This Rocket Money review by Scams Radar is going to answer that question for you: Is this personal finance app worth your time? The Rocket Money app helps users manage subscriptions, negotiate bills, and track spending. Also included are features like setting up savings goals, creating budgets, and analyzing spending habits. Using the app makes it easier for users to stay on top of their finances and save money.

Budgeting app Rocket Money simplifies financial management through its billing feature, formerly Truebill. It has over 5 million users and lets them cancel subscriptions, negotiate bills, and monitor expenses. A cost-saving tool, instead of an investment platform, this is appealing to those who wish to optimize their monthly budgets.

Rocket Money is a subsidiary of Rocket Companies, Inc., a Detroit-based fintech giant listed on the New York Stock Exchange (RKT). America’s largest mortgage lender, Rocket Mortgage, is also owned by Rocket Companies, founded by Dan Gilbert. In December 2021, Rocket acquired Truebill, which was rebranded to Rocket Money in 2022.

By making Rocket Money’s corporate structure transparent and making its operations publicly accountable, fraud risks are reduced, lending Credibility to its operations.

The Rocket Money service operates on the freemium model, which offers a free tier as well as a paid tier. In terms of compensation structure, it is straightforward, but it does include fees that impact the savings that you can make.

Free Tier: Basic subscription tracking and budgeting tools.

Premium Tier: $6–$12/month ($48–$144/year, user-selected), includes:

Bill Negotiation Fee: 30–60% of first-year savings, charged upfront. Example: Saving $240/year on a cable bill incurs a $72–$144 fee.

Affiliate Program: Pays commissions for referrals via the Impact platform.

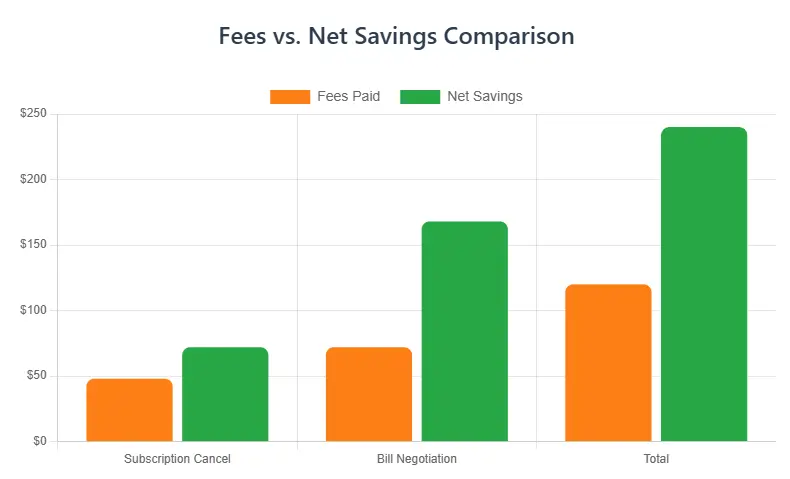

Net Savings vs. Fees

Service | Fees Paid | Net Savings |

Subscription Cancel | $48 | $72 |

Bill Negotiation | $72 | $168 |

Total | $120 | $240 |

Note: Savings are finite, and ongoing Premium costs may outweigh benefits over time.

