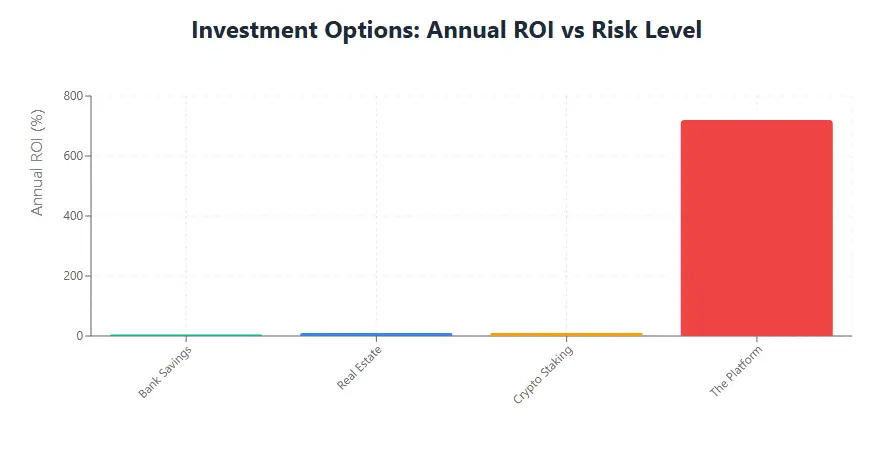

The Eagles Review reveals significant concerns about the platform’s legitimacy. Hidden ownership, unrealistic 200-300% returns, and minimal public presence suggest a Ponzi-like structure. Compared to real estate (8-12%), bank savings (4-6%), or crypto staking (5-15%), the platform’s claims are unsustainable.

Investors should prioritize regulated platforms and conduct thorough research using tools like Scamadviser or Etherscan. Protect your finances by avoiding high-risk schemes and seeking professional advice.