its ownership, compensation plan, and potential risks. With bold claims of high daily returns, wexon.pro raises important questions about whether it’s a trustworthy opportunity or a potential scam. Our detailed analysis at Scams Radar uses factual data, mathematical reasoning, and industry comparisons to help investors make informed decisions.