The legality and dangers of Paca.Finance, a website that advertises high-yield cryptocurrency investments, are examined in this Paca Finance review. It raises concerns about safety and sustainability despite the promise of large rewards. Ownership, pay plans, traffic patterns, public opinion, security, payment options, customer service, technical performance, and ROI claims are all examined. Scams Radar seeks to assist investors in making judgments by providing them with lucid data, statistics, and comparisons.

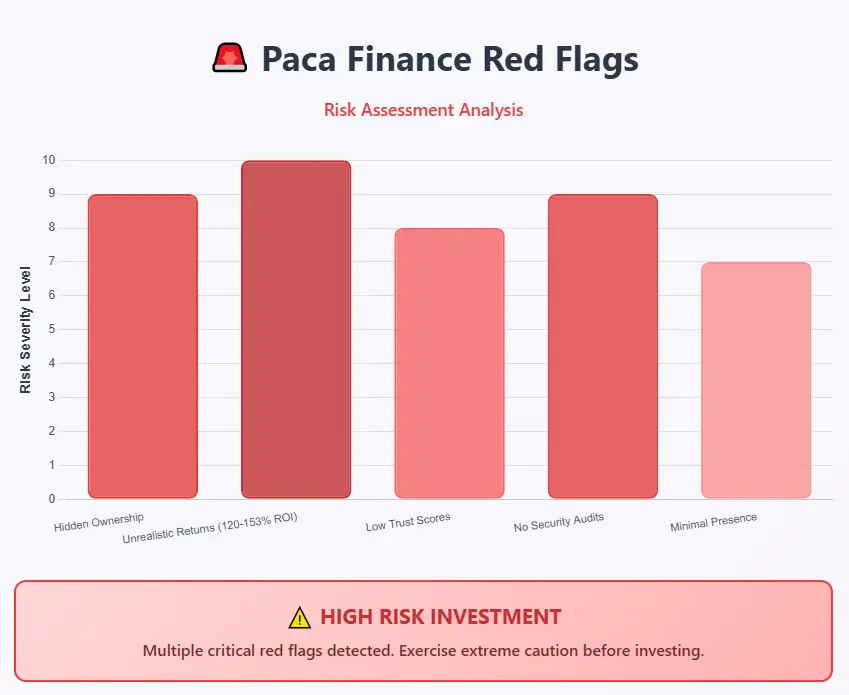

Regarding its ownership, Paca.Finance is opaque. The domain, which was registered through NameCheap on October 11, 2023, conceals owner information through privacy services. The website is hosted by Cloudflare, which is popular yet hides server locations. There is no disclosure of team profiles, professional backgrounds, or corporate registrations (such as SEC or FCA filings). Verifiable team information is usually shared by legitimate sites in order to foster confidence. For investors, this anonymity is a serious warning sign.

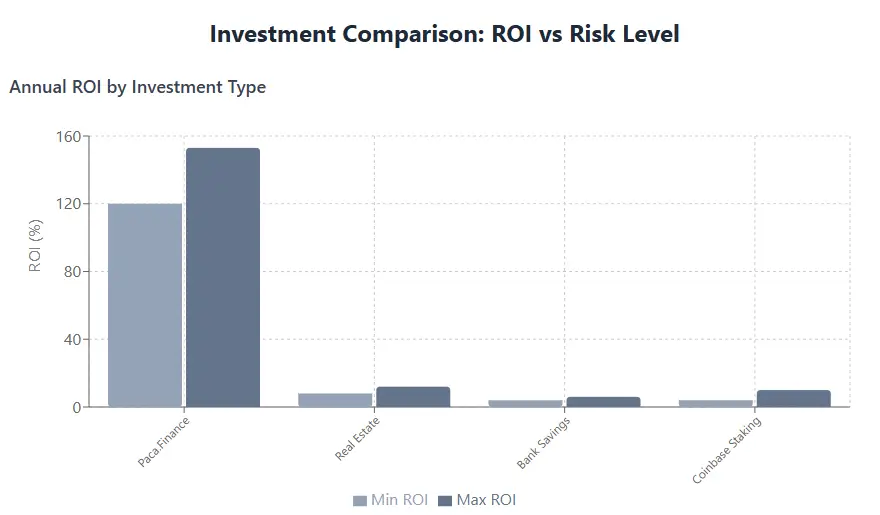

With daily profits ranging from 0.33% to 0.42%, or 120% to 153% annually, Paca.Finance suggests a Ponzi-like structure or multi-level marketing (MLM). These returns are unsustainable since they depend on fresh investor capital to cover previous ones.

