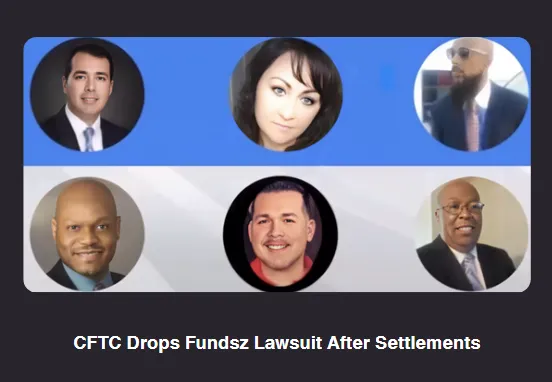

CFTC Drops Fundsz Lawsuit After Settlements

On June 18, 2025, the Commodity Futures Trading Commission (CFTC) moved to dismiss its case against Fundsz, a multi-level marketing (MLM) cryptocurrency Ponzi scheme, following settlements and default judgements against its operators. Run by Rene Larralde, Juan Pablo Valcarce, Brian Early, and Alisha Ann Kingrey, Fundsz defrauded investors through a fake crypto investment platform.

Settlements and Seizures

The CFTC filed motions on June 16 to settle with Rachel Larralde, representing her deceased father Rene’s estate, and Valcarce.

The settlements confirm Fundsz as a fraudulent scheme. Larralde’s estate will forfeit a Florida residence, $2.67 million in crypto, and a Ford Expedition.

Valcarce, already stripped of ill-gotten gains by February 2025, must cooperate with the CFTC and other agencies.

Fugitives and Ongoing Fraud

Brian Early and Alisha Ann Kingrey, who ignored the 2023 lawsuit, face default judgments. Kingrey remains in the U.S., while Early, now in Costa Rica, operates under “Coach Be” on social media, promoting a new MLM crypto scam, TrustPoly.

CFTC’s Crackdown Continues

The dismissal of CfTC drops Fundsz lawsuit as a corporate entity reflects the CFTC’s focus on holding individual scammers accountable, with settlements and asset seizures aimed at compensating victims and deterring future fraud.