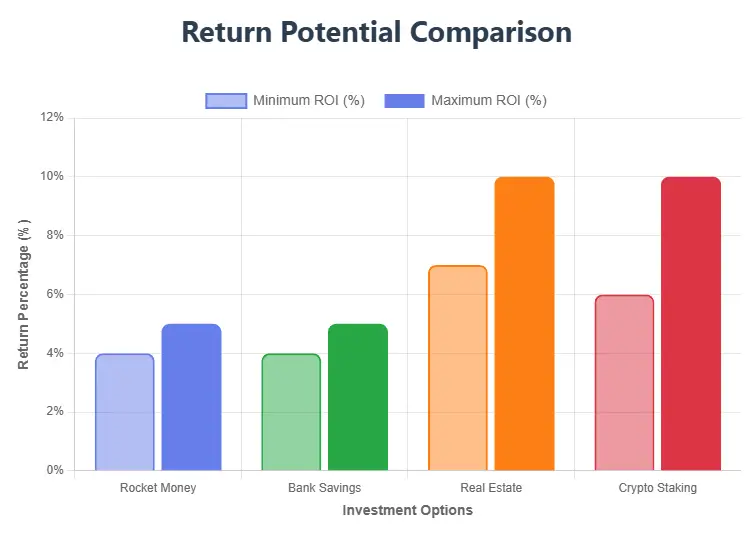

Option | ROI/APY | Risk | Cost |

|---|---|---|---|

Rocket Money | 4–5% | Low | $48–$144/year |

Bank Savings | 4–5% | Very Low | Free |

Real Estate | 7–10% | High | High |

Crypto Staking | 6–10% | Very High | Varies |

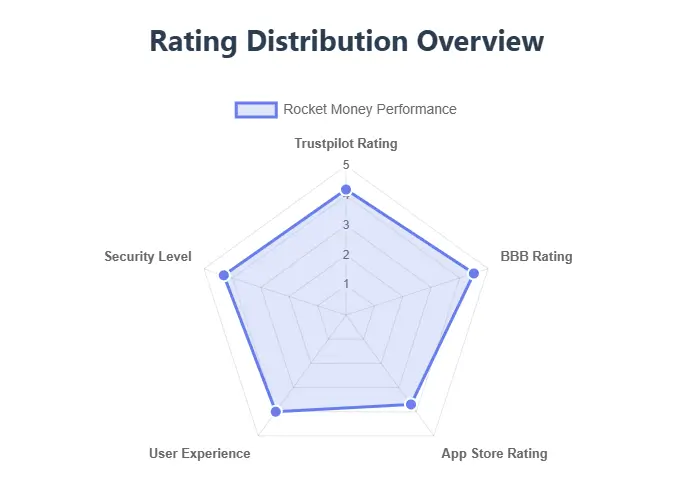

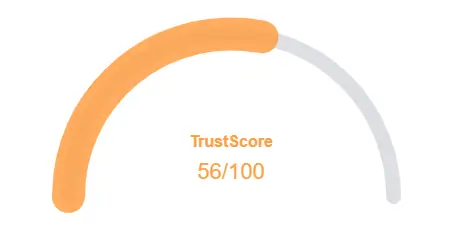

It is safe to say that Rocket Money is a legitimate company, backed by an established parent company. The company has received 4.2/5 Trustpilot reviews (4,098 reviews) and an A+ BBB rating, but 273 complaints have been filed regarding billing issues. It was praised for its user interface by CNET as an Editors’ Choice for budgeting apps in 2025.

Public Sentiment

Rocket Money uses robust security measures:

While Plaid has a reliable 2FA system, its lack of a clear privacy policy admitting data sharing raises concerns. There have been some issues with the app’s bank sync, but the app is generally considered stable (3.7/5 app store rating).

While legitimate, Rocket Money has drawbacks:

It is suitable for users looking for subscription management, however, Rocket Money is not suited for investment purposes. There are some alternatives such as YNAB ($99/year, no negotiation fees) that can be used for budgeting as well as the free tier. Charges should be monitored and 2FA should be enabled for the sake of security.

Action Steps

This Rocket Money review confirms its legitimacy as a budgeting tool backed by Rocket Companies. It offers real savings but high fees and privacy concerns limit its value. For cost-conscious users, the free tier is a safe start, while investors should seek regulated options like ETFs or high-yield savings accounts. Always verify claims and monitor accounts.

DYOR Disclaimer: This analysis uses public data as of June 2025 and isn’t financial advice. Research Rocket Money’s terms, check BBB complaints, and consult advisors before deciding.

These commonly asked questions address the validity of the Rocket Money Network’s findings. To ease any concerns, we’ve included the following questions and answers:

Rocket Money is a budgeting app that helps users track subscriptions, negotiate bills, and manage expenses. It offers a free tier for basic tools and a premium plan ($6–$12/month) for advanced features like concierge cancellation.

Yes, Rocket Money uses 256-bit encryption and Plaid for secure bank linking. However, its vague privacy policy and data-sharing practices require caution. Always enable 2FA.

Rocket Money negotiates bills (e.g., cable, internet), saving 10–30% annually. It charges 30–60% of first-year savings, so a $240 saving may net $96–$168 after fees.

In Rocket Money reviews, users praise its subscription cancellation and budgeting tools (4.2/5 on Trustpilot). However, some report high fees, slow support, and unauthorized charges.

Alternatives like YNAB ($99/year) and Empower (free) offer robust budgeting without high negotiation fees. Rocket Money’s free tier suits basic needs, but compare options for value.

Title: Find & Cancel Subscriptions, Track Your Spending, Create a Budget, and more | Rocket Money

There are no reviews yet. Be the first one to write one.