As of June 2025, Bitcoin has surpassed the critical $100,000 threshold, marking a significant achievement driven by a surge in institutional investments. This upward movement reflects growing acceptance of the digital asset within mainstream finance, signaling its increasing relevance in global economic systems.

The sharp rise in Bitcoin’s value highlights expanding adoption among institutional players, supported by a favorable regulatory climate and broader macroeconomic trends. Experts believe that sustained interest from major financial institutions could accelerate adoption further—solidifying Bitcoin as a leading asset class in the evolving digital economy.

Bitcoin’s climb past the $100,000 mark is largely attributed to a powerful surge in institutional investment and increasingly favorable financial regulations. Major industry players, including Binance and influential executives, have played key roles in shaping market confidence through strategic positioning and capital allocation.

This price breakout signals a broader transformation, positioning Bitcoin as a potential multi-trillion dollar asset class. The rally has sparked a wave of speculative interest and increased adoption among traditional financial institutions, contributing to a more optimistic tone across diverse market sectors.

Analysts view the movement as a direct reflection of sustained institutional confidence and regulatory predictability. While the sentiment remains bullish, some investors remain cautious, citing the potential for profit-taking—a pattern observed in previous bull cycles. Nonetheless, Bitcoin’s current momentum continues to reinforce its long-term relevance in the evolving global financial landscape.

The 2025 crypto cycle shares key similarities with the bullish runs of 2017 and 2021, but this time around, the market is notably shaped by heightened institutional involvement. The growing presence of traditional finance signals a deeper integration of cryptocurrency into mainstream economic frameworks.

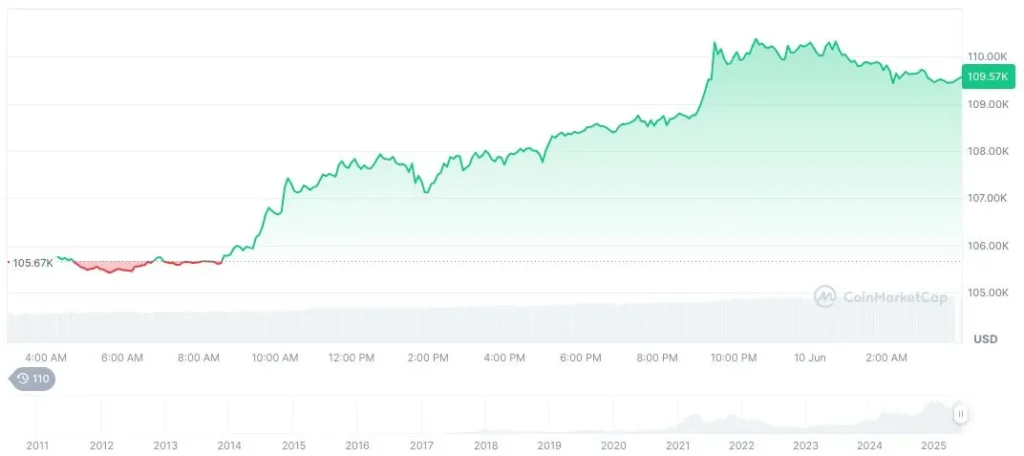

According to CoinMarketCap, Bitcoin is currently priced at $109,540.36, boasting a market cap exceeding $2.18 trillion. Its 24-hour trading volume stands at $57.96 billion, reflecting a 3.65% increase. Over the past 90 days, Bitcoin has surged by 33.25%, achieving a dominant market share of 63.59%, reinforcing its leadership in the digital asset space.

Screenshot captured at 03:53 UTC | Source: CoinMarketCap

According to insights from the Coincu research team, the current crypto market landscape is being heavily shaped by institutional participation and regulatory evolution. These elements are now seen as central forces driving both sentiment and structural market trends.

While volatility is expected to persist, analysts project a steady upward trajectory fueled by growing institutional interest. The integration of traditional market behavior into crypto trading dynamics is likely to influence future price action and investor expectations.

As Bitcoin’s reputation continues to evolve into that of a reliable, long-term asset class, it is expected to influence broader investment frameworks—prompting a shift in how portfolios are structured across both digital and traditional finance sectors.

There are no reviews yet. Be the first one to write one.