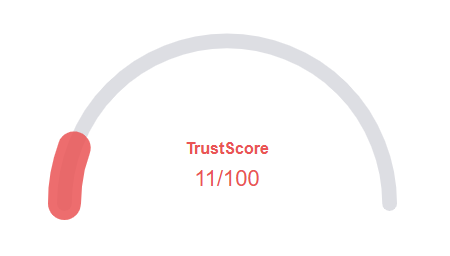

A website’s trust score is a key measure of its reliability, and the alarmingly low rating of Bittron Vertix raises serious questions about its legitimacy. Users are strongly urged to proceed with caution.

The site’s low traffic, negative feedback from users, potential phishing threats, lack of transparency about ownership, unclear hosting information, and inadequate SSL security are all major warning signs.

A poor trust score greatly heightens the risk of fraud, data breaches, and other potentially harmful activities. It’s critical to carefully assess these red flags before engaging with Bittron Vertix or similar platforms like I3Q.