Consider a $1,000 investment at 0.33% daily (120% annually), compounded daily:

Formula: FV = PV × (1 + r)^n

This expansion necessitates exponentially larger fresh investments. The platform requires 120 new investors each month in order to cover rewards for 100 investors ($100,000 total). It needs thousands more by month six, which is unsustainable.

Investment Type | Annual ROI | Risk Level |

Paca.Finance | 120–153% | Extreme |

Real Estate | 8–12% | Medium |

Bank Savings | 4–6% | Low |

Coinbase Staking | 4–10% | Medium |

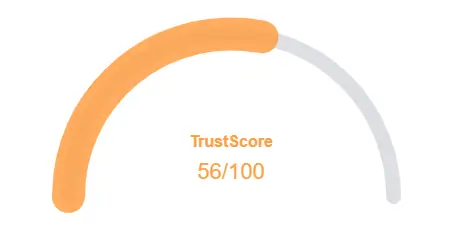

Paca Finance’s website receives very few visits (less than 5,000 per month), as indicated by its Tranco ranking. Gridinsoft flags it as a possible fraud, and Scamadviser assigns it a trust score of 1/100. Because of the secrecy and large returns, Reddit conversations emphasise scepticism. In platforms like Telegram and X, the absence of community involvement is worrisome for a network that boasts “millions in AUM.”

The platform lacks advanced security features like multi-factor authentication and cold storage, but it does employ Cloudflare for basic HTTPS encryption. In contrast to respectable platforms (like Binance), no third-party audits are revealed. The lack of technical performance statistics, including transaction speed or uptime, raises questions about trustworthiness.

Cryptocurrencies like USDT and USDC, which are irreversible and raise risk, are accepted by Paca Finance. There are no possibilities for paying using fiat money. Telegram is the only platform that offers customer service; email and live chat are not available. Reputable platforms have extensive support systems.

Low interaction and ambiguous promotional content characterize the @PACA_Finance X account. It is promoted via several Medium posts (e.g., by Lamcer31210) and Telegram groups, but these are unreliable and connected to other scams like Forsage or Mineplex. Coordinated shilling is suggested by this pattern.

Regulations may examine Paca Finance, particularly in light of Singapore’s 2025 crypto crackdowns. When fresh investments slow down, it may fall apart in 6 to 18 months if it functions as a Ponzi scheme. Because of transparency and regulation, legitimate platforms like Binance will probably outcompete it.

Serious issues are brought to light by this Paca Finance assessment, including low trust ratings, insufficient transparency, concealed ownership, and an unsustainable ROI of 120–153%. Its claims are implausible in comparison to real estate (8–12%), bank deposits (4–6%), or Coinbase staking (4–10%). Investors have to steer clear of this platform and select regulated substitutes instead. Investigate thoroughly to safeguard your money.

DYOR Disclaimer: This analysis, which was last updated on June 4, 2025, is not intended to be financial advice. Check each claim on your own. Investing in cryptocurrency carries a high risk of loss. A financial counsellor should always be consulted before making an investment.

The validity of the Paca Finance Networks study is addressed by these frequently asked questions. We’ve included the following queries and responses to allay any worries:

Paca Finance Network's low trust ratings from Scamadviser (1/100), inflated annual returns of 120–153%, and concealed ownership all raise red flags. Its lack of audits and transparency points to a significant level of risk. Until it is confirmed, investors should stay away from it.

Potential Ponzi scheme structures, irreversible cryptocurrency payments (USDT/USDC), a lack of governmental control, and inadequate customer service are among the risks. The platform's exaggerated ROI claims are unsustainable and could result in a complete loss.

Paca.Finance provides 120–153% yearly returns without transparency, in contrast to Binance or Coinbase (4–10% APY with audits). Reputable platforms are safer since they offer transparent team information and regulatory compliance.

Trust scores, security, ROI sustainability, and ownership should all be included in a trustworthy Paca Finance assessment. Look for warning signs such as anonymity, minimal traffic (less than 5,000 visits per month), and no audits to determine credibility.

As is common with Ponzi schemes, Paca.Finance's 0.33–0.42% daily returns (120–153% annually) necessitate exponentially large additional deposits. These gains are theoretically unlikely in comparison to bank deposits (4–6%) or real estate (8–12%).

Title: PACA Finance

There are no reviews yet. Be the first one to write one.